Question: All the solutions for part c say I should do this 12/31 balance of salaries and wages payable=salaries paid+1/31 balance of sw payable-salaries wage expense

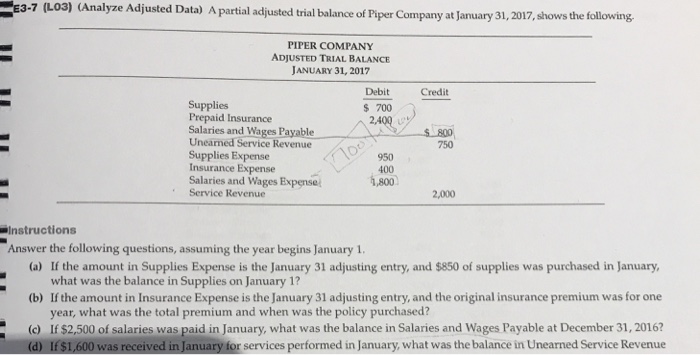

3-7 (Lo3) (Analyze Adjusted Data) A partial adusted ril balance of Piper Company at Jamuary 3u PIPER COMPANY ADJUSTED TRIAL BALANCE JANUARY 31, 2017 Debit $ 700 Credit Supplies Prepaid Insurance Salaries and Wages Payable800 Unearned Service Revenue Supplies Expense Insurance Expense Salaries and Wages Expense 1,800 Service Revenue 750 950 400 Instructions Answer the following questions, assuming the year begins January 1 (a) If the amount in Supplies Expense is the January 31 adjusting entry, and $850 of supplies was purchased in January, (b) If the amount in Insurance Expense is the January 31 adjusting entry, and the original insurance premium was for one () If $2,500 of salaries was paid in January, what was the balance in Salaries and Wages Payable at December 31, 2016? what was the balance in Supplies on January 1? year, what was the total premium and when was the policy purchased? (d) If $1,600 was received in January for services performed in January, what was the balance in Unearned Service Revenue

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts