Question: All listed forms will be used with an AGI check figure of $29,557. helpful hints included M IH Instructions Form 1040 Schedule 1 Schedule 2

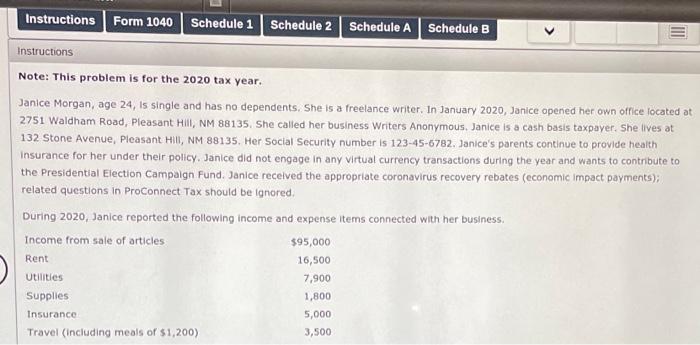

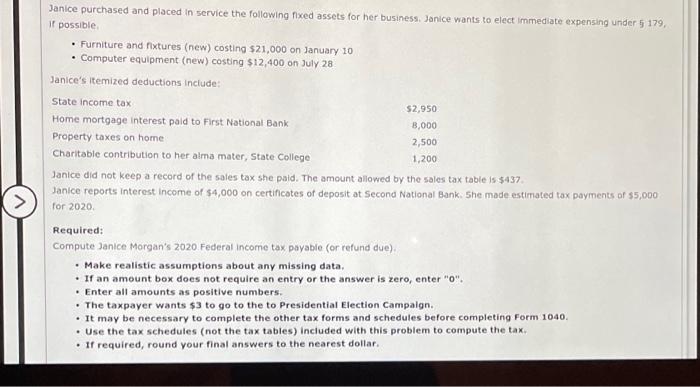

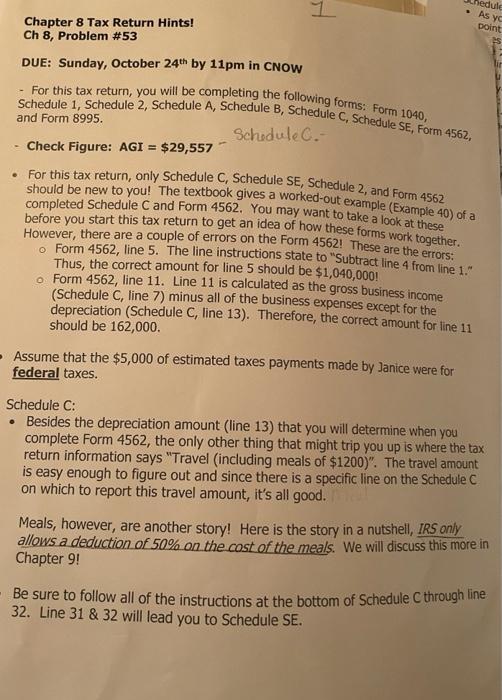

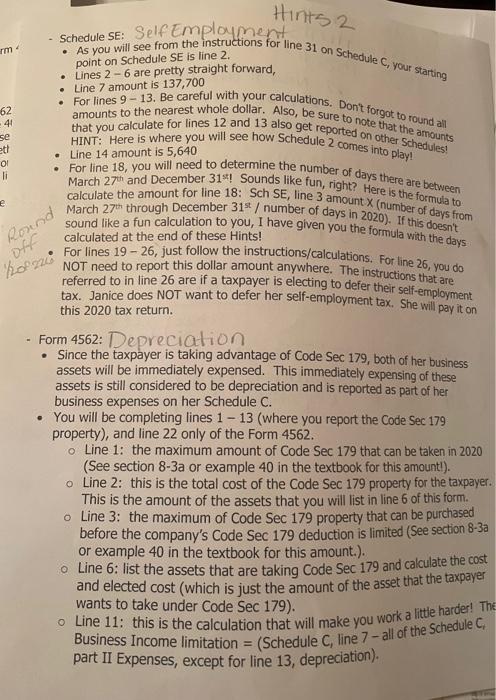

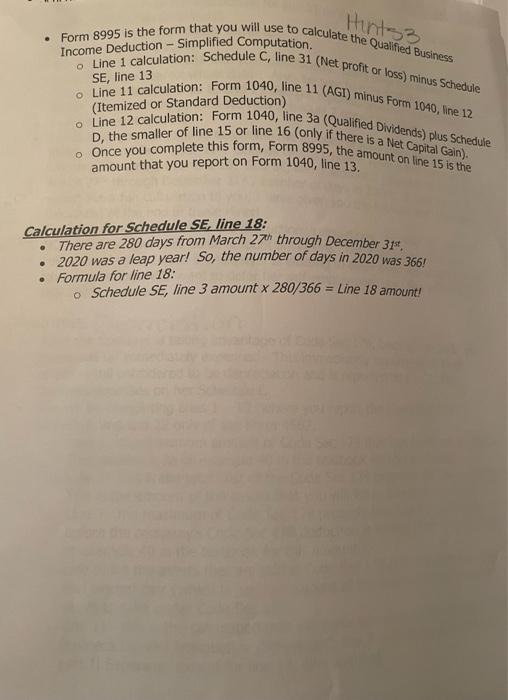

M IH Instructions Form 1040 Schedule 1 Schedule 2 Schedule A Schedule B Instructions Note: This problem is for the 2020 tax year. Janice Morgan, age 24, Is single and has no dependents. She is a freelance writer. In January 2020, Janice opened her own office located at 2751 Waldham Road, Pleasant Hill, NM 88135. She called her business Writers Anonymous, Janice is a cash basis taxpayer. She lives at 132 Stone Avenue, Pleasant HII, NM 88135. Her Social Security number is 123-45-6782. Janice's parents continue to provide health insurance for her under their policy, Janice did not engage in any virtual currency transactions during the year and wants to contribute to the Presidential Election Campaign Fund. Janice received the appropriate coronavirus recovery rebates (economic impact payments); related questions in ProConnect Tax should be ignored During 2020, Janice reported the following income and expense Items connected with her business, Income from sale of articles $95,000 16,500 7,900 Supplies 1,800 Insurance 5,000 Travel (Including meals of $1,200) 3,500 Rent Utilities Janice purchased and placed in service the following fixed assets for her business. Janice wants to elect Immediate expensing under 5 179, it possible Furniture and fixtures (new) costing $21,000 on January 10 Computer equipment (new) costing $12,400 on July 28 Janice's itemized deductions include: State income tax $2,950 Home mortgage interest paid to First National Bank 3,000 Property taxes on home 2,500 Charitable contribution to her alma mater, State College 1,200 Janice did not keep a record of the sales tax she paid. The amount allowed by the sales tax table is $437 Janice reports interest Income of $4,000 on certificates of deposit at Second National Bank. She made estimated tax payments of 5,000 for 2020 Required: Compute Janice Morgan's 2020 Federal income tax payable (or refund due) Make realistic assumptions about any missing data. If an amount box does not require an entry or the answer is zero, enter "O". Enter all amounts as positive numbers. The taxpayer wants $3 to go to the to Presidential Election Campaign. It may be necessary to complete the other tax forms and schedules before completing Form 1040 Use the tax schedules (not the tax tables) included with this problem to compute the tax. If required, round your final answers to the nearest dollar. > hedule 1 As y point Chapter 8 Tax Return Hints! Ch 8, Problem #53 DUE: Sunday, October 24th by 11pm in CNOW Schedule 1, Schedule 2, Schedule A, Schedule B, Schedule C, Schedule SE, Form 4562, - For this tax return, you will be completing the following forms: Form 1040, and Form 8995. Schedule.- - Check Figure: AGI = $29,557 . For this tax return, only Schedule Schedule Se, Schedule 2, and Form 4562 should be new to you! The textbook gives a worked-out example (Example 40) of a completed Schedule and Form 4562. You may want to take a look at these before you start this tax return to get an idea of how these forms work together. However, there are a couple of errors on the Form 4562! These are the errors: Form 4562, line 5. The line instructions state to "Subtract line 4 from line 1. Thus, the correct amount for line 5 should be $1,040,000! o Form 4562, line 11. Line 11 is calculated as the gross business income (Schedule C, line 7) minus all of the business expenses except for the depreciation (Schedule C, line 13). Therefore, the correct amount for line 11 should be 162,000 - Assume that the $5,000 of estimated taxes payments made by Janice were for federal taxes. Schedule C: . Besides the depreciation amount (line 13) that you will determine when you complete Form 4562, the only other thing that might trip you up is where the tax return information says "Travel (including meals of $1200)". The travel amount is easy enough to figure out and since there is a specific line on the Schedule C on which to report this travel amount, it's all good. Meals, however, are another story! Here is the story in a nutshell, IRS only allows a deduction of 50% on the cost of the meals. We will discuss this more in Chapter 9 Be sure to follow all of the instructions at the bottom of Schedule C through line 32. Line 31 & 32 will lead you to Schedule SE. Hints 2 Schedule SE: Self Employment rm . 62 41 se eti O li As you will see from the instructions for line 31 on Schedule C, Your Starting point on Schedule SE is line 2. Lines 2 - 6 are pretty straight forward, Line 7 amount is 137,700 amounts to the nearest whole dollar. Also, be sure to note that the amounts For lines 9-13. Be careful with your calculations. Don't forgot to round all that you calculate for lines 12 and 13 also get reported on other Schedules! HINT: Here is where you will see how Schedule 2 comes into play! Line 14 amount is 5,640 For line 18, you will need to determine the number of days there are between March 27th and December 319! Sounds like fun, right? Here is the formula to March 27th through December 31+ / number of days in 2020). If this doesn't calculate the amount for line 18: Sch SE, line 3 amount X (number of days from sound like a fun calculation to you, I have given you the formula with the days calculated at the end of these Hints! e Round off For lines 19 - 26, just follow the instructions calculations. For line 26, you do NOT need to report this dollar amount anywhere. The instructions that are referred to in line 26 are if a taxpayer is electing to defer their self-employment tax. Janice does NOT want to defer her self-employment tax. She will pay it on this 2020 tax return. Form 4562: Depreciation Since the taxpayer is taking advantage of Code Sec 179, both of her business assets will be immediately expensed. This immediately expensing of these assets is still considered to be depreciation and is reported as part of her business expenses on her Schedule C. You will be completing lines 1 - 13 (where you report the Code Sec 179 property), and line 22 only of the Form 4562. o Line 1: the maximum amount of Code Sec 179 that can be taken in 2020 (See section 8-3a or example 40 in the textbook for this amount!). o Line 2: this is the total cost of the Code Sec 179 property for the taxpayer. This is the amount of the assets that you will list in line 6 of this form. o Line 3: the maximum of Code Sec 179 property that can be purchased before the company's Code Sec 179 deduction is limited (See section 8-3a or example 40 in the textbook for this amount.). o Line 6: list the assets that are taking Code Sec 179 and calculate the cost and elected cost (which is just the amount of the asset that the taxpayer wants to take under Code Sec 179) o Line 11: this is the calculation that will make you work a little harder! The Business Income limitation = (Schedule C, line 7- all of the Schedule C, part II Expenses, except for line 13, depreciation). Hints3 SE, line 13 Form 8995 is the form that you will use to calculate the Qualified Business Income Deduction - Simplified Computation. O Line 1 calculation: Schedule C, line 31 (Net profit or loss) minus Schedule O Line 11 calculation: Form 1040, line 11 (AGI) minus Form 1040, line 12 (Itemized or Standard Deduction) o Line 12 calculation: Form 1040, line 3a (Qualified Dividends) plus Schedule D, the smaller of line 15 or line 16 (only if there is a Net Capital Gain). o Once you complete this form, Form 8995, the amount on line 15 is the amount that you report on Form 1040, line 13 Calculation for Schedule SE, line 18: There are 280 days from March 27" through December 314 2020 was a leap year! So, the number of days in 2020 was 366/ Formula for line 18: o Schedule SE, line 3 amount x 280/366 = Line 18 amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts