On December 31, 2008, HIT Company purchased all of the outstanding common shares of PUC Company for

Question:

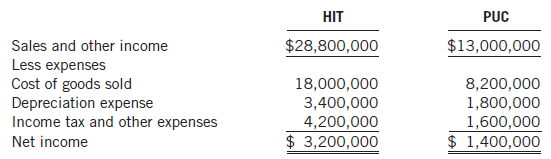

On December 31, 2008, HIT Company purchased all of the outstanding common shares of PUC Company for $12 million in cash. On that date, the shareholders’ equity of PUC consisted of $2 million in retained earnings. Both companies use the FIFO method to account for inventory and the straightline method to calculate depreciation. For the year ended December 31, 2013, the income statements for HIT and PUC were as follows:

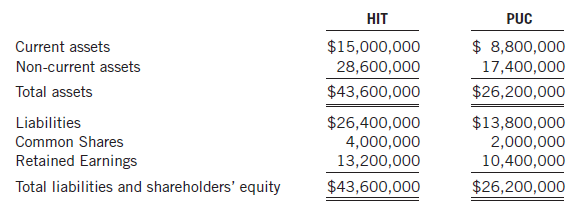

At December 31, 2013, the condensed balance sheets for the two companies were as follows:

Additional information:

1. On December 31, 2008, PUC had inventory with a fair value that was $100,000 less than its carrying value.

2. On December 31, 2008, PUC had equipment with a fair value that was $400,000 greater than its carrying value. The equipment had an estimated remaining useful life of 8 years.

3. Each year, goodwill is evaluated to determine if there has been a permanent impairment. Goodwill has a value of $3,580,000 at December 31, 2012 and $3,200,000 at December 31, 2013.

4. On January 2, 2011, PUC sold a machine to HIT for $1,200,000. PUC purchased the machine on January 1, 2006 for $1,800,000 and was depreciating the machine over 10 years. There was no change in the estimated service life at the time of the intercompany sale.

5. During 2013, HIT sold merchandise to PUC for $600,000, 75% of which remains in PUC’s inventory at December 31, 2013. On December 31, 2012, the inventory of PUC contained $100,000 of merchandise purchased from HIT. HIT earns a gross margin of 30% on its intercompany sales.

6. During 2013, HIT declared and paid dividends of $2,600,000 while PUC declared and paid dividends of $800,000.

7. Both companied pay income tax at the rate of 40%.

Required

(a) Prepare HIT’s consolidated income statement for the year ended December 31, 2013. Show supporting calculations.

(b) Calculate HIT’s consolidated retained earnings at December 31, 2013. Show supporting calculations.

Goodwill is an important concept and terminology in accounting which means good reputation. The word goodwill is used at various places in accounting but it is recognized only at the time of a business combination. There are generally two types of... Consolidated Income Statement

When talking about the group financial statements the consolidated financial statements include Consolidated Income Statement that a parent must prepare among other sets of consolidated financial statements. Consolidated Income statement that is...

Step by Step Answer: