Question: All questions in Part B will be based on the following Case Study. You are trying to estimate the intrinsic value of the shares of

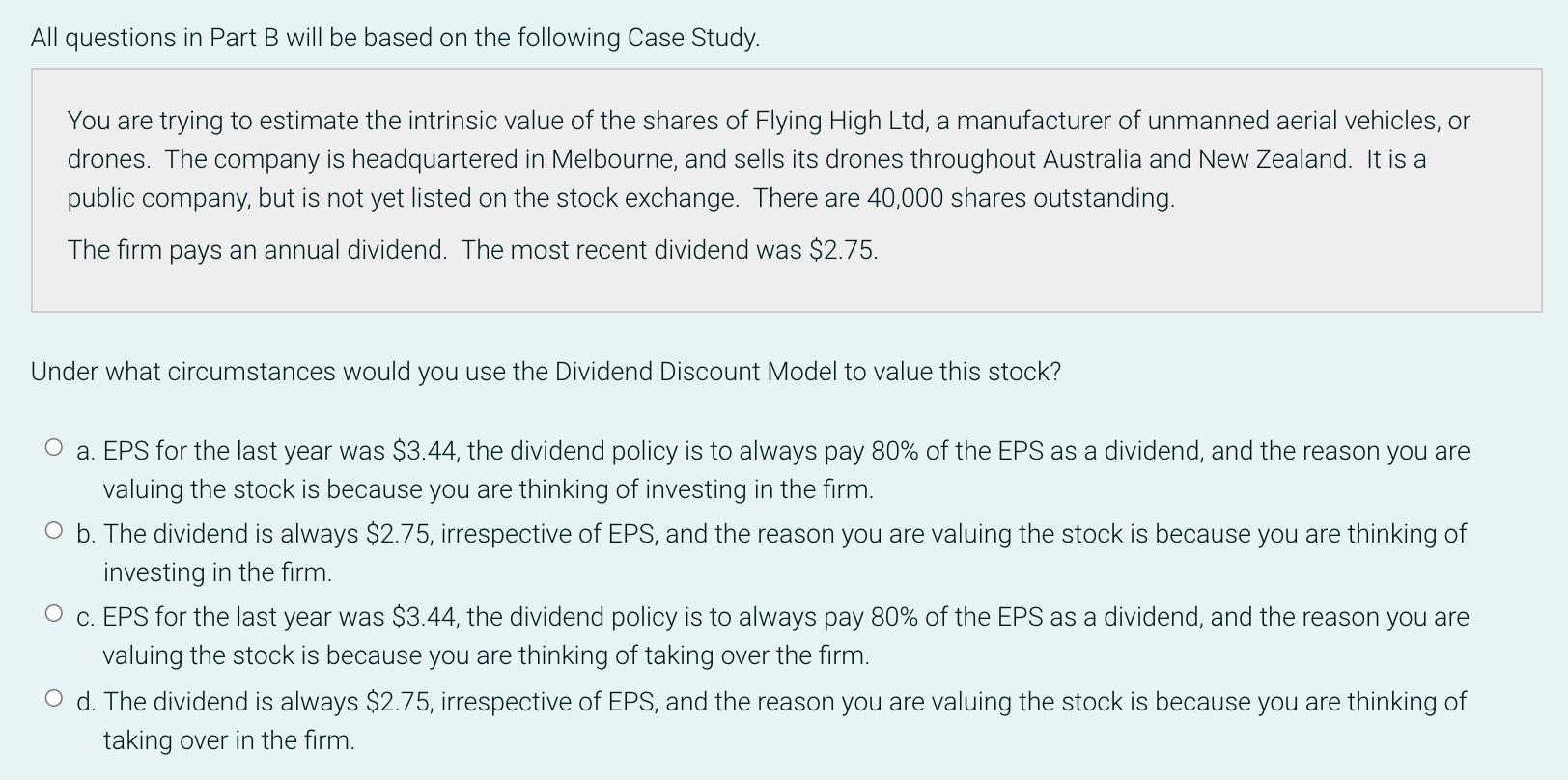

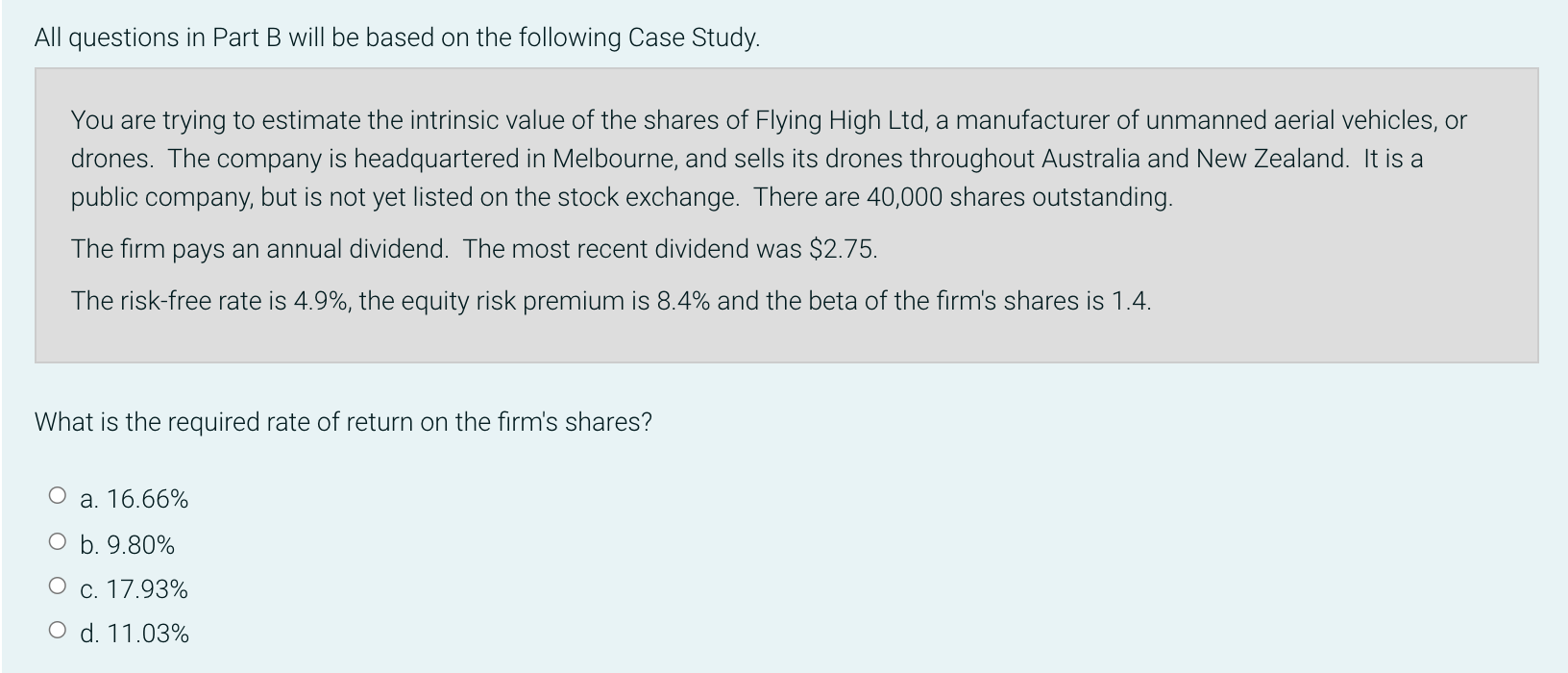

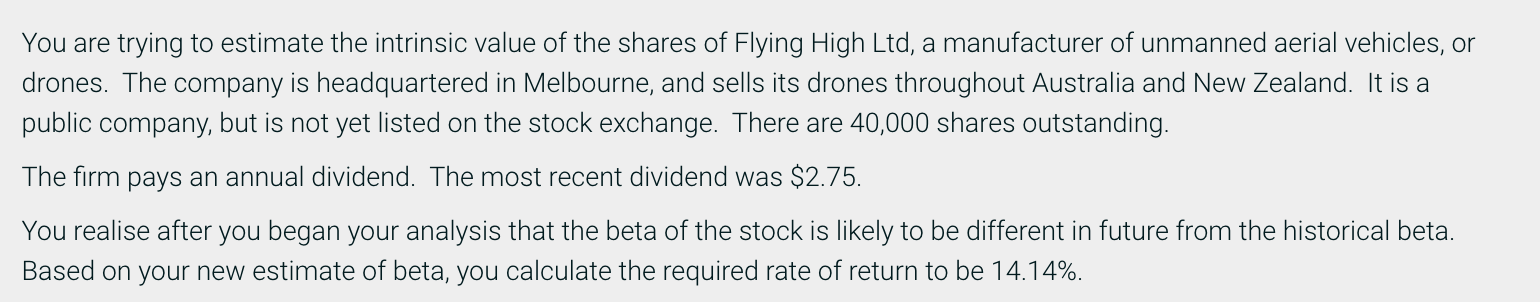

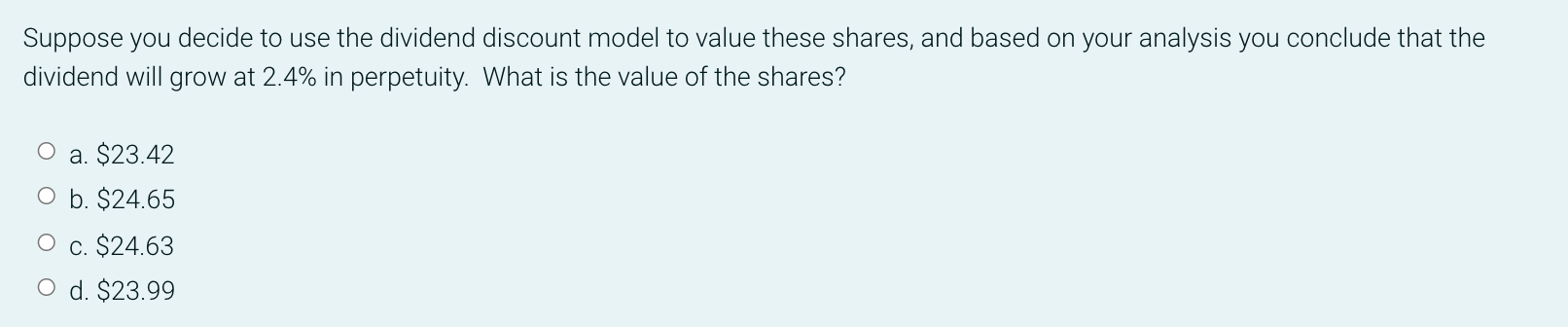

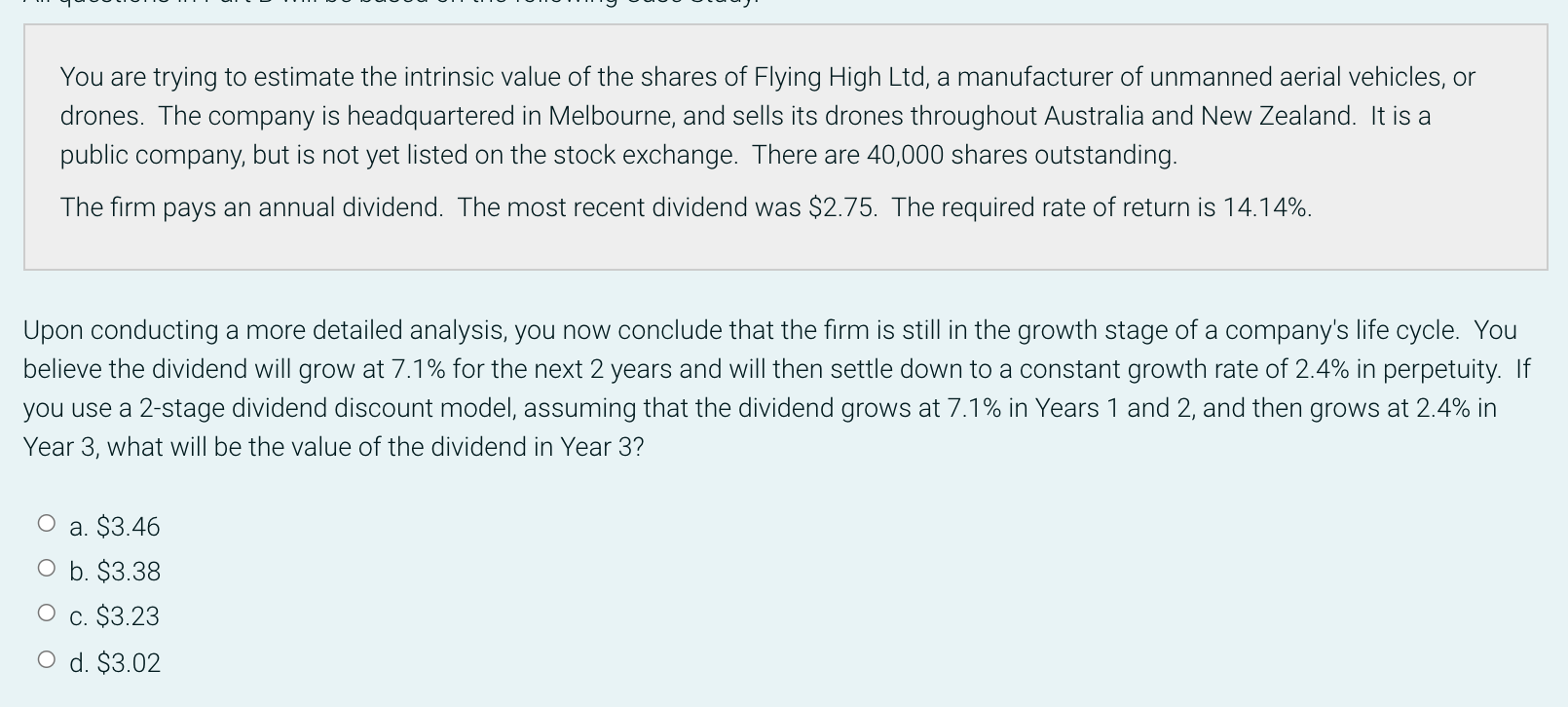

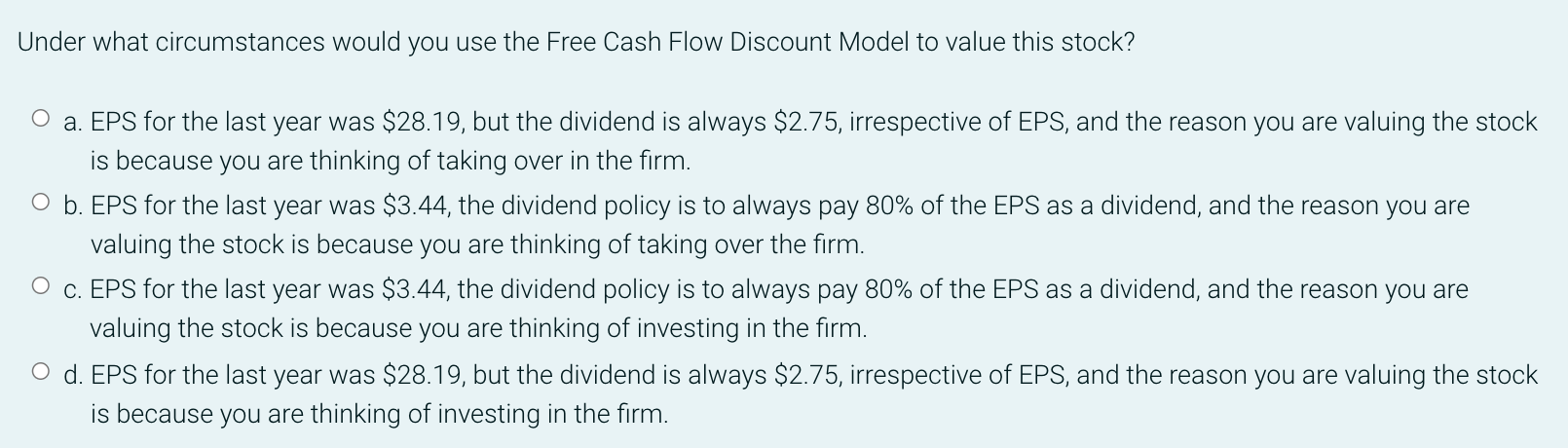

All questions in Part B will be based on the following Case Study. You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of unmanned aerial vehicles, or drones. The company is headquartered in Melbourne, and sells its drones throughout Australia and New Zealand. It is a public company, but is not yet listed on the stock exchange. There are 40,000 shares outstanding. The firm pays an annual dividend. The most recent dividend was $2.75. Under what circumstances would you use the Dividend Discount Model to value this stock? a. EPS for the last year was $3.44, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of investing in the firm. O b. The dividend is always $2.75, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of investing in the firm. O C. EPS for the last year was $3.44, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of taking over the firm. O d. The dividend is always $2.75, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of taking over in the firm. All questions in Part B will be based on the following Case Study. You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of unmanned aerial vehicles, or drones. The company is headquartered in Melbourne, and sells its drones throughout Australia and New Zealand. It is a public company, but is not yet listed on the stock exchange. There are 40,000 shares outstanding. The firm pays an annual dividend. The most recent dividend was $2.75. The risk-free rate is 4.9%, the equity risk premium is 8.4% and the beta of the firm's shares is 1.4. What is the required rate of return on the firm's shares? a. 16.66% O b. 9.80% O c. 17.93% O d. 11.03% You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of unmanned aerial vehicles, or drones. The company is headquartered in Melbourne, and sells its drones throughout Australia and New Zealand. It is a public company, but is not yet listed on the stock exchange. There are 40,000 shares outstanding. The firm pays an annual dividend. The most recent dividend was $2.75. You realise after you began your analysis that the beta of the stock is likely to be different in future from the historical beta. Based on your new estimate of beta, you calculate the required rate of return to be 14.14%. Suppose you decide to use the dividend discount model to value these shares, and based on your analysis you conclude that the dividend will grow at 2.4% in perpetuity. What is the value of the shares? a. $23.42 b. $24.65 c. $24.63 O d. $23.99 You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of unmanned aerial vehicles, or drones. The company is headquartered in Melbourne, and sells its drones throughout Australia and New Zealand. It is a public company, but is not yet listed on the stock exchange. There are 40,000 shares outstanding. The firm pays an annual dividend. The most recent dividend was $2.75. The required rate of return is 14.14%. Upon conducting a more detailed analysis, you now conclude that the firm is still in the growth stage of a company's life cycle. You believe the dividend will grow at 7.1% for the next 2 years and will then settle down to a constant growth rate of 2.4% in perpetuity. If you use a 2-stage dividend discount model, assuming that the dividend grows at 7.1% in Years 1 and 2, and then grows at 2.4% in Year 3, what will be the value of the dividend in Year 3? a. $3.46 O b. $3.38 c. $3.23 O d. $3.02 Under what circumstances would you use the Free Cash Flow Discount Model to value this stock? a. EPS for the last year was $28.19, but the dividend is always $2.75, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of taking over in the firm. O b. EPS for the last year was $3.44, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of taking over the firm. O C. EPS for the last year was $3.44, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of investing in the firm. O d. EPS for the last year was $28.19, but the dividend is always $2.75, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of investing in the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts