Question: Problem 4 You are given the following data. The Coupon Payment is $100 on a 10-year bond (10 years until maturity) with a Face Value

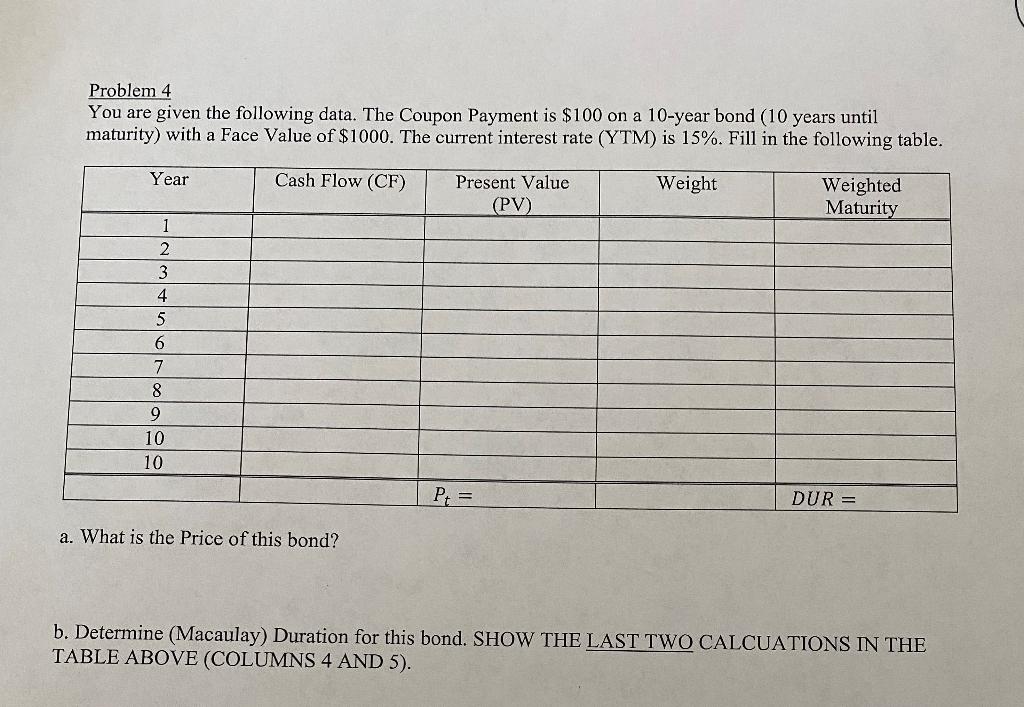

Problem 4 You are given the following data. The Coupon Payment is $100 on a 10-year bond (10 years until maturity) with a Face Value of $1000. The current interest rate (YTM) is 15%. Fill in the following table. Year Cash Flow (CF) Present Value (PV) Weight Weighted Maturity 1 2 3 4 5 6 7 8 9 10 10 P = DUR= a. What is the Price of this bond? b. Determine (Macaulay) Duration for this bond. SHOW THE LAST TWO CALCUATIONS IN THE TABLE ABOVE (COLUMNS 4 AND 5)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts