Question: All interest rates are assumed to be compounded annually unless stated otherwise. XYZ inc. considers an investment project that requires $200,000 in new equipment and

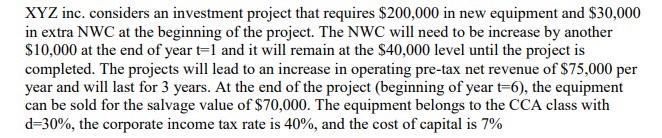

All interest rates are assumed to be compounded annually unless stated otherwise. XYZ inc. considers an investment project that requires $200,000 in new equipment and $30,000 in extra NWC at the beginning of the project. The NWC will need to be increase by another $10,000 at the end of year t=1 and it will remain at the $40,000 level until the project is completed. The projects will lead to an increase in operating pre-tax net revenue of $75,000 per year and will last for 3 years. At the end of the project (beginning of year t=6), the equipment can be sold for the salvage value of $70,000. The equipment belongs to the CCA class with d=30%, the corporate income tax rate is 40%, and the cost of capital is 7% Problem 11: Find the project's NPV. Note that if your answer is different from the one you have found in Problem 7, then you've made a mistake somewhere. Problem 12: By how much NPV would have changed if XYZ would be able to postpone the $10,000 NWC by 1 year, i.e., increase it by $10,000 at t=2 instead of t=1? Note: The solution to this question does not require any of the answers you found in the previous problem Problem 13: By how much NPV would have changed if XYZ would be able to sell the equipment for the salvage value of $80,000 instead of $70,000? Hint: do not forget about the tax shield. Note: The solution to this question does not require any of the answers you found in the previous

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts