Question: All information I was given for this question is below. Please show all work to explain how you got the answer. Thank you kindly. Times-Roman

All information I was given for this question is below. Please show all work to explain how you got the answer. Thank you kindly.

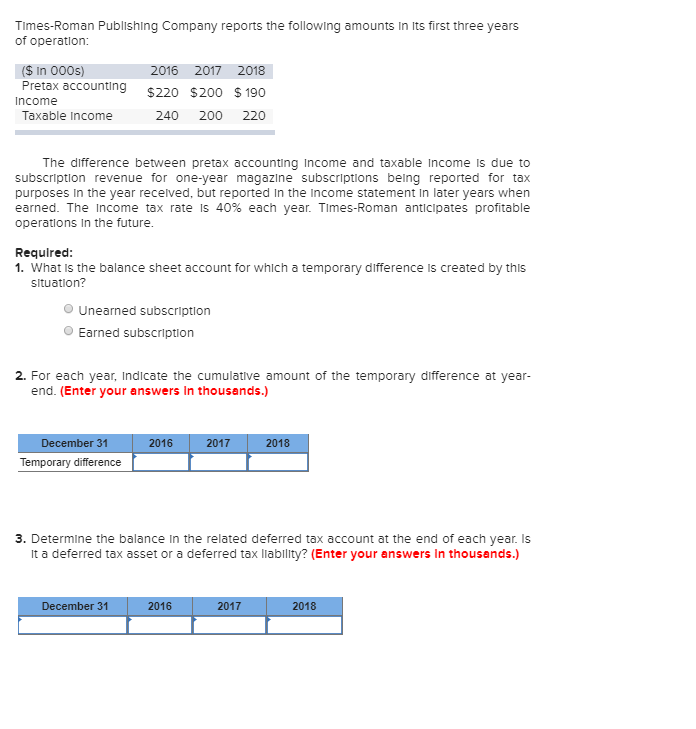

Times-Roman Publishing Company reports the following amounts In Its first three years of operation: ($ In 000s 2016 2017 2018 Pretax accounting s220 $200 $190 Income Taxable Income 240 200 220 The difference between pretax accounting Income and taxable Income Is due to subscription revenue for one-year magazine subscriptions being reported for tax purposes In the year recelved, but reported In the Income statement In later years when earned. The income tax rate Is 40% each year. Times-Roman anticipates profitable operations In the future Requirec 1. What is the balance sheet account for which a temporary difference is created by this situation? O Unearned subscription O Earned subscription 2. For each year, Indicate the cumulative amount of the temporary difference at year end. (Enter your answers In thousands.) 2016 2017 2018 Temporary difference 3. Determine the balance In the related deferred tax account at the end of each year. Is It a deferred tax asset or a deferred tax llability? (Enter your answers In thousands.) December 31 2016 2017 2018

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts