Question: all three would be extremely helpful QUESTION 13 A project has the following cash flows for years 0 through 2, respectively. -12,023, 8,623,9,242. What is

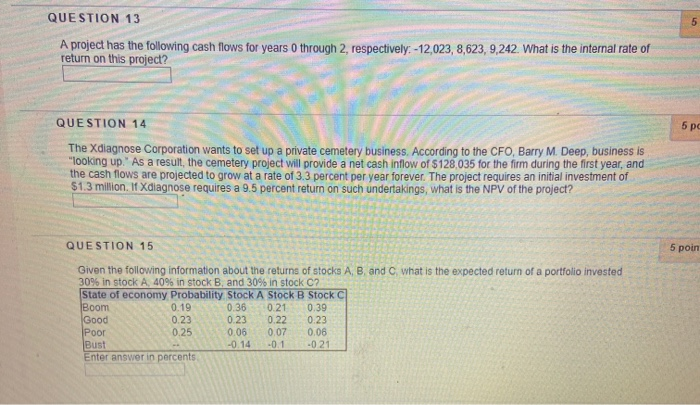

QUESTION 13 A project has the following cash flows for years 0 through 2, respectively. -12,023, 8,623,9,242. What is the internal rate of return on this project? QUESTION 14 The Xdiagnose Corporation wants to set up a private cemetery business. According to the CFO, Barry M. Deep, business is "Tooking up." As a result, the cemetery project will provide a net cash inflow of $128.035 for the firm during the first year, and the cash flows are projected to grow at a rate of 3.3 percent per year forever. The project requires an initial investment of $1.3 million. If Xdiagnose requires a 9.5 percent return on such undertakings, what is the NPV of the project? QUESTION 15 5 poin Given the following information about the returns of stocks A B and C what is the expected return of a portfolio invested 30% in stock A, 40% in stock B, and 30% in stock C? State of economy Probability Stock A Stock B Stock Boom 0.19 0.36 0.21 0.39 Good 0.23 0.23 0.22 0.23 POO 0.25 0.06 0.07 0.06 Bust -0.14 -0.1 -021 Enter answer in percents

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts