Question: All one problem just ran into the next page. PROBLEMS: SET A P26-1A company is considering three long-term capital investment proposals. Each Compute annual rate

All one problem just ran into the next page.

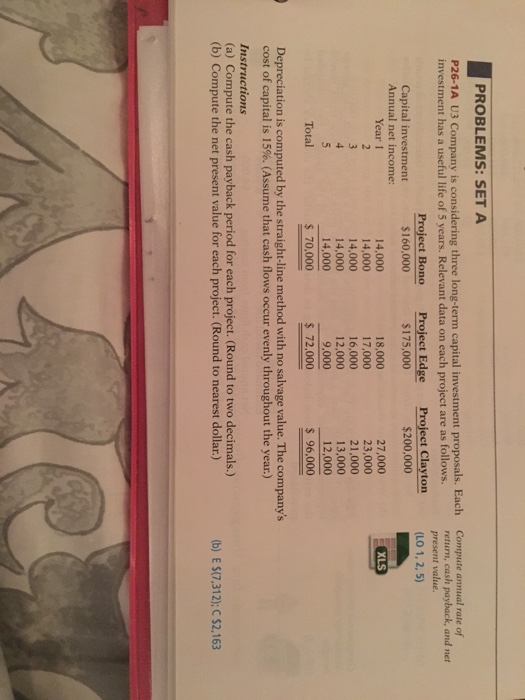

All one problem just ran into the next page. PROBLEMS: SET A P26-1A company is considering three long-term capital investment proposals. Each Compute annual rate of net U3 investment has a useful life of 5 years. Relevant data on each project are as follows. retum, cash payback, and present value. Project Bono Project Edge Project Clayton (LO 1, 2, 5) $200,000 $160,000 $175,000 Capital investment Annual net income: 27,000 18,000 XLS 14,000 Year 1 23,000 14,000 17,000 14,000 21,000 16,000 12,000 13,000 14,000 12,000 14,000 9,000 70,000 72,000 96,000 Total Depreciation is computed by the straight-line method with no salvage value. The company's cost of capital is 15%. (Assume that cash flows occur evenly throughout the year) Instructions (a) Compute the cash payback period for each project. (Round to two decimals. (b) ES(7.312); C $2,163 (b) Compute the net present value for each project. (Round to nearest dollar.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts