Question: All other solution on Chegg seems wrong, plz do not copy that!! Handwriting preferred, thanks!! Section A) Consider the European digital option that pays a

All other solution on Chegg seems wrong, plz do not copy that!! Handwriting preferred, thanks!!

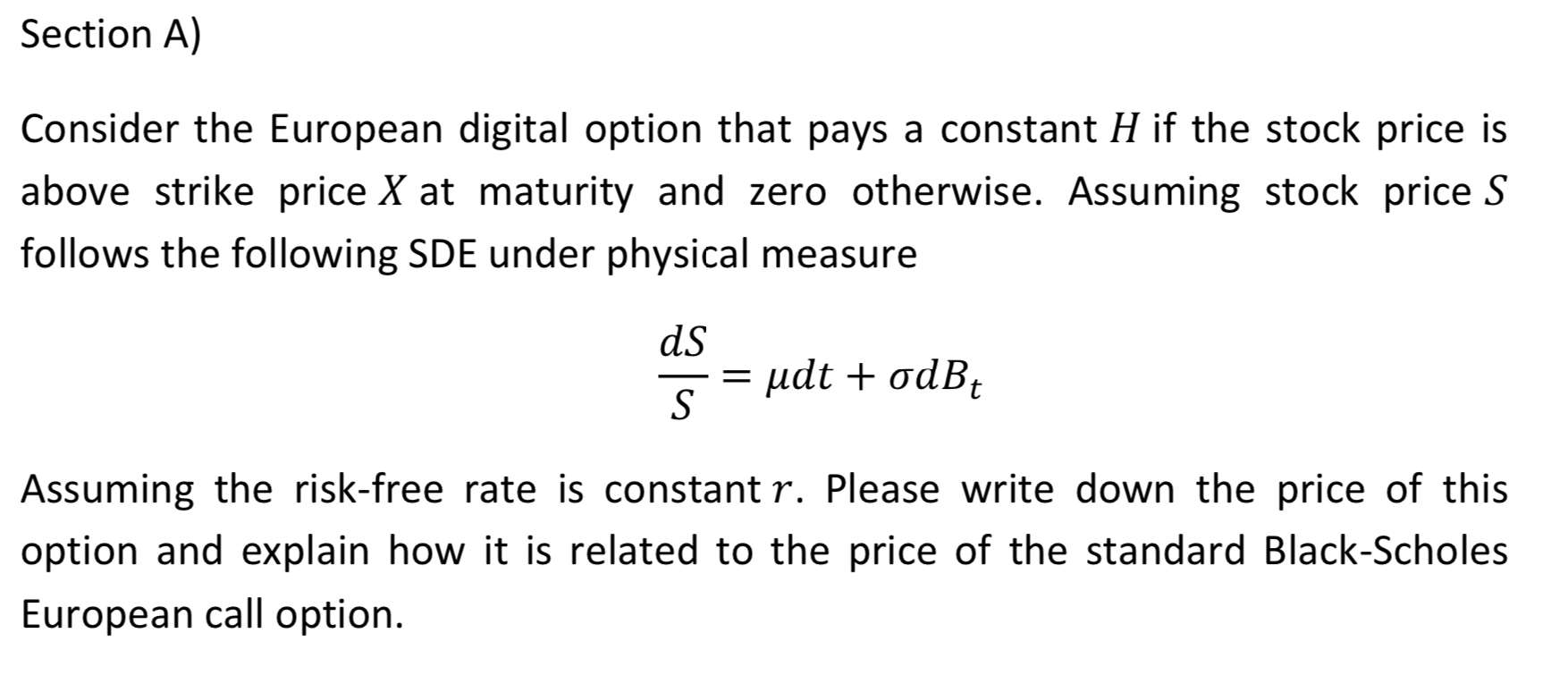

Section A) Consider the European digital option that pays a constant H if the stock price is above strike price X at maturity and zero otherwise. Assuming stock price S follows the following SDE under physical measure ds. = udt + odBt Assuming the risk-free rate is constant r. Please write down the price of this option and explain how it is related to the price of the standard Black-Scholes European call option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts