Question: ALL QUESTIONS 5. Select the best answer. 1)Shareholders' equity is equal to: totel dge nerens 10/ae de A. total assets plus total liabilities. B. net

ALL QUESTIONS

ALL QUESTIONS

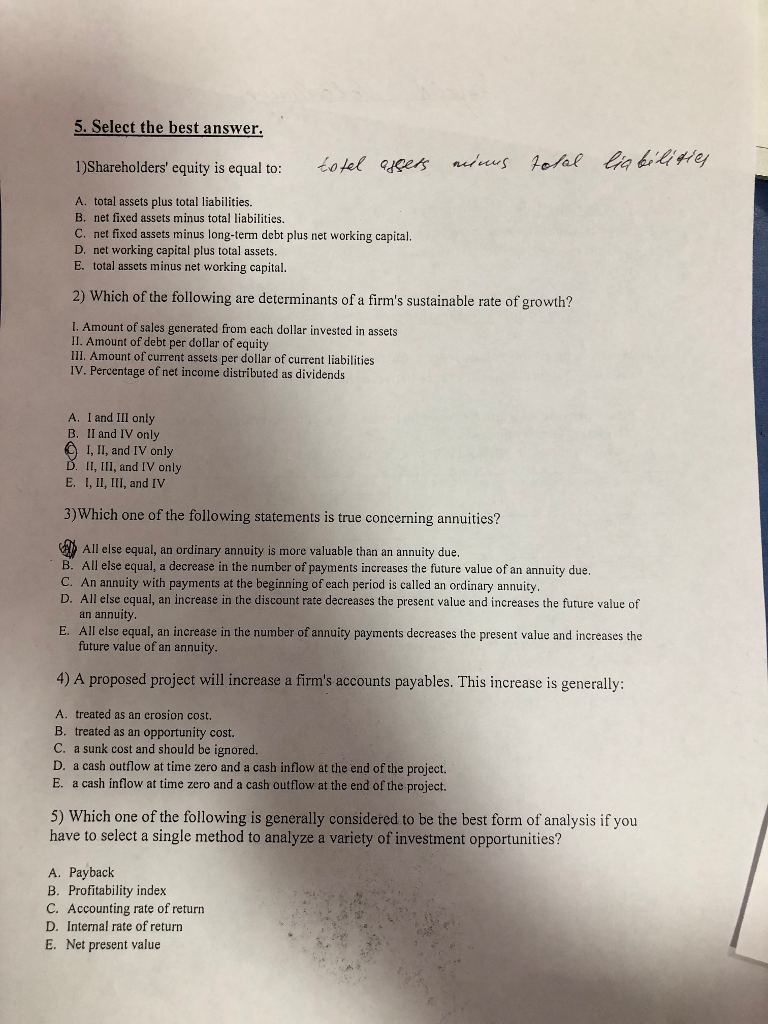

5. Select the best answer. 1)Shareholders' equity is equal to: totel dge nerens 10/ae de A. total assets plus total liabilities. B. net fixed assets minus total liabilities C. net fixed assets minus long-term debt plus net working capital. D. net working capital plus total assets. E. total assets minus net working capital. 2) Which of the following are determinants of a firm's sustainable rate of growth? 1. Amount of sales generated from each dollar invested in assets II. Amount of debt per dollar of equity III. Amount of current assets per dollar of current liabilities IV. Percentage of net income distributed as dividends A. I and III only B. II and IV only I, II, and IV only II, II1, and IV only I, II, III, and IV E. 3) Which one of the following statements is true concerning annuities? All else equal, an ordinary annuity is more valuable than an annuity due B. All else equal, a decrease in the number of payments increases the future value of an annuity due. C. An annuity with payments at the beginning of each period is called an ordinary annuity. D. All else equal, an increase in the discount rate decreases the present value and increases the future value of an annuity E. All else equal, an increase in the number of annuity payments decreases the present value and increases the future value of an annuity 4) A proposed project will increase a firm's accounts payables. This increase is generally: A. treated as an erosion cost. B. treated as an opportunity cost C. a sunk cost and should be ignored. D. a cash outflow at time zero and a cash inflow at the end of the project. E. a cash inflow at time zero and a cash outflow at the end of the project. 5) Which one of the following is generally considered to be the best form of analysis if you have to select a single method to analyze a variety of investment opportunities? A. Payback B. Profitability index C. Accounting rate of return D. Internal rate of return E. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts