Question: = Homework: Assignment 4 Question 3, B6-4 (book/static) Part 1 of 6 HW Score: 74.5%, 74.5 of 100 points O Points: 0 of 13 Save

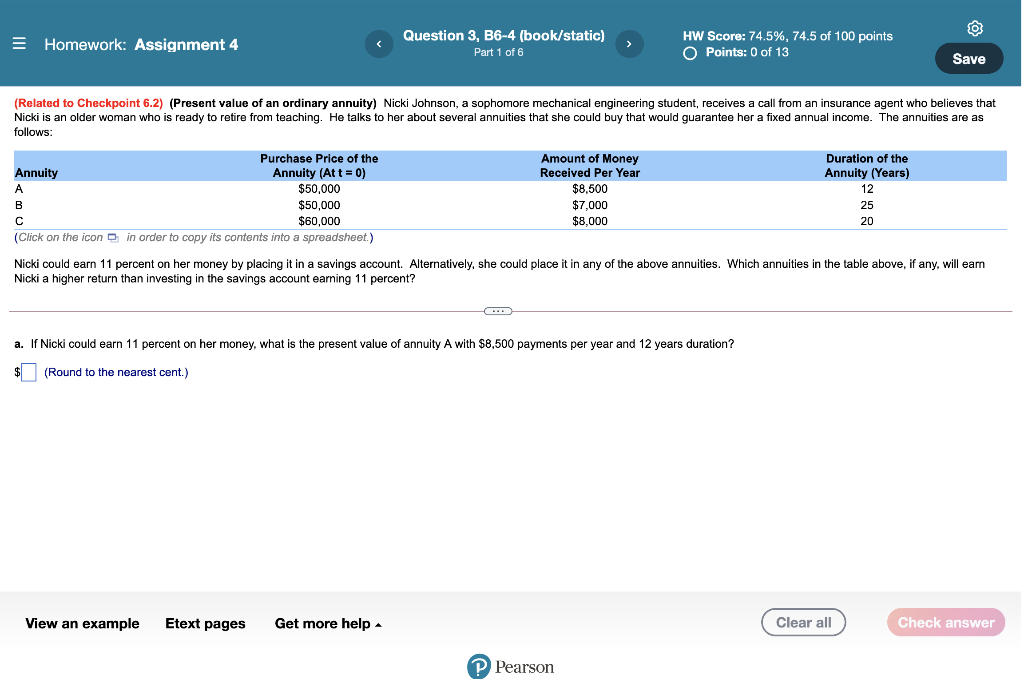

= Homework: Assignment 4 Question 3, B6-4 (book/static) Part 1 of 6 HW Score: 74.5%, 74.5 of 100 points O Points: 0 of 13 Save (Related to Checkpoint 6.2) (Present value of an ordinary annuity) Nicki Johnson, a sophomore mechanical engineering student, receives a call from an insurance agent who believes that Nicki is an older woman who i ready to retire from teaching. He talks to her about several annuities that she could buy that would guarantee her a fixed annual income. The annuities are as follows: Purchase Price of the Annuity Annuity (At t = 0) A $50,000 B $50,000 $60,000 (Click on the icon in order to copy its contents into a spreadsheet.) Amount of Money Received Per Year $8.500 $7,000 $8.000 Duration of the Annuity (Years) 12 25 20 Nicki could earn 11 percent on her money by placing it in a savings account. Alternatively, she could place it in any of the above annuities. Which annuities in the table above, if any, will earn Nicki a higher return than investing in the savings account earning 11 percent? a. If Nicki could earn 11 percent on her money, what is the present value of annuity A with $8,500 payments per year and 12 years duration? (Round to the nearest cent.) View an example Etext pages Get more help Clear all Check answer P Pearson

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts