Question: All one question and the second picture is what has to get done! thank you, I will like the answer Loan payment. Determine the equal,

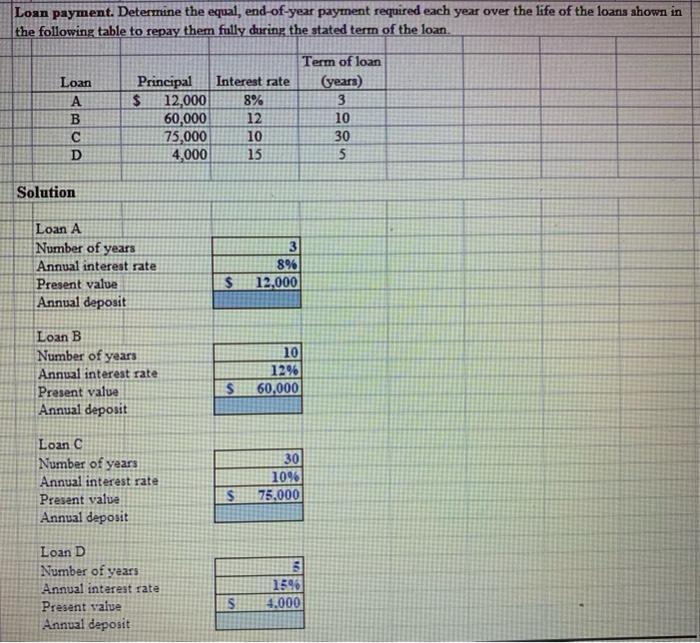

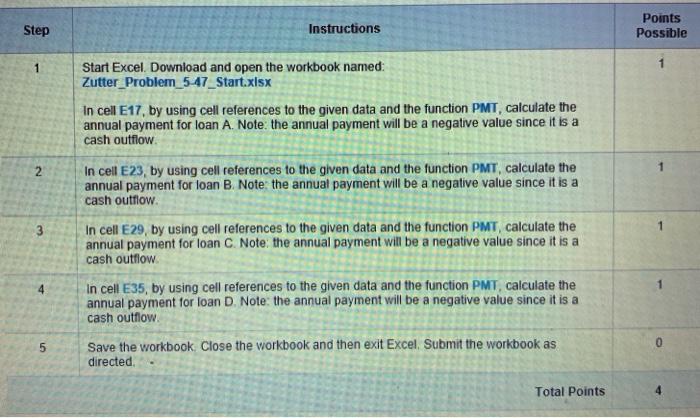

Loan payment. Determine the equal, end-of-year payment required each year over the life of the loanis shown in the following table to repay them fully during the stated term of the loan. Loan A B D Principal Interest rate $ 12,000 8% 60,000 12 75,000 10 4,000 15 Term of loan (years) 3 10 30 5 Solution Loan A Number of years Annual interest rate Present value Annual deposit 3 8% 12.000 $ Loan B Number of years Annual interest rate Present value Annual deposit 10 12% 60,000 $ Loan C Number of years Annual interest rate Present value Annual deposit 30 1096 75,000 $ Loan D Number of years Annual interest rate Present value Annual deposit 1596 4.000 Step Instructions Points Possible 1 2 Start Excel. Download and open the workbook named: Zutter_Problem_5-47_Start.xlsx In cell E17, by using cell references to the given data and the function PMT, calculate the annual payment for loan A. Notethe annual payment will be a negative value since it is a cash outflow In cell E23, by using cell references to the given data and the function PMT, calculate the annual payment for loan B. Note the annual payment will be a negative value since it is a cash outflow In cell E29, by using cell references to the given data and the function PMT, calculate the annual payment for loan C. Note: the annual payment will be a negative value since it is a cash outflow In cell E35, by using cell references to the given data and the function PMT, calculate the annual payment for loan D. Note: the annual payment will be a negative value since it is a cash outflow Save the workbook. Close the workbook and then exit Excel Submit the workbook as directed 3 4 0 en

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts