Question: All the data you need is in the template provided to you. 1 1. JTM Airlines is looking to buy Jaguar Airlines. Your boss, the

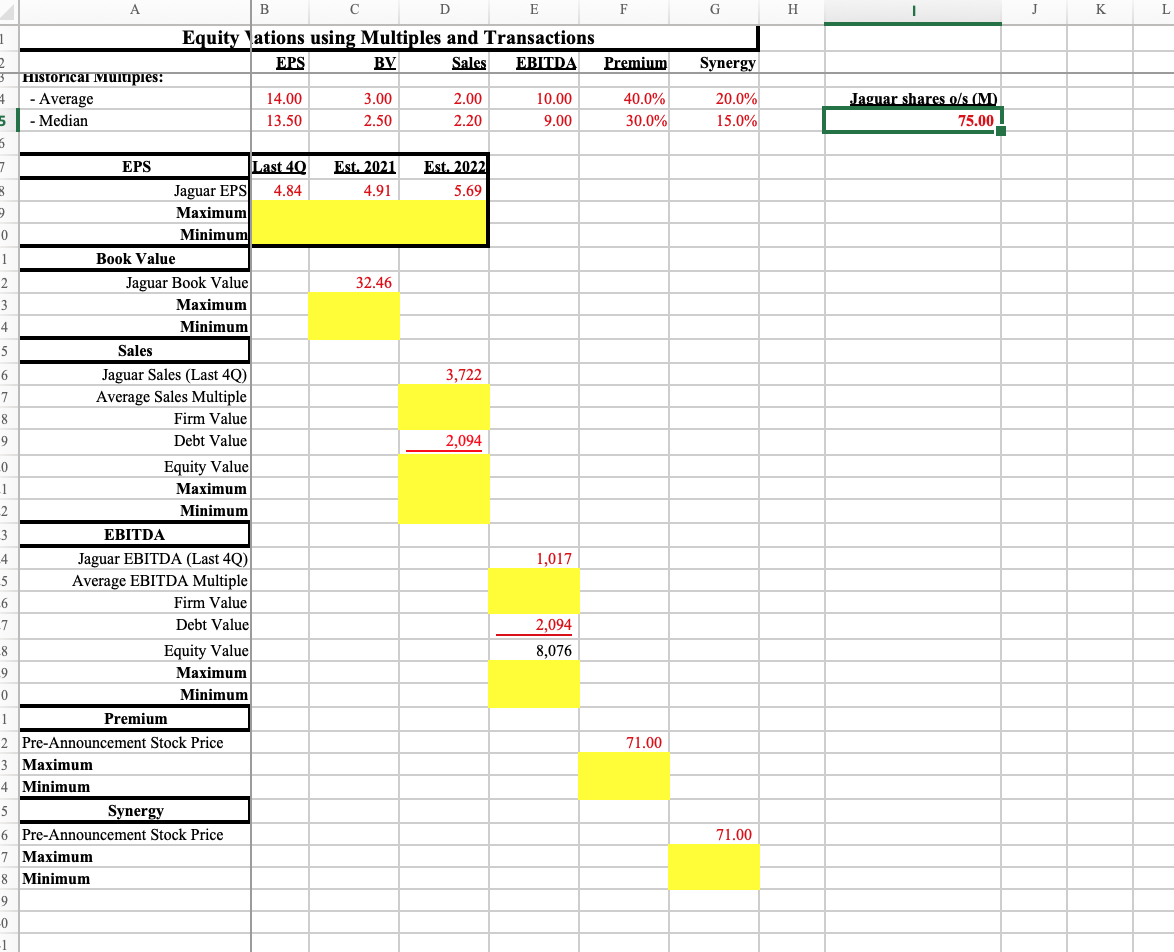

All the data you need is in the template provided to you. 1 1. JTM Airlines is looking to buy Jaguar Airlines. Your boss, the CFO, wants a quick and dirty valuation of Jaguar. You choose to look at past transactions in the airline industry to get some numbers and put them in an Excel spreadsheet. For Jaguar, you find out the firm's key financial values and put them in the spreadsheet. To remind yourself that they are inputs, you should color them red. Using EPS, Book Value (BV), Sales, EBITDA, Premium and Synergy over stock price, what should be Jaguar's prices per share? G H J K L Synergy 20.0% 15.0% Jaguar shares o/s (M) 75.00 D E 1 Equity Wations using Multiples and Transactions EPS BV Sales EBITDA Premium 3 Historical Multiples: 4. - Average 14.00 3.00 2.00 10.00 40.0% 5 - Median 13.50 2.50 2.20 9.00 30.0% 5 7 EPS Last 40 Est. 2021 Est. 2022 3 Jaguar EPS 4.84 4.91 5.69 Maximum 0 Minimum 1 Book Value 2 Jaguar Book Value 32.46 3 Maximum 4 Minimum 5 Sales 6 Jaguar Sales (Last 40) 3,722 7 Average Sales Multiple 8 Firm Value 9 Debt Value 2,094 0 Equity Value 1 Maximum 2 Minimum 3 EBITDA 4 Jaguar EBITDA (Last 40) 1,017 5 Average EBITDA Multiple 6 Firm Value -7 Debt Value 2,094 8 Equity Value 8,076 9 Maximum 0 Minimum 1 Premium 2 Pre-Announcement Stock Price 71.00 3 Maximum 4 Minimum 5 Synergy 6 Pre-Announcement Stock Price 7 Maximum 8 Minimum 9 -0 -1 71.00 All the data you need is in the template provided to you. 1 1. JTM Airlines is looking to buy Jaguar Airlines. Your boss, the CFO, wants a quick and dirty valuation of Jaguar. You choose to look at past transactions in the airline industry to get some numbers and put them in an Excel spreadsheet. For Jaguar, you find out the firm's key financial values and put them in the spreadsheet. To remind yourself that they are inputs, you should color them red. Using EPS, Book Value (BV), Sales, EBITDA, Premium and Synergy over stock price, what should be Jaguar's prices per share? G H J K L Synergy 20.0% 15.0% Jaguar shares o/s (M) 75.00 D E 1 Equity Wations using Multiples and Transactions EPS BV Sales EBITDA Premium 3 Historical Multiples: 4. - Average 14.00 3.00 2.00 10.00 40.0% 5 - Median 13.50 2.50 2.20 9.00 30.0% 5 7 EPS Last 40 Est. 2021 Est. 2022 3 Jaguar EPS 4.84 4.91 5.69 Maximum 0 Minimum 1 Book Value 2 Jaguar Book Value 32.46 3 Maximum 4 Minimum 5 Sales 6 Jaguar Sales (Last 40) 3,722 7 Average Sales Multiple 8 Firm Value 9 Debt Value 2,094 0 Equity Value 1 Maximum 2 Minimum 3 EBITDA 4 Jaguar EBITDA (Last 40) 1,017 5 Average EBITDA Multiple 6 Firm Value -7 Debt Value 2,094 8 Equity Value 8,076 9 Maximum 0 Minimum 1 Premium 2 Pre-Announcement Stock Price 71.00 3 Maximum 4 Minimum 5 Synergy 6 Pre-Announcement Stock Price 7 Maximum 8 Minimum 9 -0 -1 71.00

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts