Question: All questions in Part B will be based on the following Case Study. You are trying to estimate the intrinsic value of the shares of

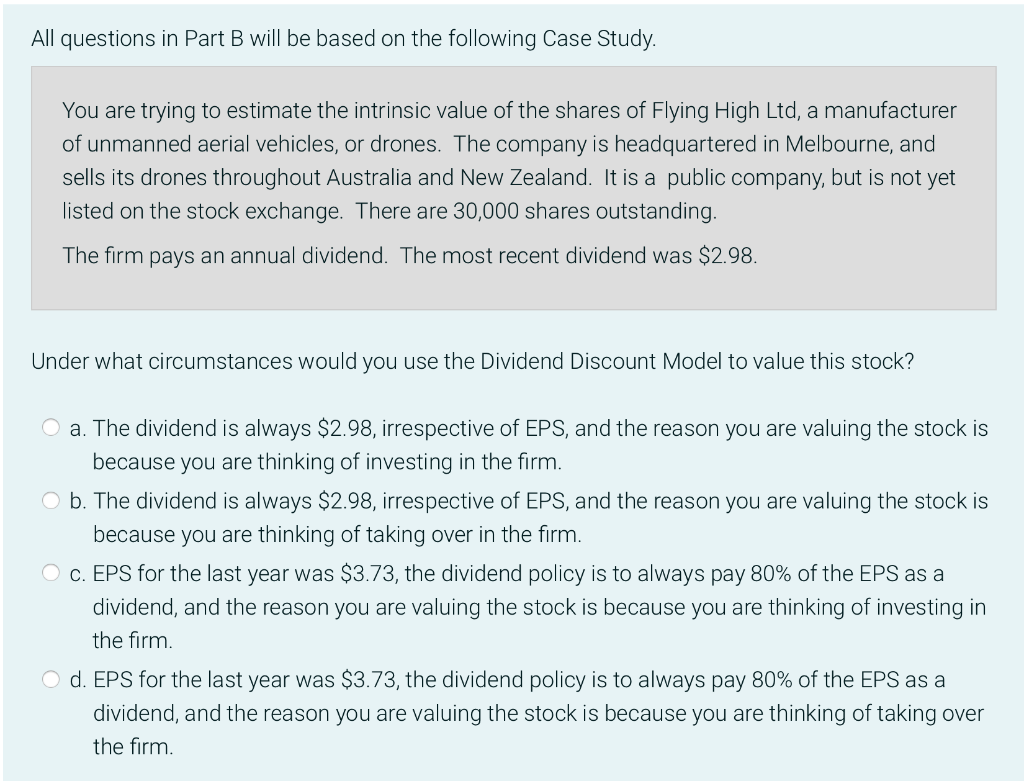

All questions in Part B will be based on the following Case Study. You are trying to estimate the intrinsic value of the shares of Flying High Ltd, a manufacturer of unmanned aerial vehicles, or drones. The company is headquartered in Melbourne, and sells its drones throughout Australia and New Zealand. It is a public company, but is not yet listed on the stock exchange. There are 30,000 shares outstanding. The firm pays an annual dividend. The most recent dividend was $2.98. Under what circumstances would you use the Dividend Discount Model to value this stock? O a. The dividend is always $2.98, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of investing in the firm. b. The dividend is always $2.98, irrespective of EPS, and the reason you are valuing the stock is because you are thinking of taking over in the firm. c. EPS for the last year was $3.73, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of investing in the firm O d. EPS for the last year was $3.73, the dividend policy is to always pay 80% of the EPS as a dividend, and the reason you are valuing the stock is because you are thinking of taking over the firm

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts