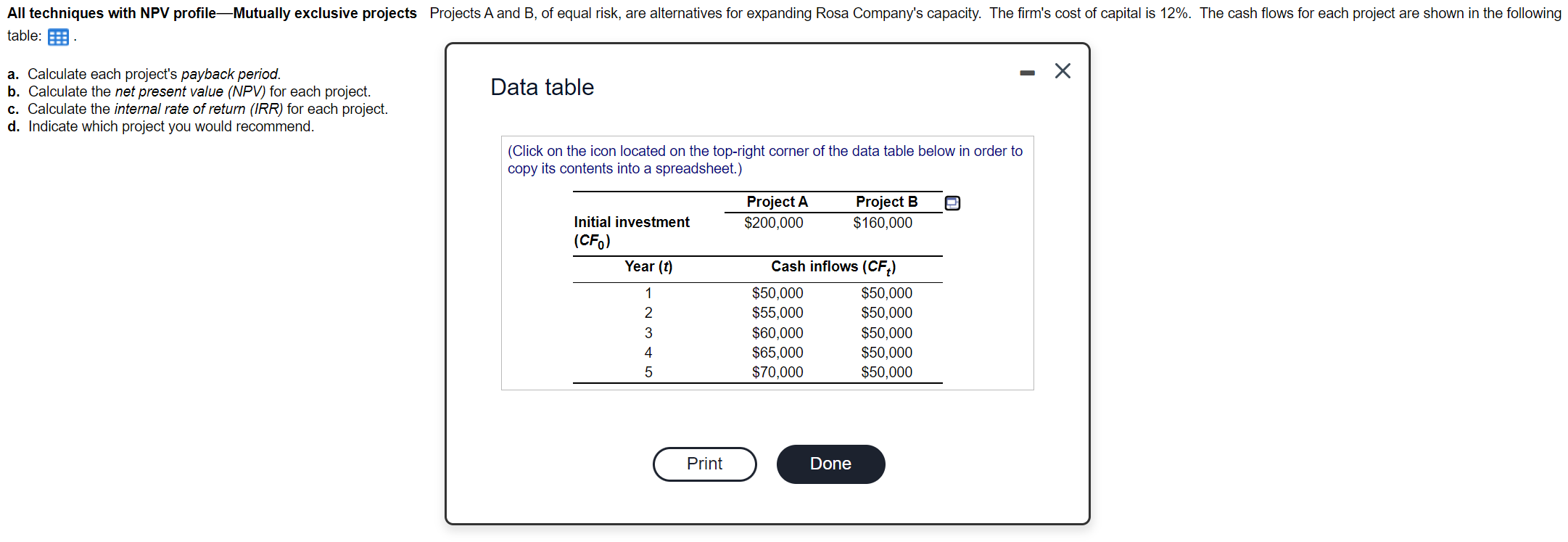

Question: - All techniques with NPV profileMutually exclusive projects Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost

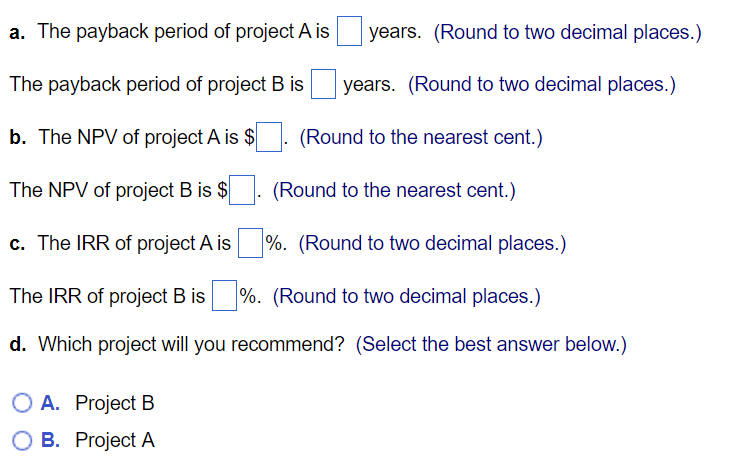

- All techniques with NPV profileMutually exclusive projects Projects A and B, of equal risk, are alternatives for expanding Rosa Company's capacity. The firm's cost of capital is 12%. The cash flows for each project are shown in the following table: a. Calculate each project's payback period. b. Calculate the net present value (NPV) for each project. Data table c. Calculate the internal rate of return (IRR) for each project. d. Indicate which project you would recommend. (Click on the icon located on the top-right corner of the data table below in order to copy its contents into a spreadsheet.) Project A $200,000 Project B $160,000 Initial investment (CFO) Year (t) 1 2 Cash inflows (CF) $50,000 $50,000 $55,000 $50,000 $60,000 $50,000 $65,000 $50,000 $70,000 $50,000 3 4 5 Print Done a. The payback period of project A is years. (Round to two decimal places.) The payback period of project B is years. (Round to two decimal places.) b. The NPV of project A is $ (Round to the nearest cent.) The NPV of project B is $ (Round to the nearest cent.) c. The IRR of project A is %. (Round to two decimal places.) The IRR of project Bis %. (Round to two decimal places.) d. Which project will you recommend? (Select the best answer below.) O A. Project B B. Project A

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts