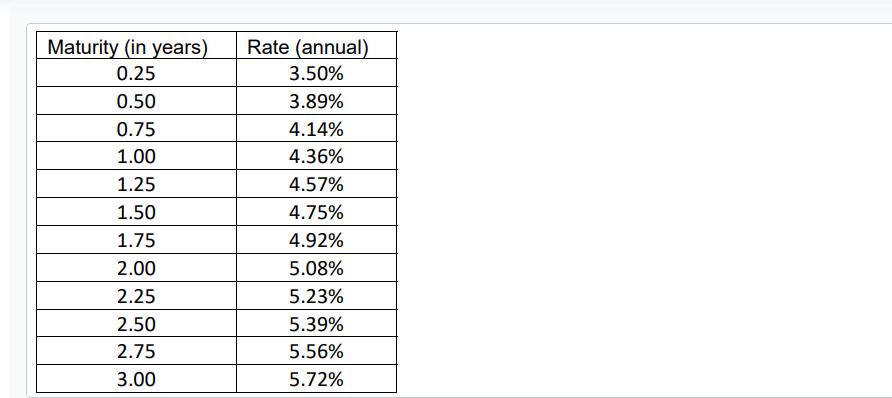

Question: All rates in this table are quoted using semi-annual compounding convention. Imagine that today is January 1, 2023. Pretend that each year has 360 days

All rates in this table are quoted using semi-annual compounding convention.

Imagine that today is January 1, 2023. Pretend that each year has 360 days and each month has 30 days. Price the following bonds using the spot curve given in Table 1:

a. Bond A: A zero-coupon bond maturing on January 1, 2026.

b. Bond B: A semi-annual coupon bond maturing on July 1, 2025, giving 4% coupon per year.

c. Bond C: A quarterly-coupon bond that matures on October 1, 2026, giving 8% coupon per year.

Maturity (in years) 0.25 0.50 0.75 1.00 1.25 1.50 1.75 2.00 2.25 2.50 2.75 3.00 Rate (annual) 3.50% 3.89% 4.14% 4.36% 4.57% 4.75% 4.92% 5.08% 5.23% 5.39% 5.56% 5.72%

Step by Step Solution

There are 3 Steps involved in it

To price the bonds A B and C using the spot curve provided in Table 1 you can calculate the present ... View full answer

Get step-by-step solutions from verified subject matter experts