Question: All questions utilize the multivariate demand function for Toyotas given in C4 on text page 82, initially with: P M = $20000P G = $1.00I

All questions utilize the multivariate demand function for Toyotas given in C4 on text page 82, initially with:

PM = $20000PG = $1.00I = $15000A = $10000

This function is:

QT = 200 -.01PT +.005PM -10PG +.01I +.003A

1.Use the above to calculate the arc price elasticity of demand between PT = $40000 and PT = $30000.The arc elasticity formula is:

2.Calculate the quantity demanded at each of the above prices and revenue that will result if the quantity is sold (fill in table below).

3.Marketing suggests lowering PT from $40000 to $30000.The size of the elasticity coefficient in #1 should tell you what is likely to happen to revenue.Explain why this is (or is not) a good marketing suggestion from a revenue viewpoint (note: your answer in #1 and the calculations in #2 should be giving the same message).If the implications in #1 and #2 differ, does the difference make sense (or did you make a mistake in #1 or #2)?

4.Calculate the point price elasticity of demand for Toyotas at PT = $40000(which should make QT = 70).Does this elasticity value indicate that The demand for Toyotas is relatively elastic to changes in the price of Toyotas?Explain why or why not. The formula is:

5.Calculate the point advertising elasticity of demand with PT = 30000 and A = $10000.Use QT corresponding to PT = $30000 (which should make QT = 170).Other variables and their values are given at the top, before question #1.Does this elasticity indicate that the demand for Toyotas is relatively responsive to changes in advertising expenditures?Explain why or why not.The formula is:

6.Calculate the point income elasticity of demand with PT = $30000 (which should make QT = 170) and I = $15000.Does this elasticity coefficient indicate that the demand for Toyotas is relatively responsive to changes in income?Explain why or why not.The formula is:

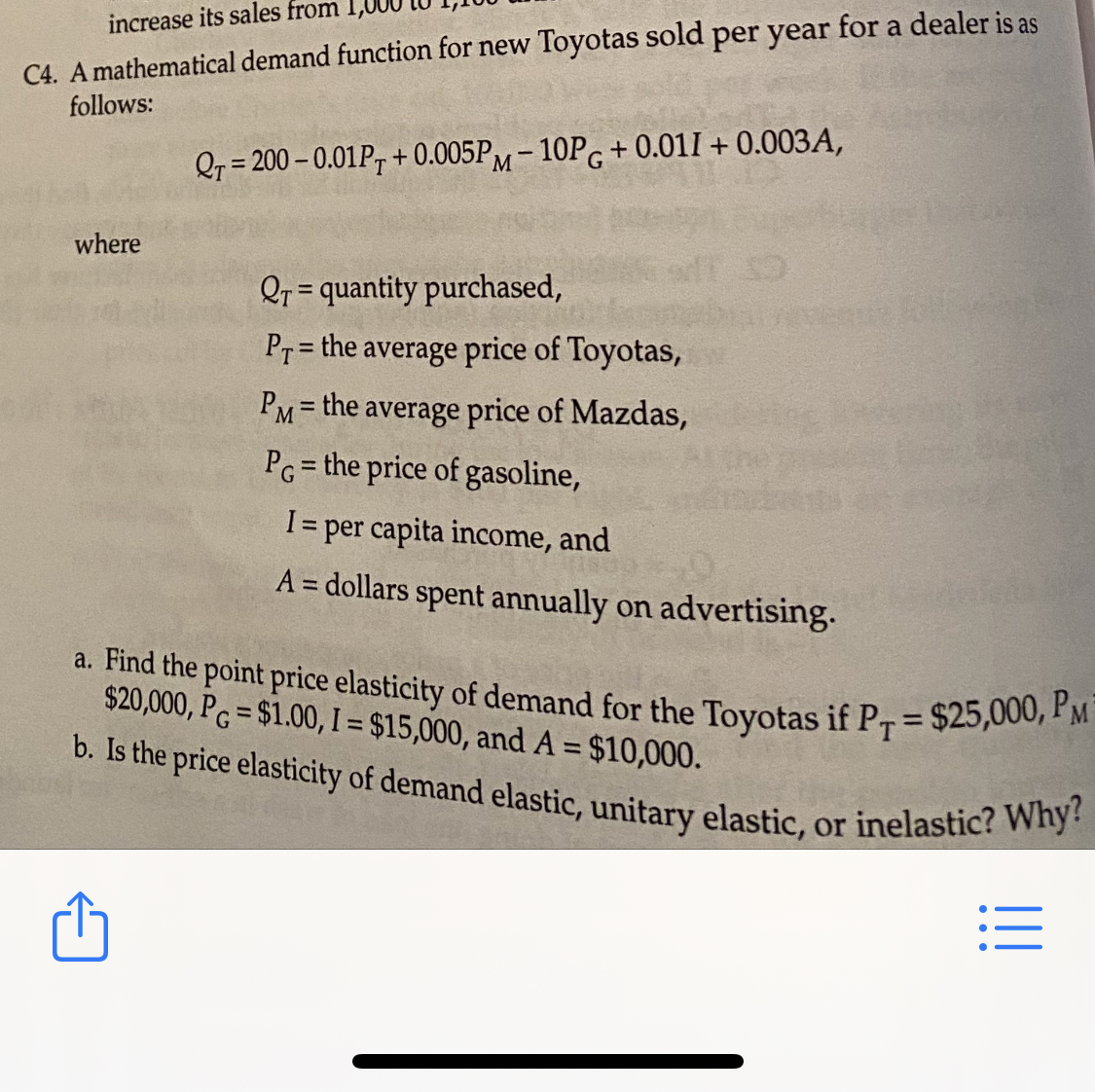

ELASTICITY EXERCISE Name _________________________ Due _________ Please show work in detail. All questions utilize the multivariate demand function for Toyotas given in C4 on text page 82, initially with: PM = $20000 PG = $1.00 I = $15000 A = $10000 This function is: QT = 200 -.01PT +.005PM -10PG +.01I +.003A 1. Use the above to calculate the arc price elasticity of demand between PT = $40000 and PT = $30000. The arc elasticity formula is: E p= Q P1 + P2 P Q1 +Q2 2. Calculate the quantity demanded at each of the above prices and revenue that will result if the quantity is sold (fill in table below). PT QT Revenue $40000 $30000 3. Marketing suggests lowering PT from $40000 to $30000. The size of the elasticity coefficient in #1 should tell you what is likely to happen to revenue. Explain why this is (or is not) a good marketing suggestion from a revenue viewpoint (note: your answer in #1 and the calculations in #2 should be giving the same message). If the implications in #1 and #2 differ, does the difference make sense (or did you make a mistake in #1 or #2)? 4. Calculate the point price elasticity of demand for Toyotas at PT = $40000 (which should make QT = 70). Does this elasticity value indicate that The demand for Toyotas is relatively elastic to changes in the price of Toyotas? Explain why or why not. The formula is: E P= Q T PT PT Q T 5. Calculate the point advertising elasticity of demand with PT = 30000 and A = $10000. Use QT corresponding to PT = $30000 (which should make QT = 170). Other variables and their values are given at the top, before question #1. Does this elasticity indicate that the demand for Toyotas is relatively responsive to changes in advertising expenditures? Explain why or why not. The formula is: EA= QT A A QT 6. Calculate the point income elasticity of demand with PT = $30000 (which should make QT = 170) and I = $15000. Does this elasticity coefficient indicate that the demand for Toyotas is relatively responsive to changes in income? Explain why or why not. The formula is: EI= QT I I QT Elasticity12.docx 091419 increase its sales from 1,000 C4. A mathematical demand function for new Toyotas sold per year for a dealer is as follows: QT = 200 -0.01PT + 0.005PM - 10Pc + 0.011 + 0.003A, where QT = quantity purchased, PT = the average price of Toyotas, PM = the average price of Mazdas, PG = the price of gasoline, I = per capita income, and A = dollars spent annually on advertising. a. Find the point price elasticity of demand for the Toyotas if PT = $25,000, PM $20,000, Pc = $1.00, I = $15,000, and A = $10,000. b. Is the price elasticity of demand elastic, unitary elastic, or inelastic? Why

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts