Question: all parts please = Homework: Assignment 7 Question 5, B14-26 (book/static) Part 1 of 3 > HW Score: 10%, 10 of 100 points O Points:

all parts please

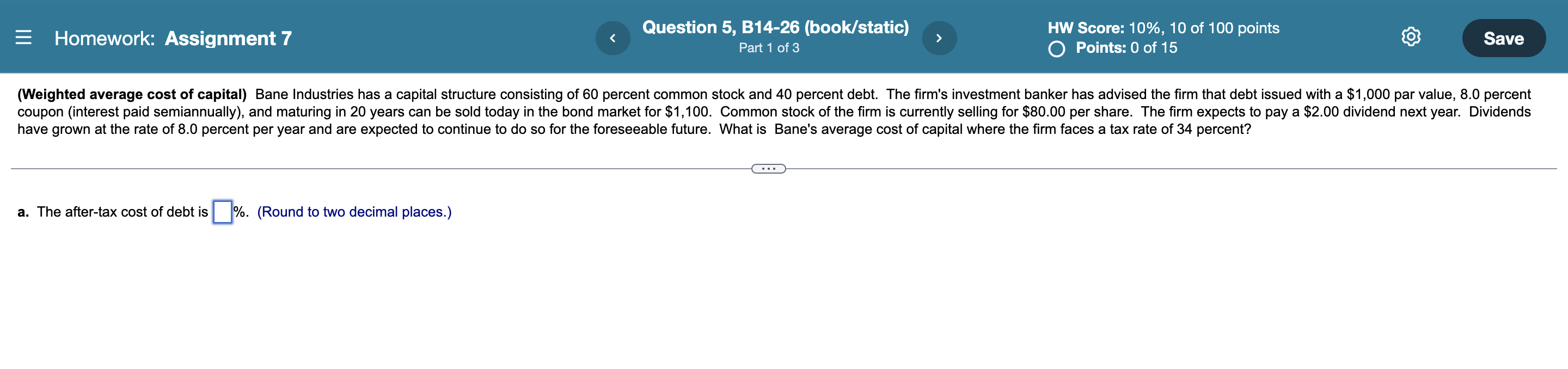

= Homework: Assignment 7 Question 5, B14-26 (book/static) Part 1 of 3 > HW Score: 10%, 10 of 100 points O Points: 0 of 15 Save (Weighted average cost of capital) Bane Industries has a capital structure consisting of 60 percent common stock and 40 percent debt. The firm's investment banker has advised the firm that debt issued with a $1,000 par value, 8.0 percent coupon (interest paid semiannually), and maturing in 20 years can be sold today in the bond market for $1,100. Common stock of the firm is currently selling for $80.00 per share. The firm expects to pay a $2.00 dividend next year. Dividends have grown at the rate of 8.0 percent per year and are expected to continue to do so for the foreseeable future. What is Bane's average cost of capital where the firm faces a tax rate of 34 percent? a. The after-tax cost of debt is %. (Round to two decimal places.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts