Question: ALL ONE QUESTION ALL ONE QUESTION Question 20 4 pts Questions (20-23) are based on the Information that follows Carbax Corp, stock trades (5) 575

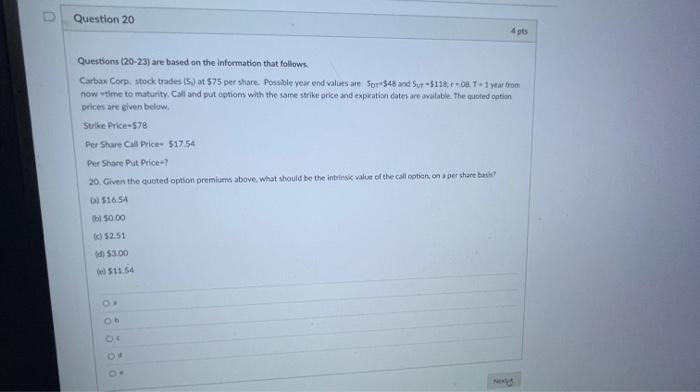

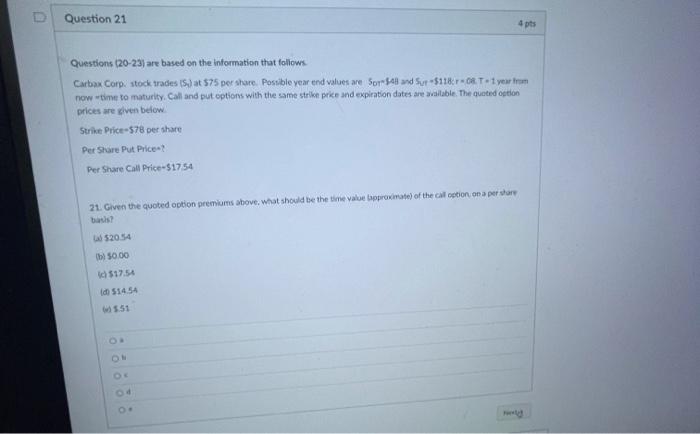

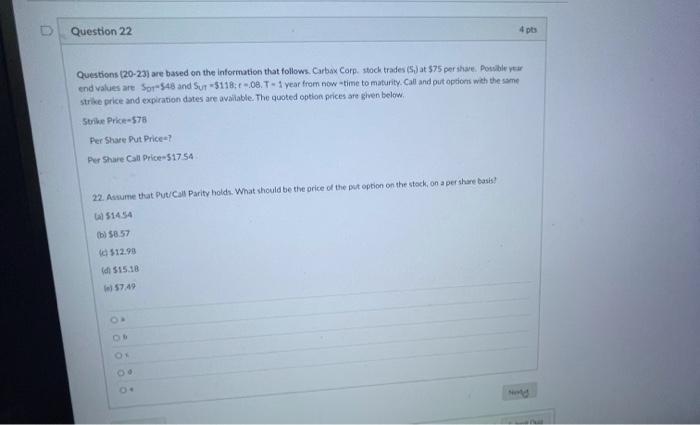

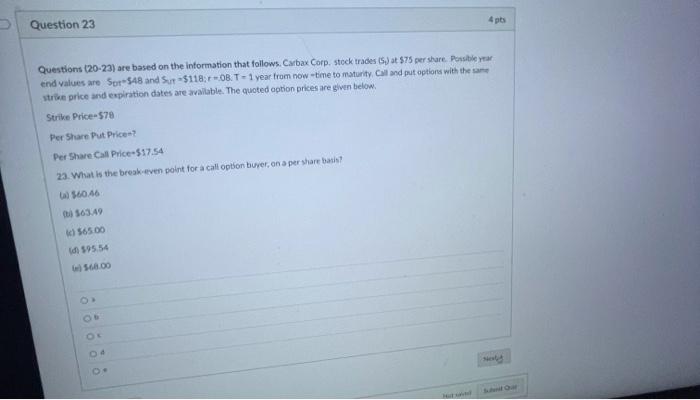

Question 20 4 pts Questions (20-23) are based on the Information that follows Carbax Corp, stock trades (5) 575 per share. Possible year end valutare Sor $48 and Sur-5118-01T1 year from now time to maturity. Call and put options with the same strike price and expiration dates are available. The quoted option prices are given below Sulke Price-578 Per Share Cal Price 517.54 Per Share Put Price? 20. Given the quoted option premiums above. What should be the intrinsic value of the call option, on a pershare bavi 516 54 bi 50.00 5251 d) $3.00 el $11.54 Question 21 4 pts Questions (20-23) are based on the information that follows Carbax Corp, stock traces (5) at 575 per share. Possible year end values are Sort 543 and Su-51180 T. 1 year from now time to maturity. Call and put options with the same strike price and expiration dates are available. The quoted option prices are diven below Strike Price-578 per share Per Share Put Price Per Share Call Price-51754 21. Given the quoted option premiums above, what should be the time value approximate of the call option on a perstar 520 54 b) 50.00 10 517.54 Id 51454 551 D Question 22 4 pts Questions (20-23) are based on the information that follows. Carbox Corp. stock trades (5.) at 575 pershare. Possible year end values are Sor-548 and Sur-5118:08. T- 1 year from now time to maturity. Call and put options with the same Strike price and expiration dates are available. The quoted option prices are given below Strike Price-578 Per Share Put Price? Per Share Cal Price-51754 22. Assume that Put/Call Parity holds. What should be the price of the put option on the stock, on a pershare basis! 51454 $8.57 $12.99 Id $15.18 57:49 4gb Question 23 Questions (20-23) are based on the information that follows. Carbax Corp. stock trades (5) at $75 per share. Possible year end values are Sor-548 and Su-51180B.T - 1 year from now time to maturity. Call and put options with the same stre price and expiration dates are available. The quoted option prices are given below Strike Price-578 Per Share Put Price Per Share Call Price-517.54 23. What is the break-even point for a call option buyer, on a per share basis 560.46 563.49 Id $65.00 Id 595 54 08.00 Net

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts