Question: all multiple choice questions!! answer all please Question 23 (2.5 points) Which of the following projects below should the firm accept? The firm has a

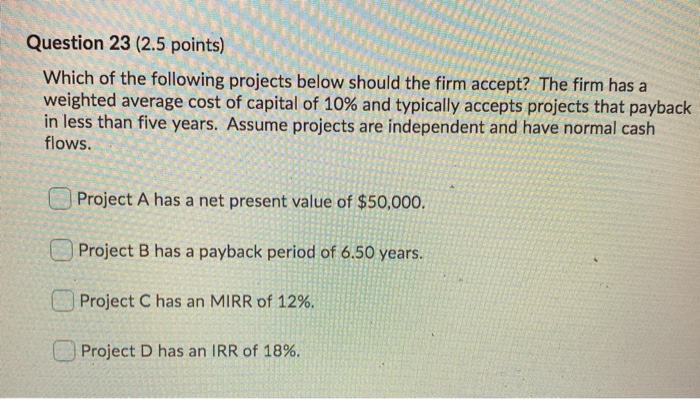

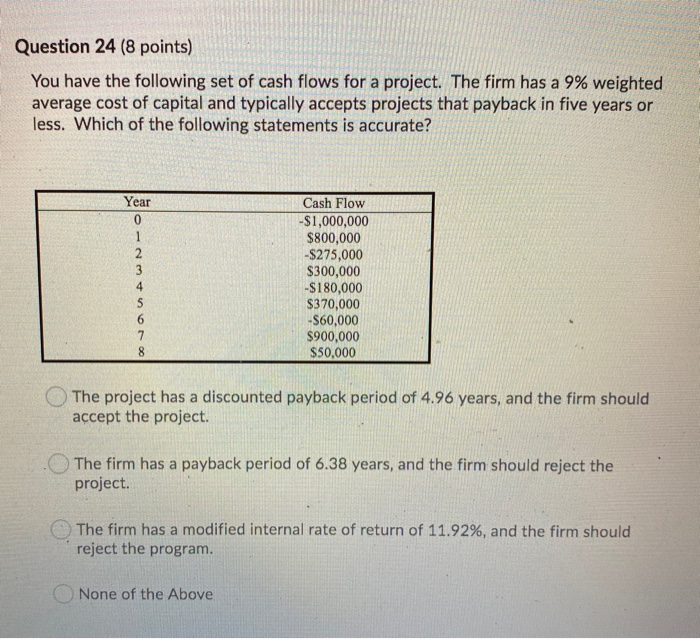

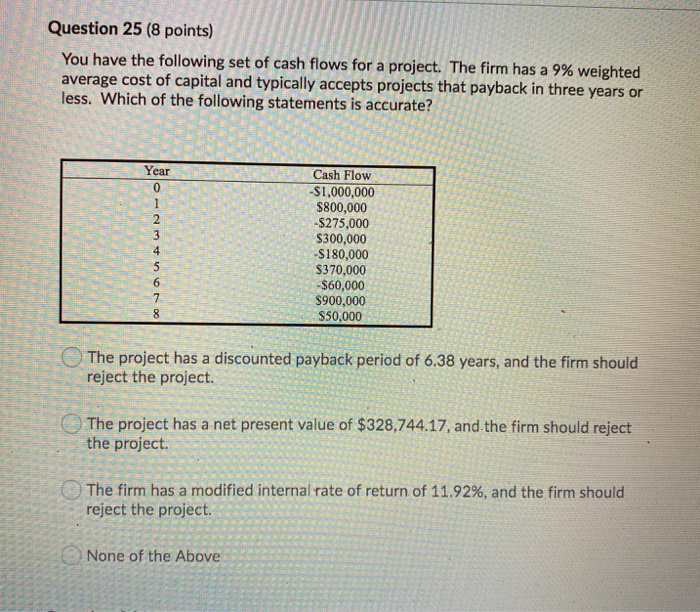

Question 23 (2.5 points) Which of the following projects below should the firm accept? The firm has a weighted average cost of capital of 10% and typically accepts projects that payback in less than five years. Assume projects are independent and have normal cash flows. Project A has a net present value of $50,000. Project B has a payback period of 6.50 years. Project C has an MIRR of 12%. Project D has an IRR of 18%. Question 24 (8 points) You have the following set of cash flows for a project. The firm has a 9% weighted average cost of capital and typically accepts projects that payback in five years or less. Which of the following statements is accurate? Year caWN-O Cash Flow -$1,000,000 $800,000 -$275,000 $300,000 -$180,000 $370,000 -S60,000 $900,000 $50,000 The project has a discounted payback period of 4.96 years, and the firm should accept the project. The firm has a payback period of 6.38 years, and the firm should reject the project. The firm has a modified internal rate of return of 11.92%, and the firm should reject the program. None of the Above Question 25 (8 points) You have the following set of cash flows for a project. The firm has a 9% weighted average cost of capital and typically accepts projects that payback in three years or less. Which of the following statements is accurate? Le Year Cash Flow -$1,000,000 $800,000 -$275,000 $300,000 -$180,000 $370,000 -$60,000 $900,000 $50.000 6 8 The project has a discounted payback period of 6.38 years, and the firm should reject the project. The project has a net present value of $328,744.17, and the firm should reject the project. SALT The firm has a modified internal rate of return of 11.92%, and the firm should reject the project. None of the Above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts