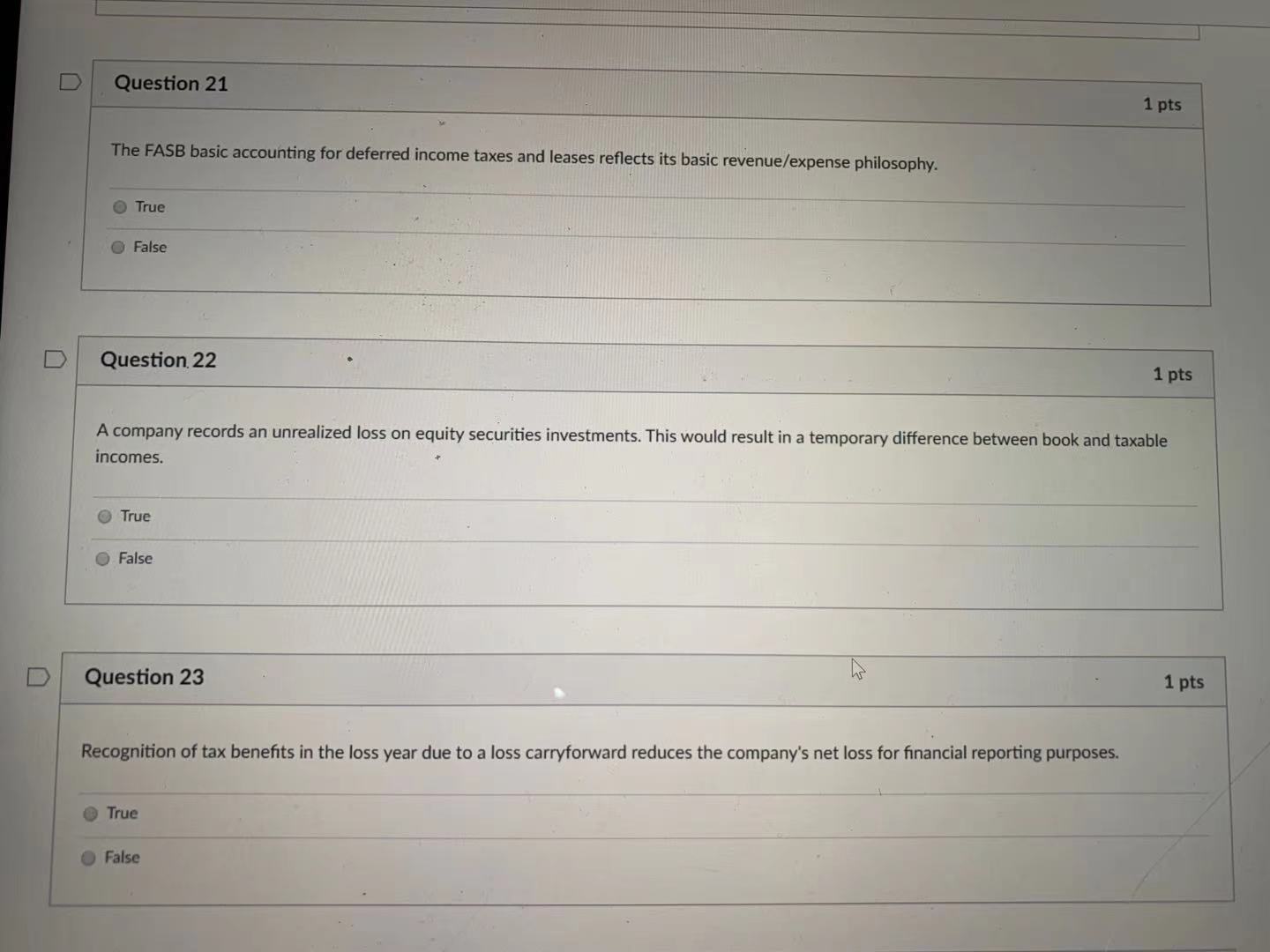

Question: D Question 21 1 pts The FASB basic accounting for deferred income taxes and leases reflects its basic revenue/expense philosophy. True O False D Question.

D Question 21 1 pts The FASB basic accounting for deferred income taxes and leases reflects its basic revenue/expense philosophy. True O False D Question. 22 1 pts A company records an unrealized loss on equity securities investments. This would result in a temporary difference between book and taxable incomes. True False D Question 23 1 pts Recognition of tax benefits in the loss year due to a loss carryforward reduces the company's net loss for financial reporting purposes. True O False

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts