Question: Question 6 (1 point) Consider the / spot and forward exchange rates in the table below. The risk-free 1-year interest rates on the euro and

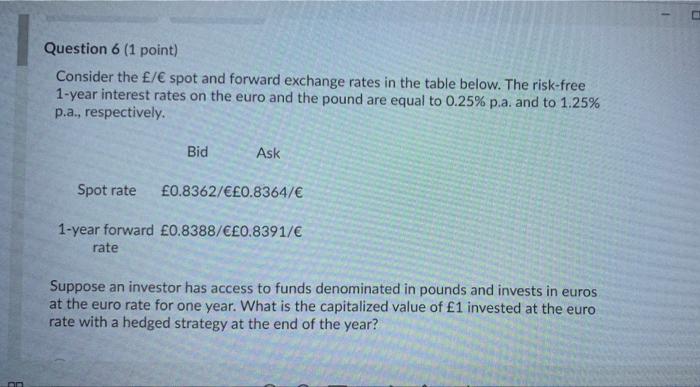

Question 6 (1 point) Consider the / spot and forward exchange rates in the table below. The risk-free 1-year interest rates on the euro and the pound are equal to 0.25% p.a. and to 1.25% p.a., respectively. Bid Ask Spot rate 0.8362/0.8364/ 1-year forward 0.8388/0.8391/ rate Suppose an investor has access to funds denominated in pounds and invests in euros at the euro rate for one year. What is the capitalized value of 1 invested at the euro rate with a hedged strategy at the end of the year? OD

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts