Question: All else constant, what would Digbys SG&A/Sales ratio be if the company had spent an additional $1,500,000 for Defts promotional budget and $750,000 for Defts

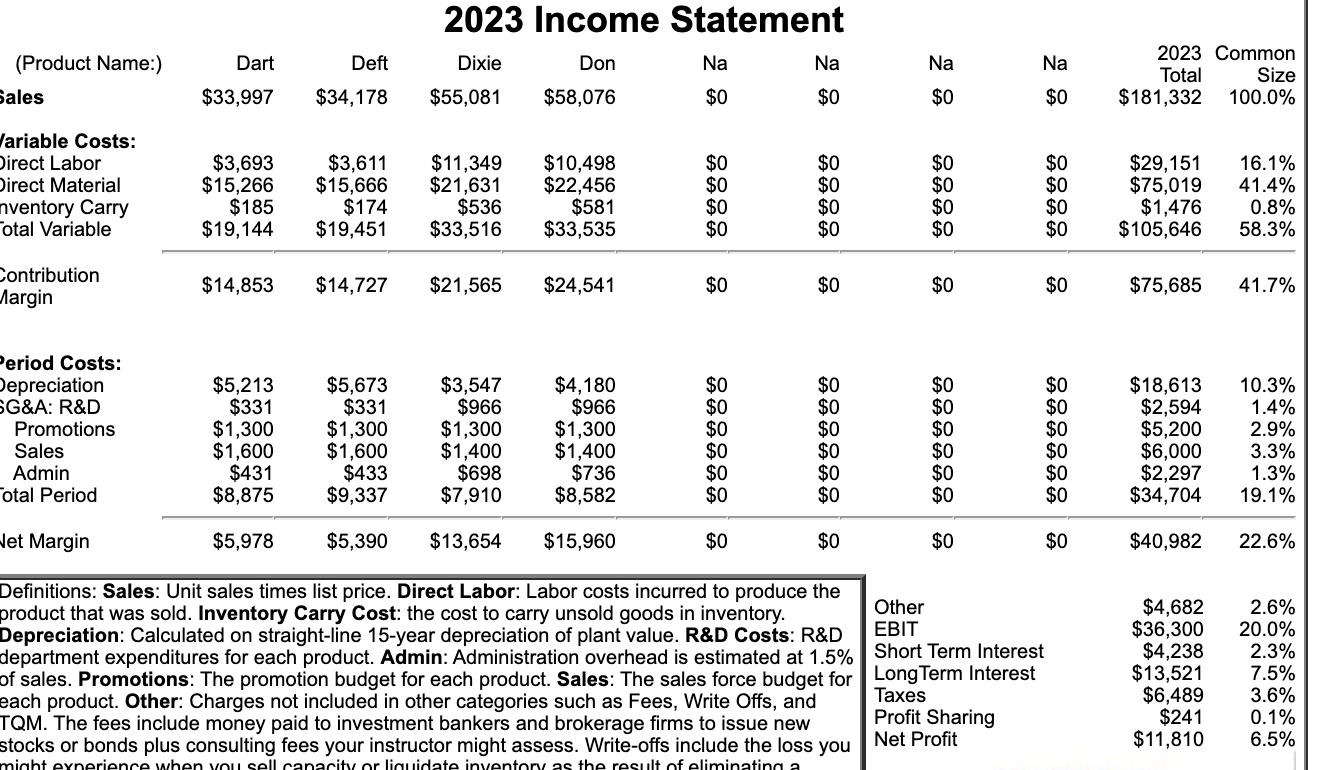

All else constant, what would Digbys SG&A/Sales ratio be if the company had spent an additional $1,500,000 for Defts promotional budget and $750,000 for Defts sales budget?

Don Na 2023 Income Statement Dixie Na $55,081 $58,076 Na Na (Product Name:) Sales 2023 Common Dart $33,997 Deft $34,178 Total $181,332 Size 100.0% Variable Costs: Direct Labor Direct Material nventory Carry Total Variable $3,693 $15,266 $185 $19,144 $3,611 $15,666 $174 $19,451 $11,349 $21,631 $536 $33,516 $10,498 $22,456 $581 $33,535 $29,151 $75,019 $1.476 $105,646 16.1% 41.4% 0.8% 58.3% Contribution Margin $14,853 $14,727 $21,565 $24,541 $0 $75,685 41.7% $0 $0 Period Costs: Depreciation SG&A: R&D Promotions Sales Admin Total Period $5,213 $331 $1,300 $1,600 $431 $8,875 $5,673 $331 $1,300 $1,600 $433 $9,337 $3,547 $966 $1,300 $1,400 $698 $7,910 $4,180 $966 $1,300 $1,400 $736 $8,582 $18,613 $2,594 $5,200 $6,000 $2,297 $34,704 10.3% 1.4% 2.9% 3.3% 1.3% 19.1% $0 Het Margin $5,978 $5,390 $13,654 $15,960 $0 $0 $40,982 22.6% Definitions: Sales: Unit sales times list price. Direct Labor: Labor costs incurred to produce the product that was sold. Inventory Carry Cost: the cost to carry unsold goods in inventory. Depreciation: Calculated on straight-line 15-year depreciation of plant value. R&D Costs: R&D department expenditures for each product. Admin: Administration overhead is estimated at 1.5% of sales. Promotions: The promotion budget for each product. Sales: The sales force budget for each product. Other: Charges not included in other categories such as Fees, Write Offs, and TQM. The fees include money paid to investment bankers and brokerage firms to issue new stocks or bonds plus consulting fees your instructor might assess. Write-offs include the loss you might eynerience when you sell canacity or liquidate inventory as the result of eliminating a Other EBIT Short Term Interest Long Term Interest Taxes Profit Sharing Net Profit $4,682 $36,300 $4,238 $13,521 $6,489 $241 $11,810 2.6% 20.0% 2.3% 7.5% 3.6% 0.1% 6.5%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts