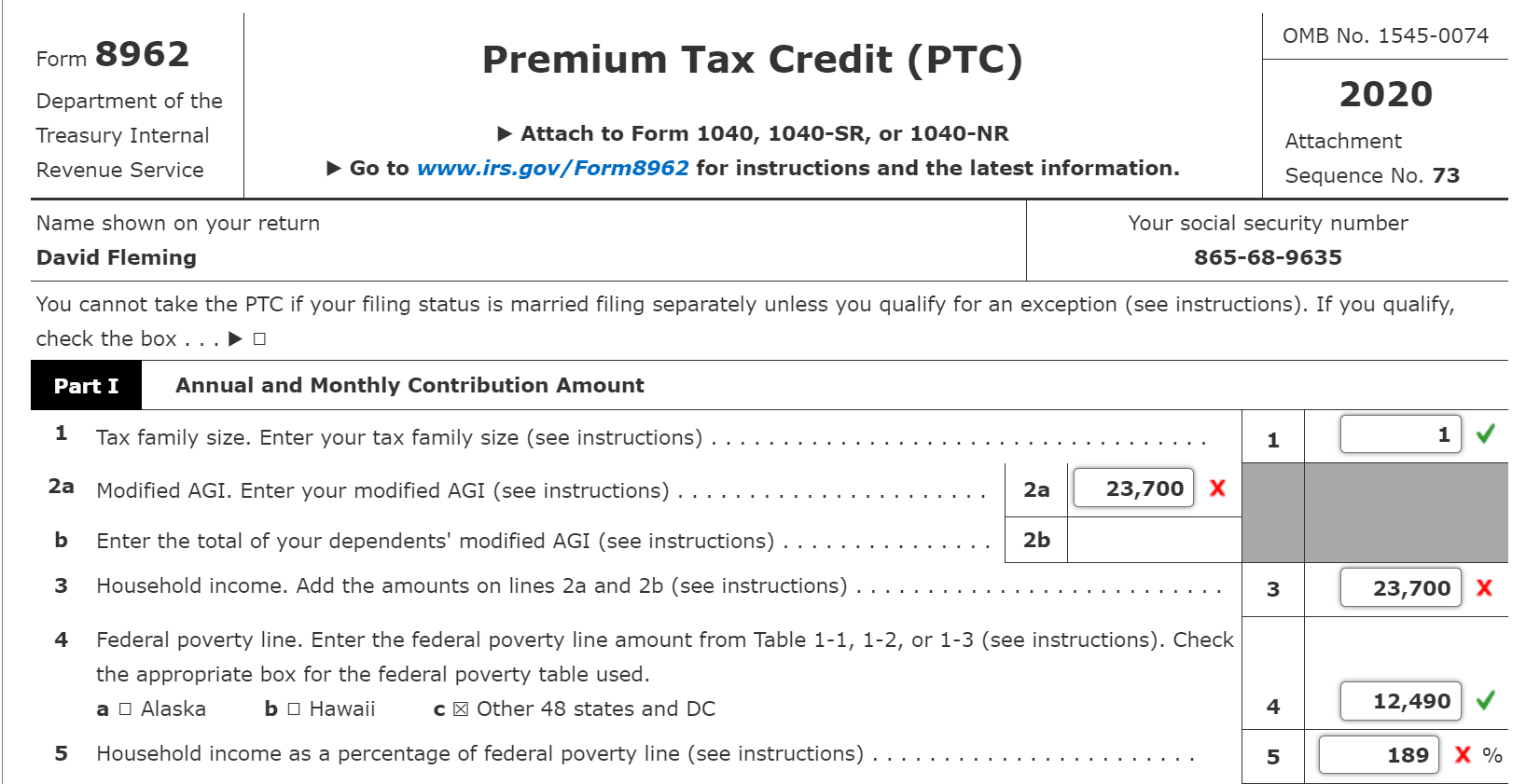

Question: ALL I NEED HELP ON IS THE MODIFIED AGI!!!! David Fleming is a single taxpayer. His Social Security number is 865-68-9635 and his date of

ALL I NEED HELP ON IS THE MODIFIED AGI!!!! David Fleming is a single taxpayer. His Social Security number is 865-68-9635 and his date of birth is September 18, 1975.

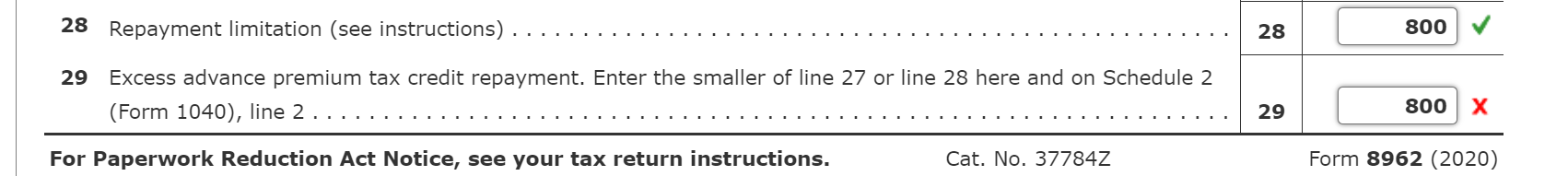

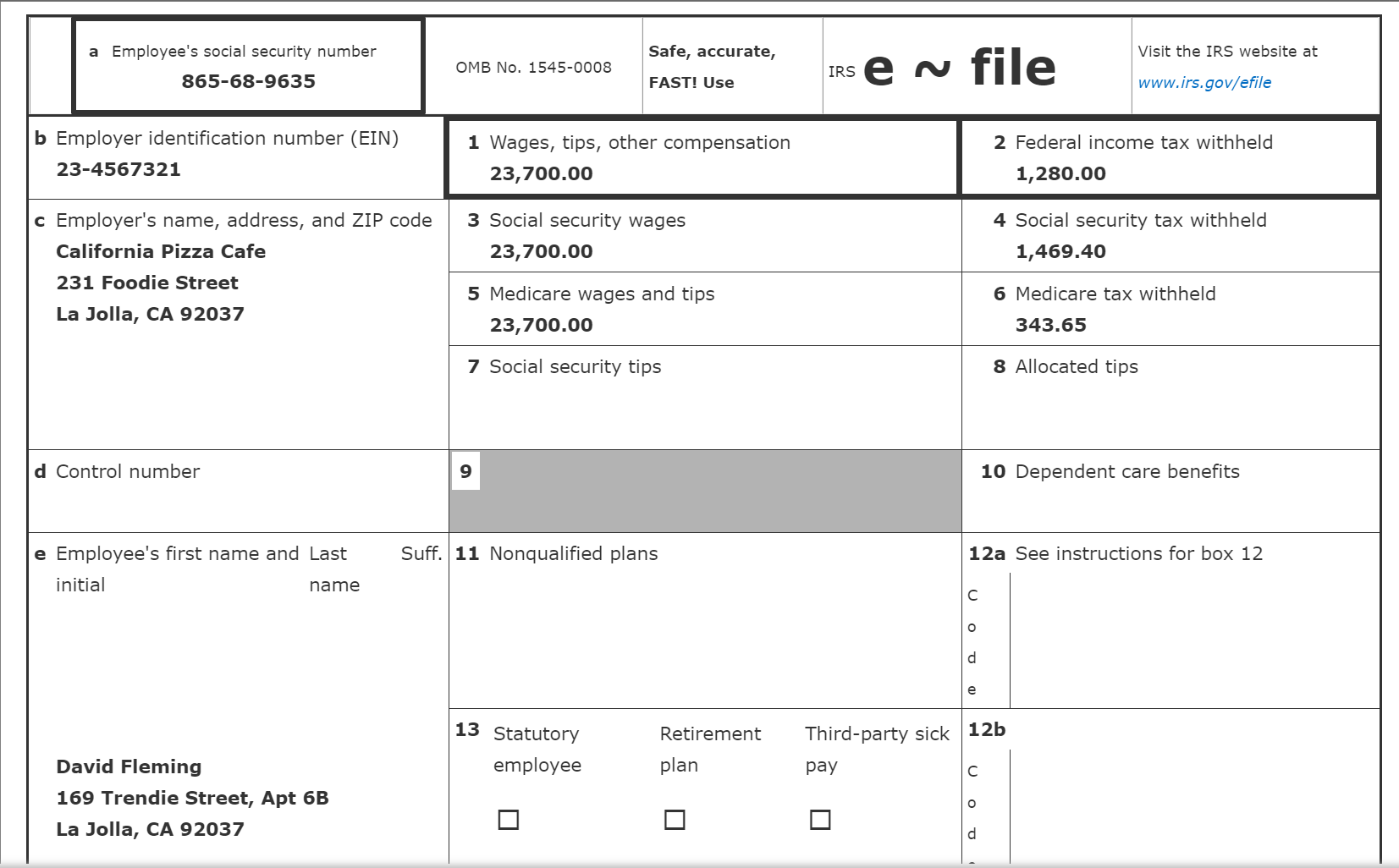

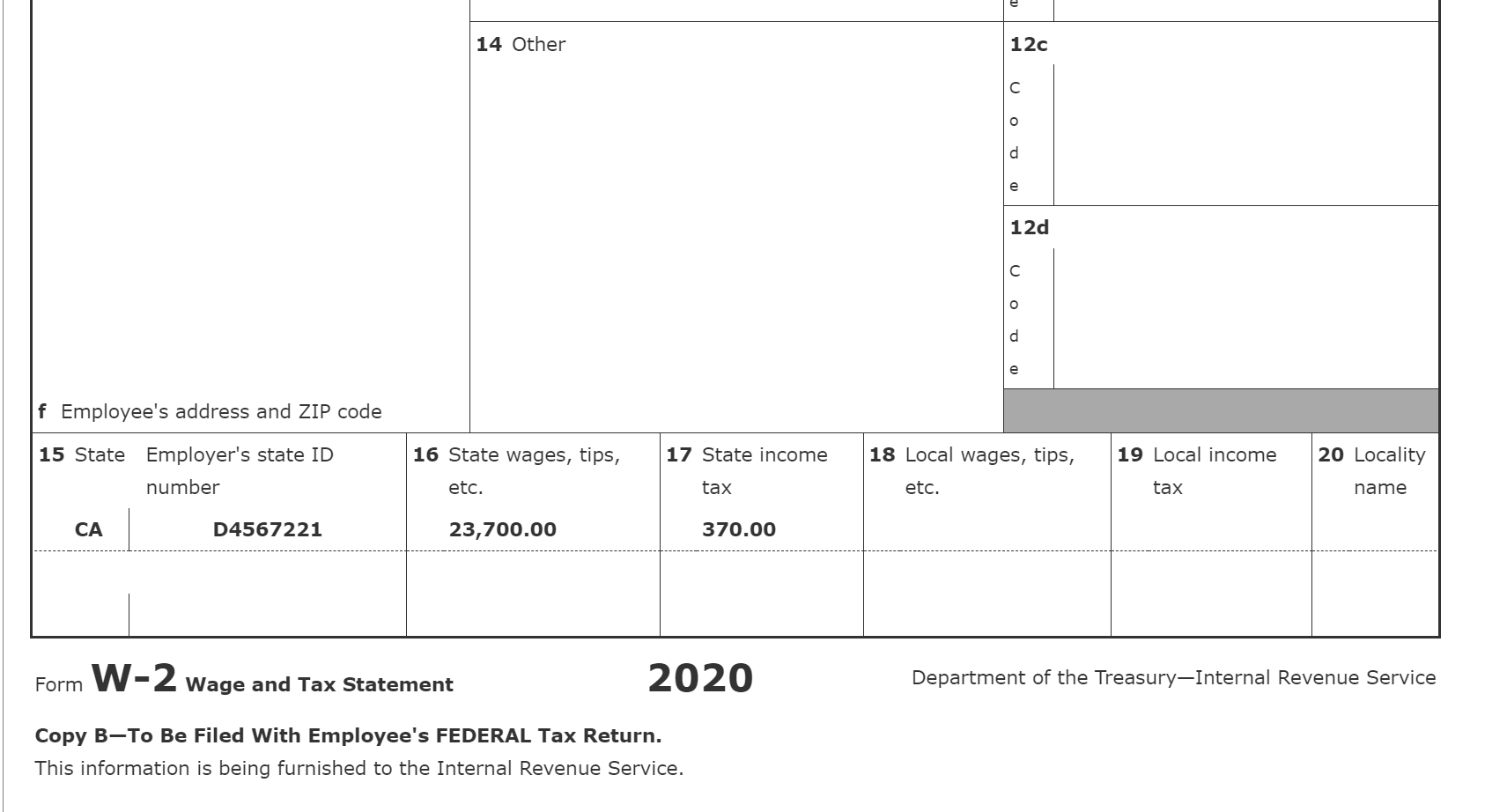

David was employed as a delivery person for a local pizza restaurant and received a W-2 from his employer.

David's only other source of income during the year was a prize he won appearing on a game show. The game show sent David home with a Form 1099-MISC (see separate tab).

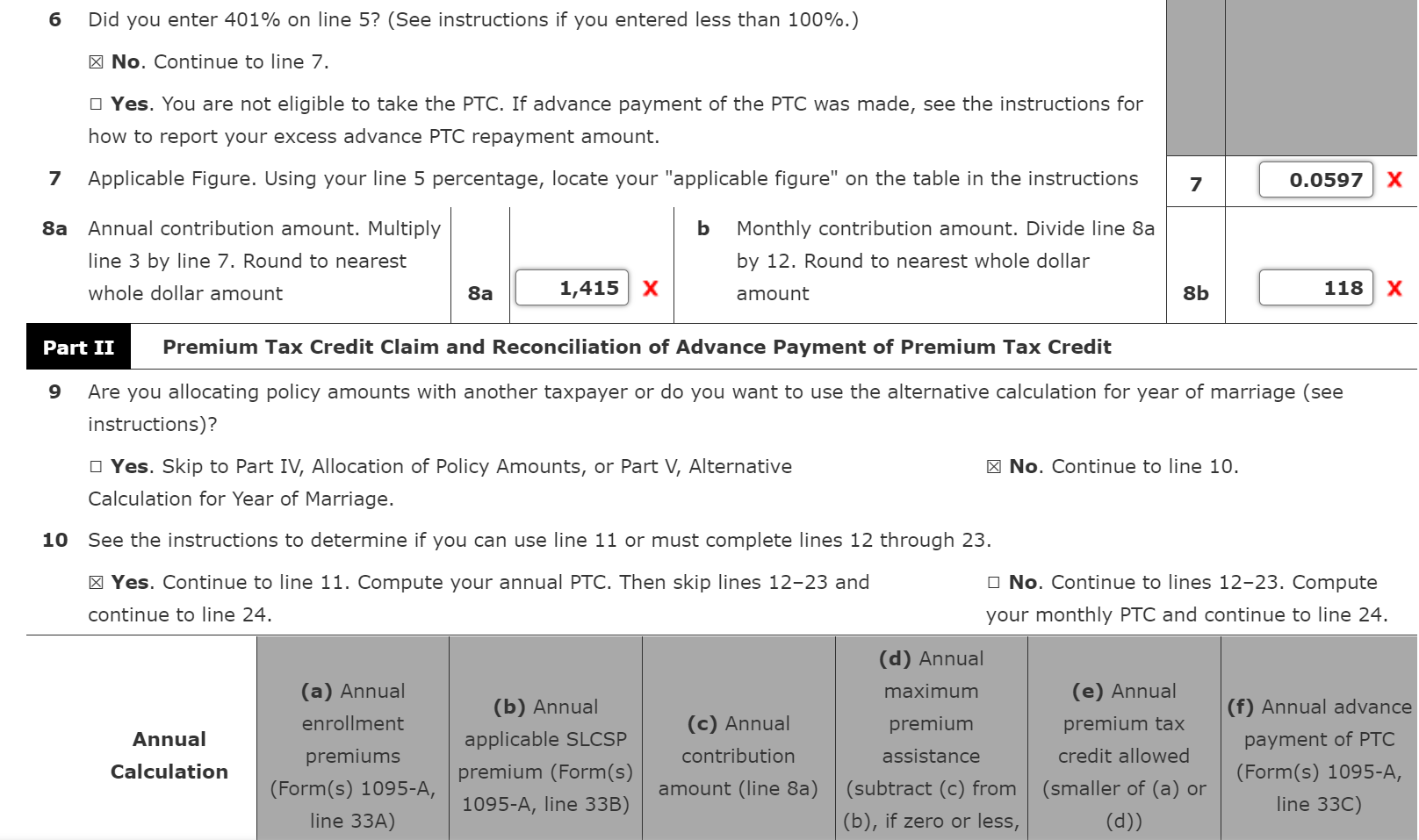

He has no other adjustments to income or deductible expenses except for a single cash payment of $500 to a charity after winning big at the game show and a $1,200 EIP received in 2020. Unfortunately, David's employer did not provide health care to its employees but David signed up for coverage through his state's health care exchange. Click here to access theForm 1095-Athe exchange sent him.

Required:

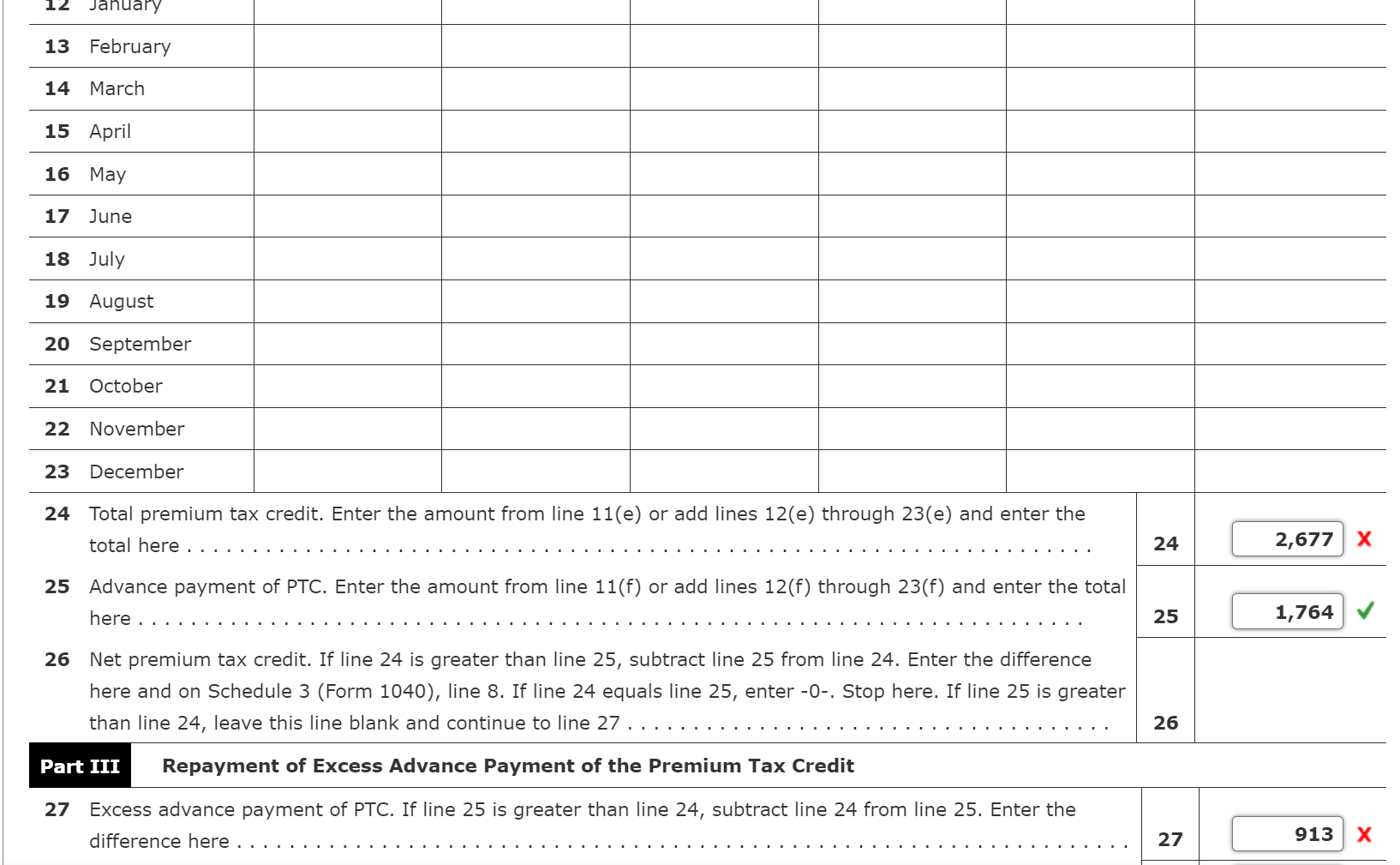

Complete David's Form 1040, Schedule 1, Schedule 2, and Form 8962.

- Make realistic assumptions about any missing data.

- The taxpayer had health care coverage for the entire year. He doe not want to make a contribution to the presidential campaign.

- Enter all amounts as positive numbers.

- If an amount box does not require an entry or the answer is zero, enter "0".

Complete David's Form 8962.

Click here to access theForm 1095-Athe exchange sent him.

Click here to access the2020 Applicable Figure Table.

- The Federal Poverty Line for single person is $12,490.

- The repayment amount, if any, is limited to $800 for a single taxpayer at David's level.

- For line 5, see Worksheet 2 which is provided below the tax form. For line 5,do notround; instead multiply this number by 100 (to express it as a percentage) and then drop any numbers after the decimal point. For example: 0.9984, enter the result as 99; for 1.8565, enter the result as 185; and for 3.997, enter the result as 399.

- For line 7, enter the amount as shown on the 2020 Applicable Figure Table. For all other answers, if required, round your final answers to the nearest dollar.

OMB No. 1545-0074 Form 3952 Premium Tax Credit (PTC) Department of the 2020 Treasury Internal F Attach to Form 1040, 1040-SR, or 1040-NR Attachment Revenue Service > Go to www.irs.gov/Form8962 for instructions and the latest information. Sequence No. 73 Name shown on your return Your social security number David Fleming 865-68-9635 You cannot take the PTC if your ling status is married filing separately unless you qualify for an exception (see instructions). If you qualify, check the box . . . b [I m Annual and Monthly Contribution Amount 1 Tax family size. Enter your tax family size (see instructions) ................................... \\' 23 Modied AGI. Enter your modified AGI (see instructions) ...................... 2a X b Enter the total of your dependents' modied AGI (see instructions) ............... 2b 3 Household income. Add the amounts on lines 2a and 2b (see instructions) .......................... X 4 Federal poverty line. Enter the federal poverty line amount from Table 1-1, 1-2, or 1-3 (see instructions). Check the appropriate box for the federal poverty table used. a El Alaska b Hawaii c Other 48 states and DC 4 -'I 5 Household income as a percentage of federal poverty line (see instructions) ....................... 5 X% Did you enter 401% on line 5? (See instructions if you entered less than 100%.) No. Continue to line 7. III Yes. You are not eligible to take the PTC. If advance payment of the PTC was made, see the instructions for how to report your excess advance PTC repayment amount. Applicable Figure. Using your line 5 percentage, locate your "applicable figure" on the table in the instructions Annual contribution amount. Multiply b Monthly contribution amount. Divide line 8a line 3 by line 7. Round to nearest by 12. Round to nearest whole dollar whole dollar amount 8a X amount -x 8b -X Premium Tax Credit Claim and Reconciliation of Advance Payment of Premium Tax Credit 9 Are you allocating policy amounts with another taxpayer or do you want to use the alternative calculation for year of marriage (see 10 instructions)? III Yes. Skip to Pan: IV, Allocation of Policy Amounts, or Part V, Alternative No. Continue to line 10. Calculation for Year of Marriage. See the instructions to determine if you can use line 11 or must complete lines 12 through 23. Yes. Continue to line 11. Compute your annual PTC. Then skip lines 1223 and III No. Continue to lines 1223. Compute continue to line 24. your monthly PTC and continue to line 24. Annual Calculation 11 January 13 February 14 March 15 April 16 May 17 June 18 July 19 August 20 September 21 October 22 November 23 December 24 Total premium tax credit. Enter the amount from line 11(e) or add lines 12(e) through 23(e) and enter the -x total here ..................................................................... 24 - 25 Advance payment of PTC. Enter the amount from line 11(f) or add lines 12(f) through 23(f) and enter the total here ........................................................................ 25 11764 'I 26 Net premium tax credit. If line 24 is greater than line 25, subtract line 25 from line 24. Enter the difference here and on Schedule 3 (Form 1040), line 8. If line 24 equals line 25, enter -0-. Stop here. If line 25 is greater than line 24, leave this line blank and continue to line 27 ..................................... 26 m Repayment of Excess Advance Payment of the Premium Tax Credit 27 Excess advance payment of PTC. If line 25 is greater than line 24, subtract line 24 from line 25. Enter the difference here .................................................................... 27 X 23 Repayment limitation (see instructions) ................................................... 29 Excess advance premium tax credit repayment. Enter the smaller of line 27 or line 28 here and on Schedule 2 (Form 1040), line 2 ................................................................. For Paperwork Reduction Act Notice, see your tax return instructions. Cat. No. 377842 28 - 29 -x Form 8962 (2020) a Employee's social security number Safe, accurate, OMB No. 1545-0008 865-68-9635 FAST! Use IRS e ~ file Visit the IRS website at www.irs.gov/efile b Employer identification number (EIN) 1 Wages, tips, other compensation 2 Federal income tax withheld 23-4567321 23,700.00 1,280.00 c Employer's name, address, and ZIP code 3 Social security wages 4 Social security tax withheld California Pizza Cafe 23,700.00 1,469.40 231 Foodie Street 5 Medicare wages and tips 6 Medicare tax withheld La Jolla, CA 92037 23,700.00 343.65 7 Social security tips 8 Allocated tips d Control number 9 10 Dependent care benefits e Employee's first name and Last Suff. 11 Nonqualified plans 12a See instructions for box 12 initial name C O 13 Statutory Retirement Third-party sick 12b David Fleming employee plan pay 169 Trendie Street, Apt 6B O La Jolla, CA 92037 0 0f Employee's address and ZIP code 15 State Employer's state ID 16 State wages, tips, 17 State income 18 Local wages, tips, 19 Local income 20 Locality number etc. tax etc. tax name CA l D4567221 23,700.00 370.00 Form W- 2 Wage and Tax Statement 2020 Department of the TreasuryInternal Revenue Service Copy BTo Be Filed With Employee's FEDERAL Tax Return. This information is being furnished to the Internal Revenue Service