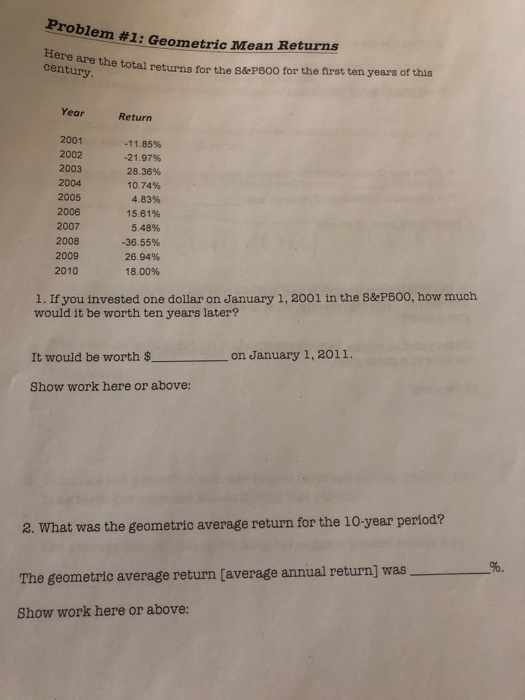

Question: all one question please help with all Problem #1: Geometric Mean Returns Here are the total returns for the S&P500 for the first ten years

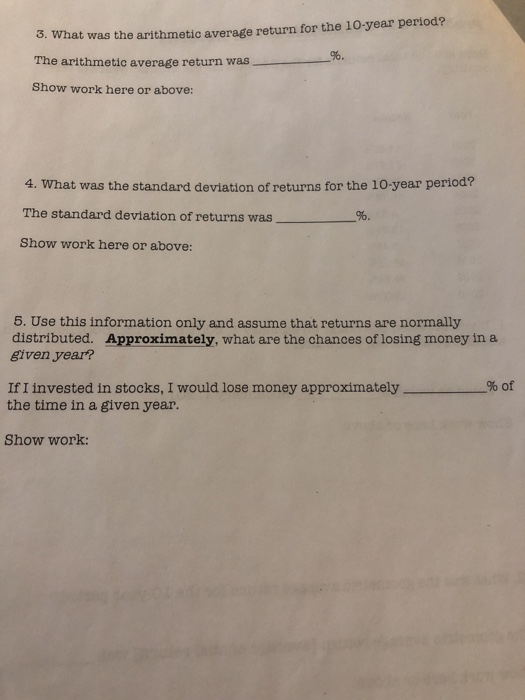

Problem #1: Geometric Mean Returns Here are the total returns for the S&P500 for the first ten years of this century. Year Return 2001 -11.85 % -21.97 % 2002 2003 28.36% 2004 10.74% 2005 4.83% 2006 15.61% 2007 5.48% 2008 -36.55% 2009 26.94% 18.00 % 2010 1. If you invested one dollar on January 1, 2001 in the S&eP500, how much would it be worth ten years later? on January 1, 2011. It would be worth $ Show work here or above: 2. What was the geometric average return for the 10-year period? The geometric average return [average annual return] was Show work here or above: 8. What was the arithmetic average return for the 10-year period? %. The arithmetic average return was Show work here or above: 4. What was the standard deviation of returns for the 10-year period? The standard deviation of returns was %. Show work here or above: 5. Use this information only and assume that returns are normally distributed. Approximately, what are the chances of losing money in a given year? % of If I invested in stocks, I would lose money approximately the time in a given year. Show work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts