Question: all the information needed to solve this problem is given survey of accounting question this is all the information we are given to work with

all the information needed to solve this problem is given

survey of accounting question

this is all the information we are given to work with

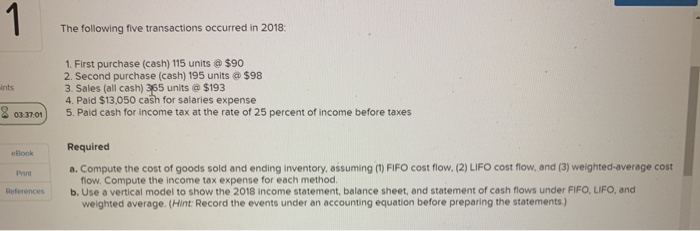

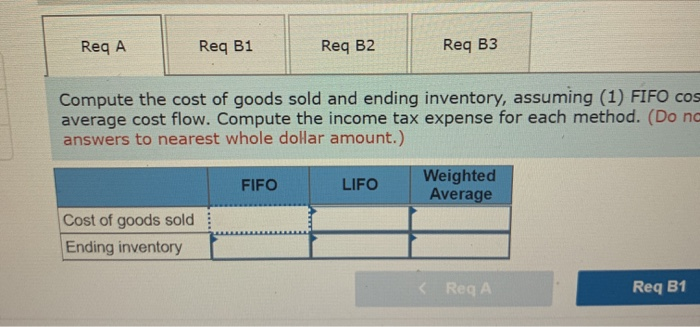

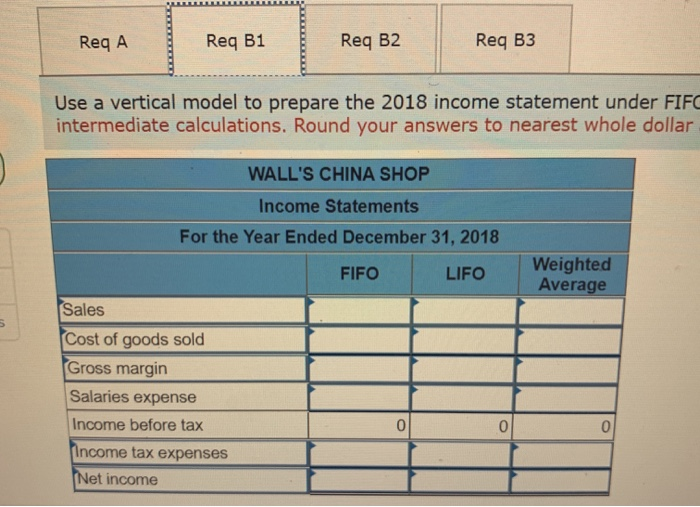

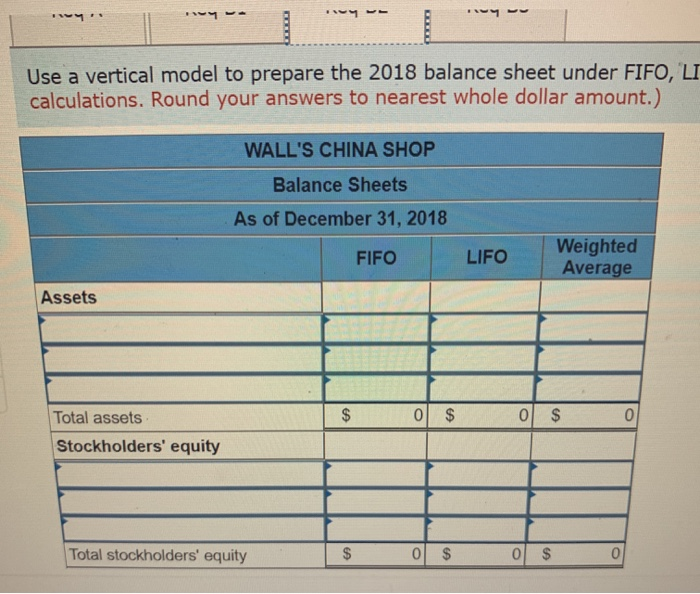

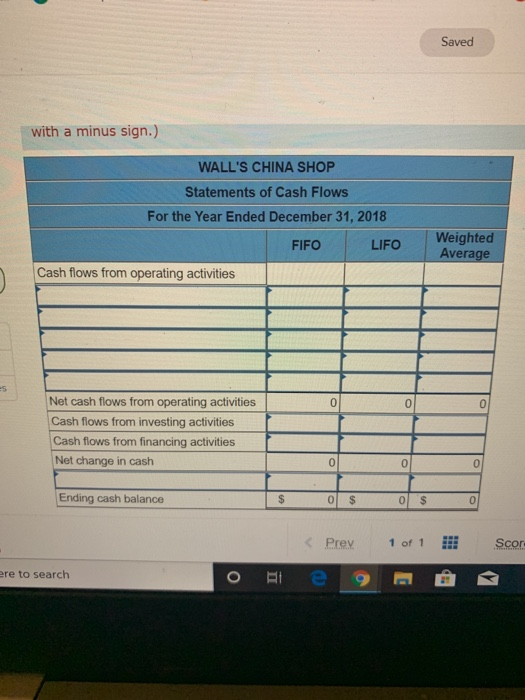

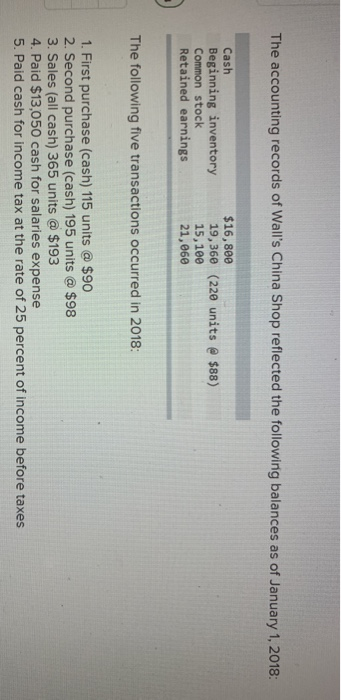

The following five transactions occurred in 2018 nts 1. First purchase (cash) 115 units @ $90 2. Second purchase (cash) 195 units @ $98 3. Sales (all cash) 365 units @ $193 4. Paid $13,050 cash for salaries expense 5. Paid cash for income tax at the rate of 25 percent of income before taxes 8 03:2701 Required eBook a. Compute the cost of goods sold and ending Inventory, assuming (1) FIFO cost flow. (2) LIFO cost flow, and (3) weighted average cost flow. Compute the income tax expense for each method b. Use a vertical model to show the 2018 income statement, balance sheet, and statement of cash flows under FIFO LIFO and weighted average (Hint: Record the events under an accounting equation before preparing the statements) Req A Req B1 Req B2 Req B3 Compute the cost of goods sold and ending inventory, assuming (1) FIFO COS average cost flow. Compute the income tax expense for each method. (Do no answers to nearest whole dollar amount.) FIFO LIFO Weighted Average Cost of goods sold Ending inventory

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts