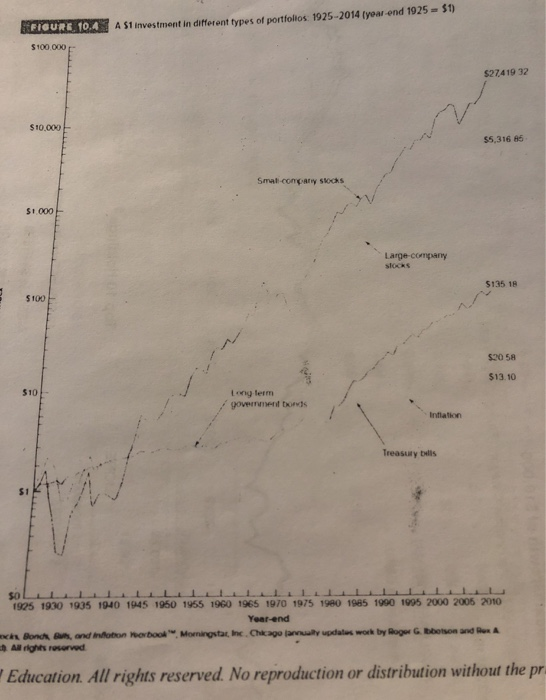

Question: all one problem please help with all FIGURE 10. 4 A $1 investment in different types of portfolios 1925-2014 [year-end 1925 = 51) $100.000 $27419

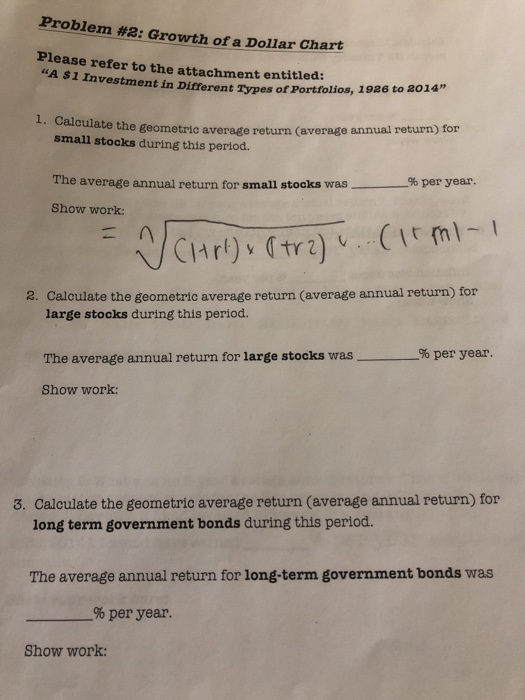

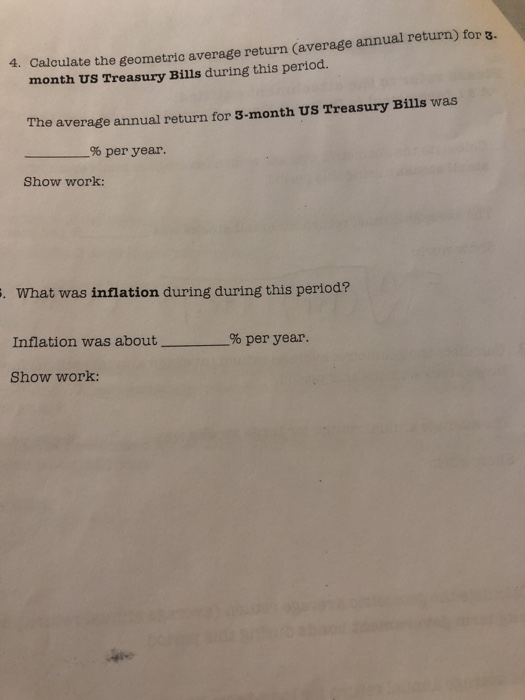

FIGURE 10. 4 A $1 investment in different types of portfolios 1925-2014 [year-end 1925 = 51) $100.000 $27419 32 $10.000 $5,316 86 Smat company los $.000 Large company $135 18 5100 500 5 $13.10 government to Infat Treasury tells 1925 1930 1939 1940 1949 1950 1959 1960 1969 1970 1975 1980 1985 1990 1995 2000 2005 2010 Year-end Bon art, and not abood Morningstar Ine. Chikapo mwly updates work by Hogor B o x All rights reserved Education. All rights reserved. No reproduction or distribution without the pr Problem #2: Growth of a Dollar Chart Please refer to the attachment entitled: "A $1 Investment in Differ sument in Different Types of Portfolios, 1926 to 2014" 1. Calculate the geometric av date the geometric average return (average annual return) for small stocks during this period. % per year. The average annual return for small stocks was Show work: CH) x (tra) u...(15 ml-1 2. Calculate the geometric average return (average annual return) for large stocks during this period. The average annual return for large stocks was % per year. Show work: 3. Calculate the geometric average return (average annual return) for long term government bonds during this period. The average annual return for long-term government bonds was % per year. Show work: 4. Calculate the geometric average return (average annual return) for 3. month US Treasury Bills during this period. The average annual return for 3-month US Treasury Bills was % per year. Show work: 5. What was inflation during during this period? Inflation was about - % per year. Show work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts