Question: All work must be shown and completely worked out. Please and thank you! Please Reply All Parts Lesson 9 Activity Imagine that you recently got

All work must be shown and completely worked out. Please and thank you!

Please Reply All Parts

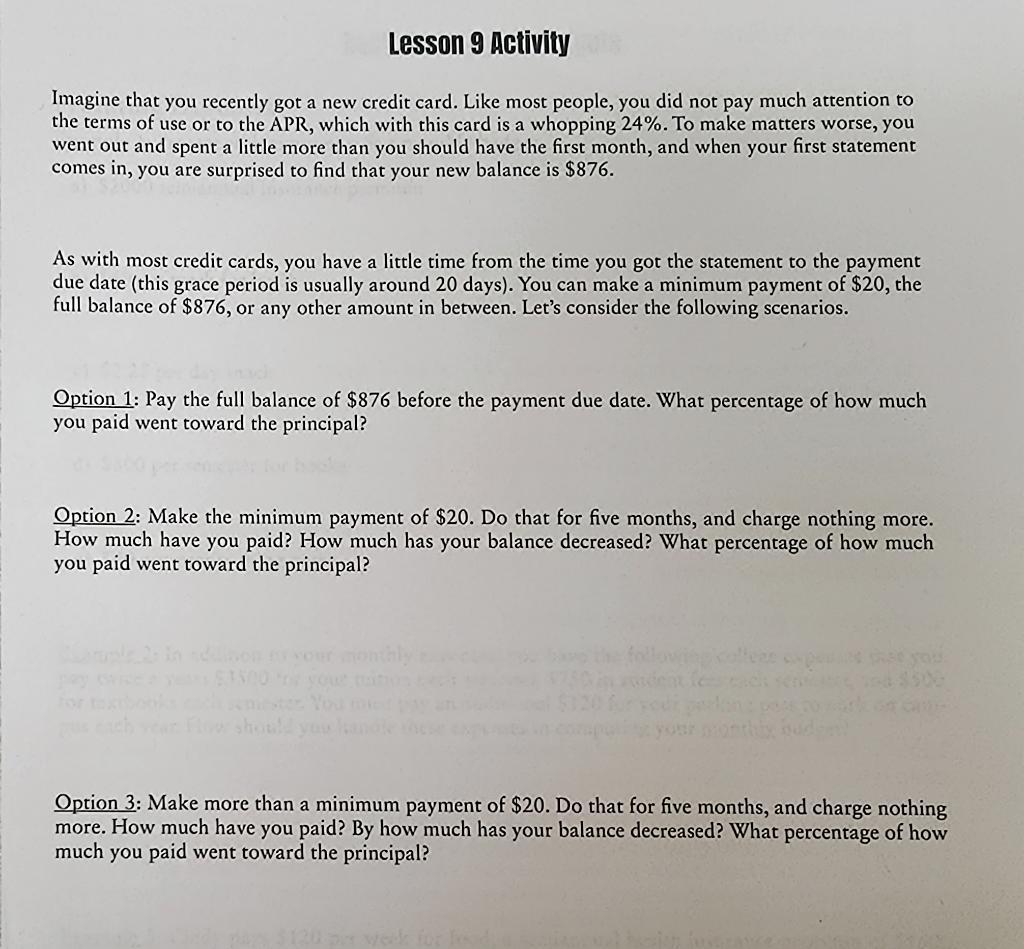

Lesson 9 Activity Imagine that you recently got a new credit card. Like most people, you did not pay much attention to the terms of use or to the APR, which with this card is a whopping 24%. To make matters worse, you went out and spent a little more than you should have the first month, and when your first statement comes in, you are surprised to find that your new balance is $876. As with most credit cards, you have a little time from the time you got the statement to the payment due date (this grace period is usually around 20 days). You can make a minimum payment of $20, the full balance of $876, or any other amount in between. Let's consider the following scenarios. Option 1: Pay the full balance of $876 before the payment due date. What percentage of how much you paid went toward the principal? Option 2: Make the minimum payment of $20. Do that for five months, and charge nothing more. How much have you paid? How much has your balance decreased? What percentage of how much you paid went toward the principal? Option 3: Make more than a minimum payment of $20. Do that for five months, and charge nothing more. How much have you paid? By how much has your balance decreased? What percentage of how much you paid went toward the principal

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts