Question: Student instructions: This worksheet is for problem 1 9 - 8 . The problem begins on previous tab where information needed to solve the problem

Student instructions: This worksheet is for problem The problem begins on previous tab where

information needed to solve the problem is shown in the section marked "given." Use this information

where needed to complete the necessary calculations for question a in the section below. Then

proceed to the next tab to complete the pro forma financial statements for question and to the third

tab to answer questions c and d

Problem INCOME STATEMENT

BALANCE SHEET, as of Dec

increase in proportion with sales

from Tab a

increase in proportion with sales

increase in proportion with sales

same

increase in proportion with sales

same

same

same

same

AFN to balance:

obtain from ST sources Problem

EastWest Trading Company Credit Policy Analysis Revised

Question c:

Incremental cash flows associated with the credit policy change

Initial investment at T

AFN from Tab B

Future incremental cash flows, T onward:

Inflows:

Increase in Sales

Outflows:

Increase in Cost of Goods Sold

Increase in Bad Debt Expense

Increase in Other Operating Exps

Increase in Interest Expense

Increase in Taxes

Total Outflows

Net future incremental cash flows

Question d Investment Decision:

NPV of the Credit Policy Change:

Comments:Use the same information given in problem with the following changes. Mr Blues asked Mr Scott Hayward, the general manager of sales of EastWest, to recheck the payment patterns and credit history of EastWests customers to be absolutely sure that the change in credit policy would indeed be beneficial to the company. Astrict scrutiny by Mr Hayward resulted in the following changes in expected payment pattern and bad debts:

Under the old policy: percent of the customers take advantage of the discount and pay in days. percent of the customers forgo the discount and pay in days. The remaining percent pay in days.

Under the new credit policy, the payment pattern is expected to be as follows: percent of the customers will take advantage of the discount and pay in days.

percent of the customers will forgo the discount and pay in days. The remaining percent will pay in days.

Bad debt expenses are expected to rise from percent to percent with the change in credit policy. Under this changed scenario, is adoption of the new credit policy advisable?

Also assume that the cost of goods sold and other operating expenses in the income statement and all current asset and current liability items, except accounts receivable, vary directly with sales.

a Calculate average collection periods and accounts receivable under the old and the new policies.

b Develop pro forma income statements and balance sheets under the old and the new policies.

c Calculate the incremental cash flows for and the subsequent years.

d Advise Mr Blues if he should adopt the new policy.

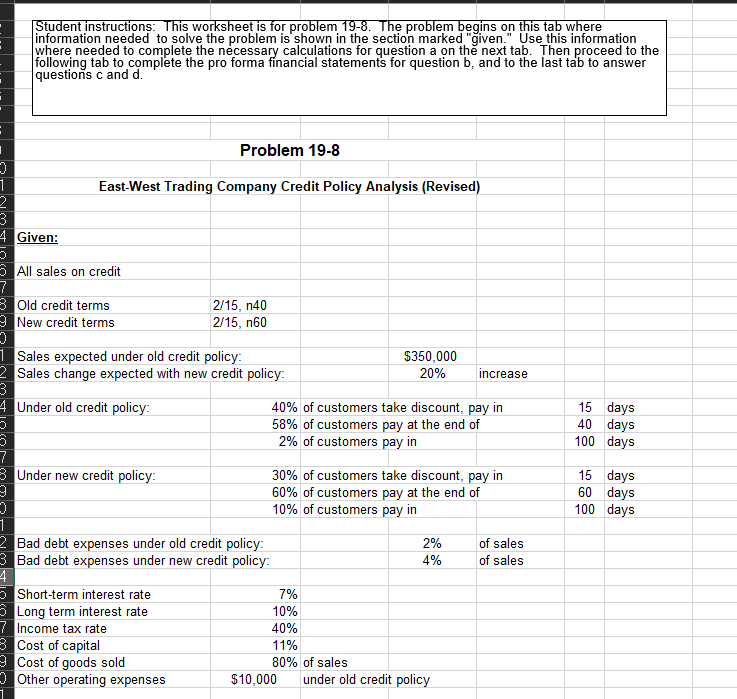

Please use the cell formulas to showStudent instructions: This worksheet is for problem The problem begins on this tab where

information needed to solve the problem is shown in the section marked "given." Use this information

where needed to complete the necessary calculations for question a on the next tab. Then proceed to the

following tab to complete the pro forma financial statements for question b and to the last tab to answer

questions c and d

Problem

EastWest Trading Company Credit Policy Analysis Revised

Given:

All sales on credit

Sales expected under old credit policy:

Sales change expected with new credit policy:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock