Question: All the data you need is in the template provided to you. There is not any additional information provided for this question. JTM Airlines is

All the data you need is in the template provided to you. There is not any additional information provided for this question.

JTM Airlines is looking to buy Jaguar Airlines. Your boss, the CFO, wants a quick and dirty valuation of Jaguar. You choose to look at past transactions in the airline industry to get some numbers and put them in an Excel spreadsheet. For Jaguar, you find out the firm's key financial values and put them in the spreadsheet. To remind yourself that they are inputs, you should color them red. Using EPS, Book Value (BV), Sales, EBITDA, Premium and Synergy over stock price, what should be Jaguar's prices per share.

(Jaguar EPS * Median EPS Multiple)

(Jaguar EPS* Average EPS Multiple)

(Jaguar Book Value* Median BV Multiple)

(Jaguar Book Value* Average BV Multiple)

Sales (using average) (using median)

Equity Value (Firm Value-Debt Value)

Max (Equity Value/Jaguar shares o/s)

EBITDA (using Average) (using median)

Average EBITDA Multiple

Firm Value (Jaguar EBITDA*EBITDA Multiple)

Equity Value (Firm Value-Debt Value)

Max (Equity Value/Jaguar shares o/s)

Min

Premium

Pre-Announcement Stock Price

Max Pre-announcement price*(1+median premium multiple)

Min Pre-announcement price*(1+median premium multiple)

Synergy

Pre-announcement price

Max Pre-announcement price*(1+median synergy multiple)

Min

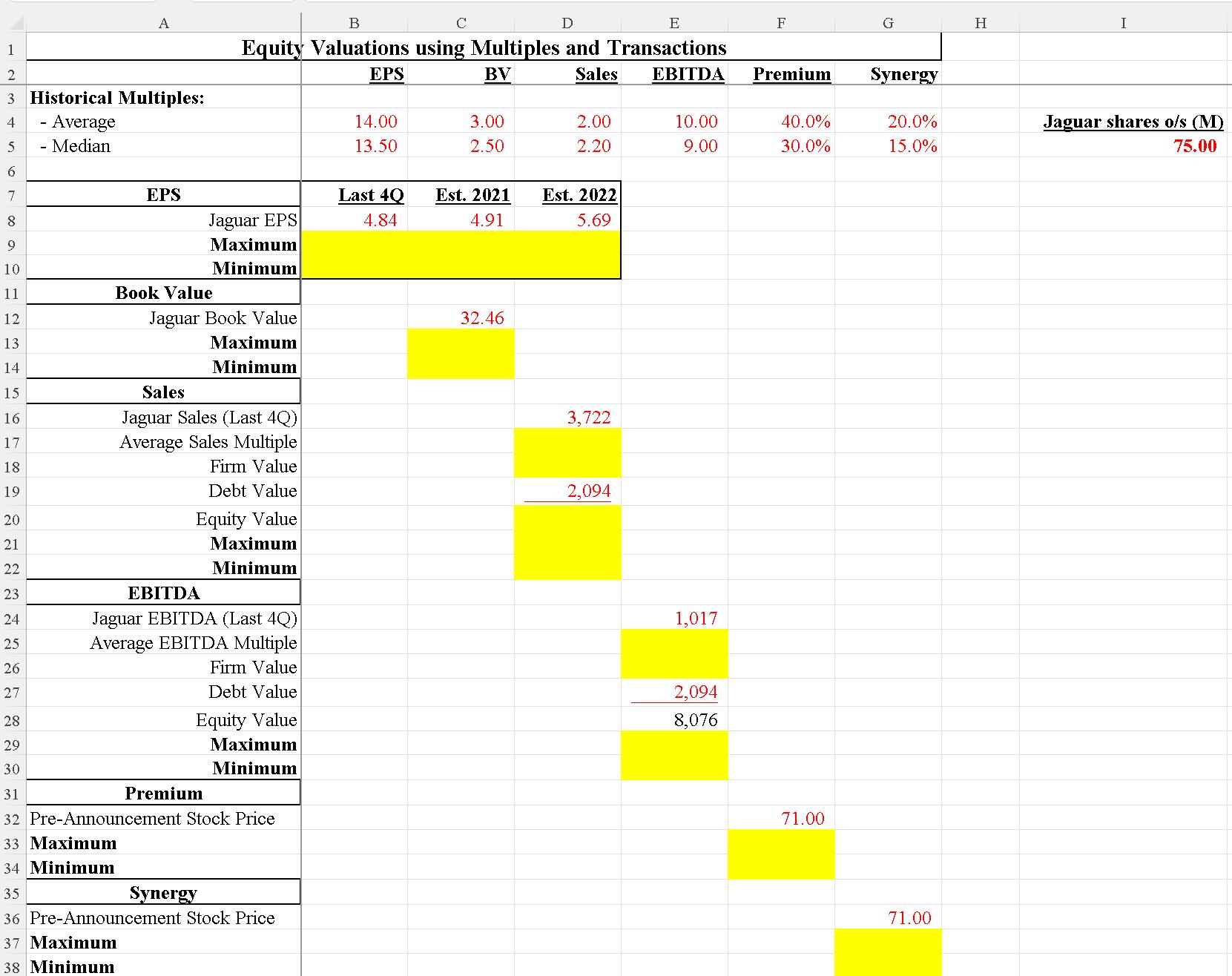

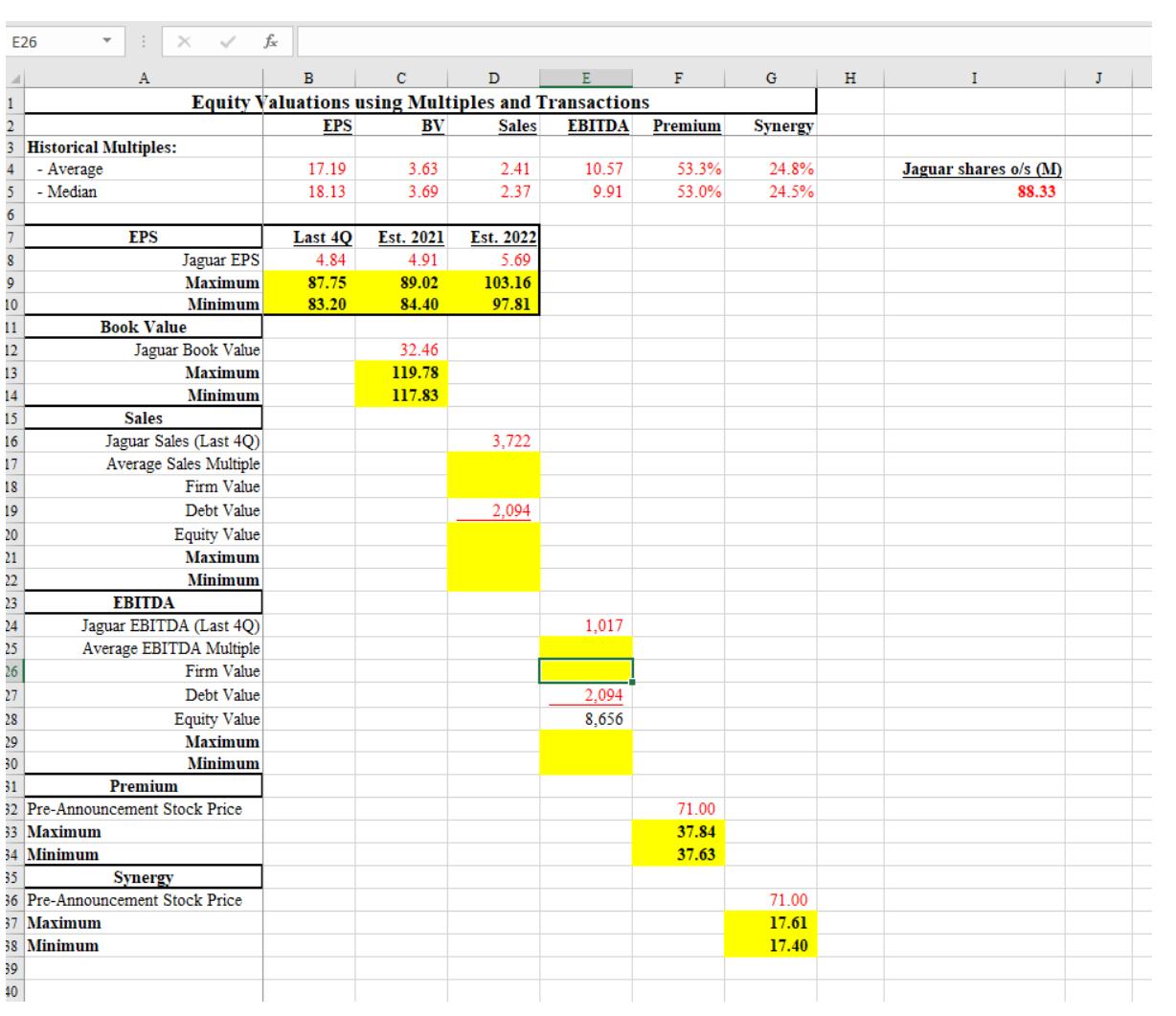

Equity Valuations using Multiples and Transactions

EPS BV Sales EBITDA Premium Synergy

Historical Multiples

Average 17.19 3.63 2.41 10.57 53.30% 24.80% Jaguar shares o/s (M)

Median 18.13 3.69 2.37 9.91 53% 24.50% 88.33

EPS Last 4Q Est 2021 Est 2022

Jaguar EPS 4.84 4.91 5.69

Maximum 87.7492 89.0183 103.1597 (Jaguar EPS* Median EPS Multiple)

Minimum 83.1996 84.4029 97.8111 (Jaguar EPS* Average EPS Multiple)

Book Value

Jaguar Book Value 32.46

Maximum 119.7774 (Jaguar Book Value*Median BV Multiple)

Minimum 117.8298 (Jaguar Book Value*Average BV Multiple)

Sales (using average) (using median)

Jaguar Sales (Last 4Q) 3722 3722

Average Sales Multiple 2.41 2.37

Firm Value 8970.02 8821.14 (Jaguar Sales* Sales Multiple)

Debt Value 2094 2094

Equity Value 6876.02 6727.14 (Firm Value- Debt Value)

Maximum 77.84467338 (Equity Value/Jaguar shares o/s)

Minimum 76.15917582

EBITDA (using average) (using median)

Jaguar EBITDA (Last 4Q) 1017 1017

Average EBITDA Multiple 10.57 9.91

Firm Value 10749.69 10078.47 (Jaguar EBITDA*EBITDA Multiple)

Debt Value 2094 2094

Equity Value 8655.69 7984.47 (Firm Value- Debt Value)

Maximum 97.99264123 (Equity Value/Jaguar shares o/s)

Minimum 90.3936375

Premium

Pre-Announcement Stock Price 71

Maximum 108.843 Pre-announcement price*(1+median premium multiple)

Minimum 108.63 Pre-announcement price*(1+average premium multiple)

Synergy

Pre-Announcement Stock Price 71

Maximum 88.608 Pre-announcement price*(1+median synergy multiple)

1 2 3 Historical Multiples: 4 - Average 5 - Median 6 7 8 9 10 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 27 A 28 29 30 EPS Book Value B C D E Equity Valuations using Multiples and Transactions EPS BV Jaguar EPS Maximum Minimum Jaguar Book Value Premium Sales Jaguar Sales (Last 4Q)| Average Sales Multiple Firm Value Debt Value Equity Value Maximum Minimum Synergy EBITDA Jaguar EBITDA (Last 4Q) Average EBITDA Multiple Firm Value Debt Value Equity Value Maximum Minimum Maximum Minimum 31 32 Pre-Announcement Stock Price 33 Maximum 34 Minimum 35 36 Pre-Announcement Stock Price 37 Maximum 38 Minimum 14.00 13.50 Last 4Q 4.84 3.00 2.50 Est. 2021 4.91 32.46 Sales EBITDA Premium 2.00 2.20 Est. 2022 5.69 3,722 2,094 10.00 9.00 1,017 F 2,094 8,076 40.0% 30.0% 71.00 G Synergy 20.0% 15.0% 71.00 H I Jaguar shares o/s (M) 75.00

Step by Step Solution

3.50 Rating (173 Votes )

There are 3 Steps involved in it

The detailed answer for the above question is provi... View full answer

Get step-by-step solutions from verified subject matter experts