Question: All techniques with NPV profileMutually exclusive projects Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of

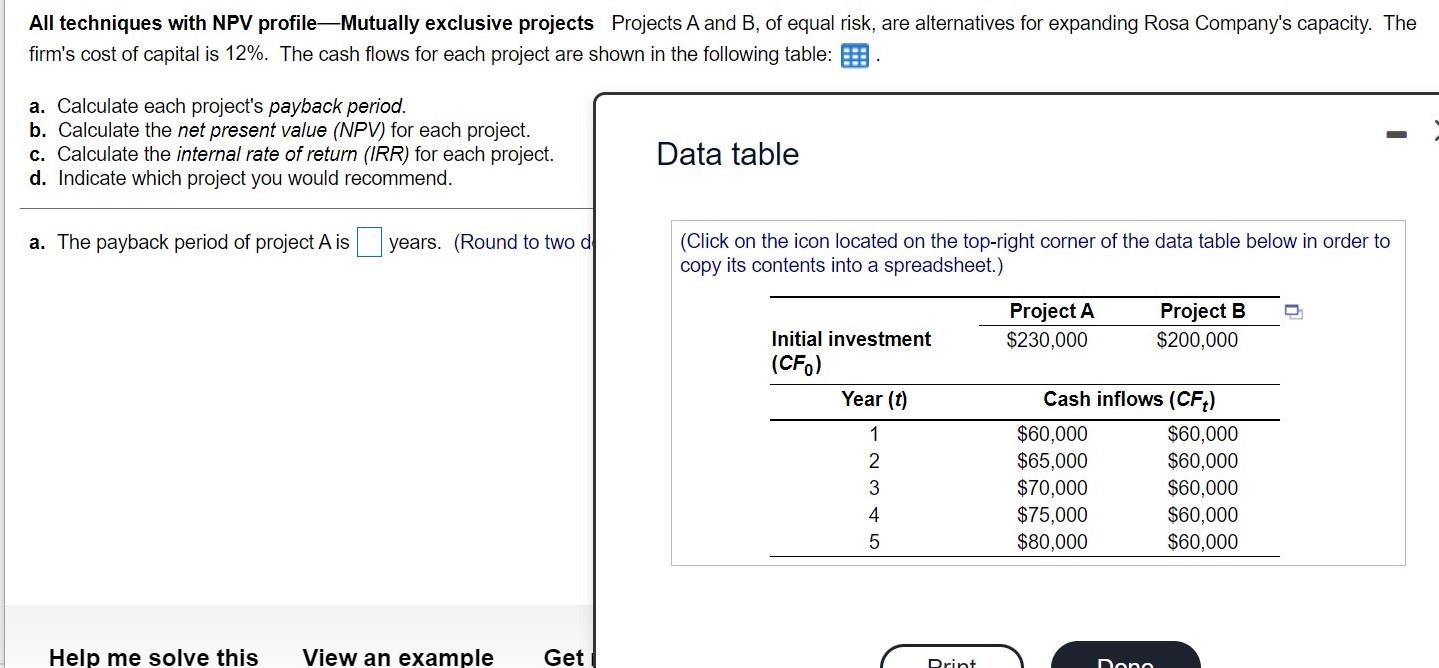

All techniques with NPV profileMutually exclusive projects Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of capital is 12%. The cash flows for each project are shown in the following table: B a. Calculate each project's payback period. b. Calculate the net present value (NPV) for each project. c. Calculate the internal rate of return (IRR) for each project. d. Indicate which project you would recommend. Data table a. The payback period of project A is years. (Round to two d (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Project A $230,000 Project B $200,000 Initial investment (CF) Year (t) 1 2 3 01 AWN Cash inflows (CF) $60,000 $60,000 $65,000 $60,000 $70,000 $60,000 $75,000 $60,000 $80,000 $60,000 4 5 Help me solve this View an example Get Drint Dona

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts