Question: Show your work as much as possible below each question to get full credit (Le, you should provide information about PV: FV. PMT, I/Y, N

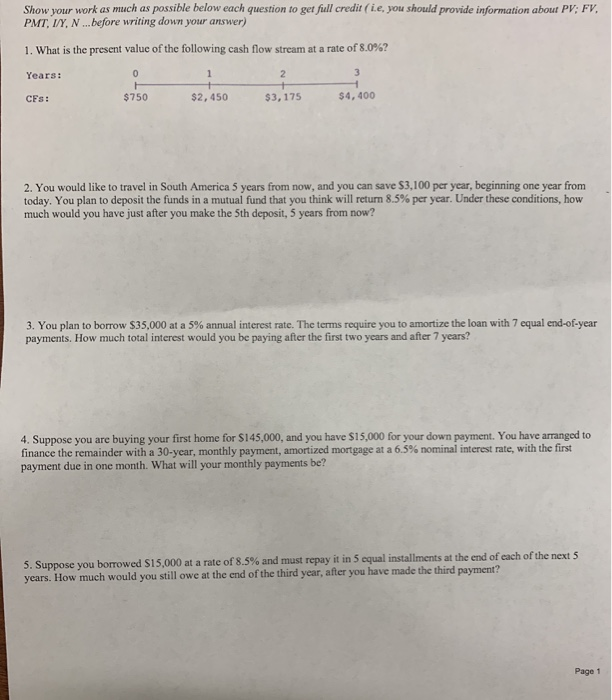

Show your work as much as possible below each question to get full credit (Le, you should provide information about PV: FV. PMT, I/Y, N ... before writing down your answer) 1. What is the present value of the following cash flow stream at a rate of 8.0%? Years: CFs: $2,450 $3,175 $4,400 2. You would like to travel in South America 5 years from now, and you can save $3,100 per year, beginning one year from today. You plan to deposit the funds in a mutual fund that you think will return 8.5% per year. Under these conditions, how much would you have just after you make the Sth deposit, 5 years from now? 3. You plan to borrow $35,000 at a 5% annual interest rate. The terms require you to amortize the loan with 7 equal end-of-year payments, How much total interest would you be paying after the first two years and after 7 years? 4. Suppose you are buying your first home for $145,000, and you have $15,000 for your down payment. You have arranged to finance the remainder with a 30-year, monthly payment, amortized mortgage at a 6.5% nominal interest rate, with the first payment due in one month. What will your monthly payments be? 5. Suppose you borrowed $15,000 at a rate of 8.5% and must repay it in Sequal installments at the end of each of the next s years. How much would you still owe at the end of the third year, after you have made the third payment? Page 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts