Question: All three Question 21 1 pts The FASB basic accounting for deferred income taxes and leases reflects its basic revenue/expense philosophy. True False Question 22

All three

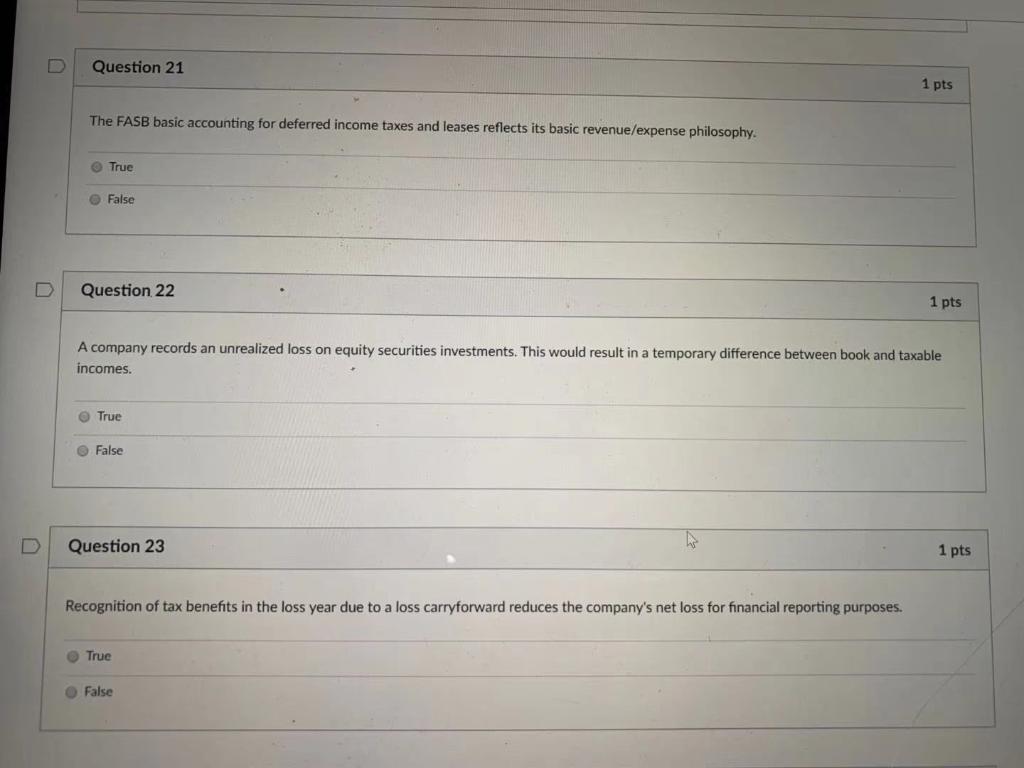

Question 21 1 pts The FASB basic accounting for deferred income taxes and leases reflects its basic revenue/expense philosophy. True False Question 22 1 pts A company records an unrealized loss on equity securities investments. This would result in a temporary difference between book and taxable incomes. True False Question 23 1 pts Recognition of tax benefits in the loss year due to a loss carryforward reduces the company's net loss for financial reporting purposes. True False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts