Question: All work needs to be shown in excel or in a word document please.... Quesiton P3-29 Alison News X C Cheg x C Cheg x

All work needs to be shown in excel or in a word document please.... Quesiton P3-29

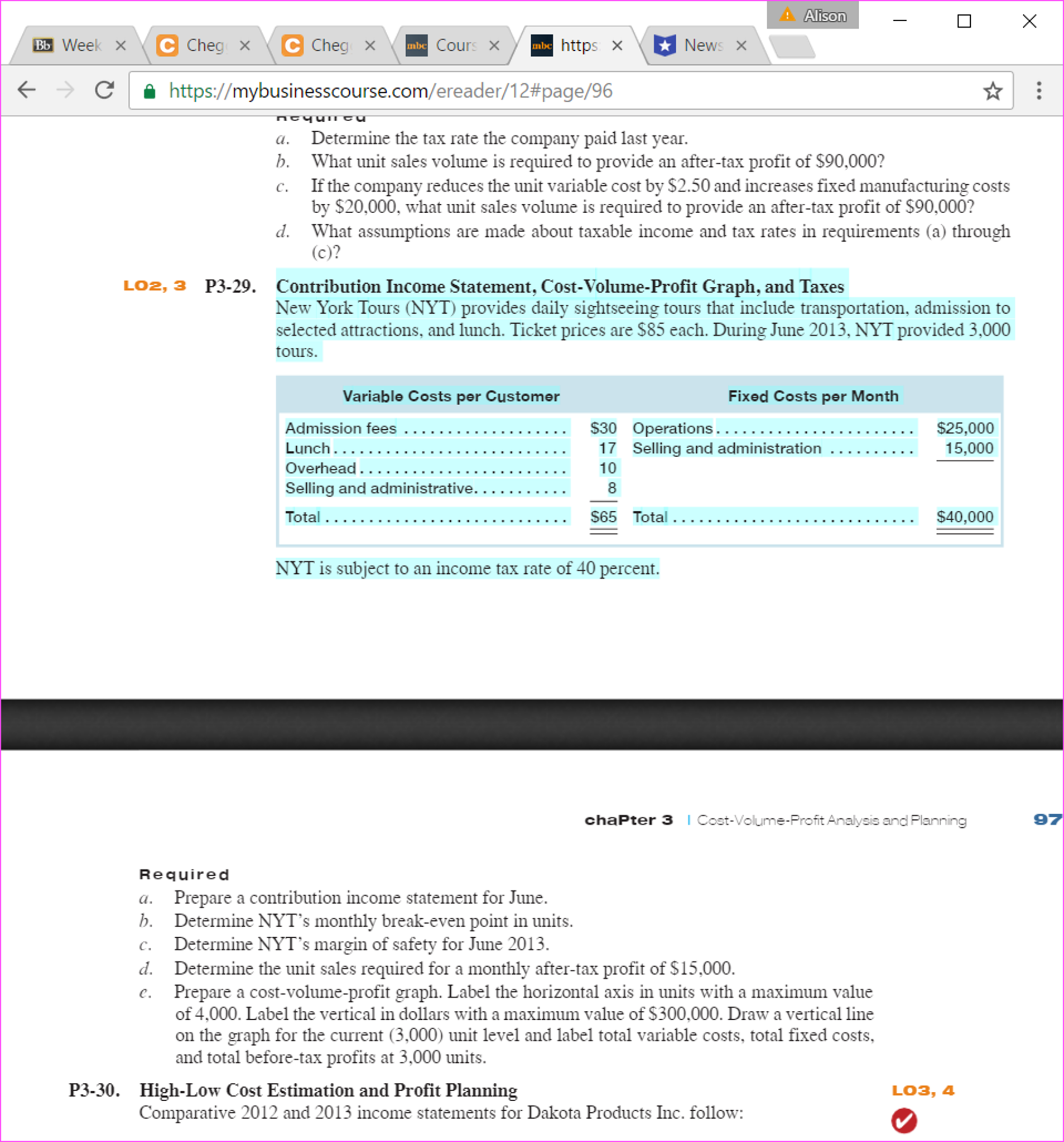

Alison News X C Cheg x C Cheg x Bb Week X be Cours X bc https X C https:// business course.com my /ereader/12#page/96 Determine the tax rate the company paid last year b. What unit sales volume is required to provide an after-tax profit of $90,000? c. If the company reduces the unit variable cost by $2.50 and increases fixed manufacturing costs by $20,000, what unit sales volume is required to provide an after-tax profit of $90,000? d. What assumptions are made about taxable income and tax rates in requirements (a through (c)? LO2, 3 P3-29. Contribution Income Statement, Cost-Volume-Profit Graph, and Taxes New York Tours (NYT provides daily sightseeing tours that include transportation, admission to selected attractions, and lunch. Ticket prices are $85 each. During June 2013, NYT provided 3,000 tours Variable Costs per Customer Fixed costs per Month $25,000 Admission fees $30 operations 17 Selling and administration Lunch 15,000 Overhead 10 Selling and administrative $40,000 Tota $65 Total NYT is subject to an income tax rate of 40 percent chapter 3 l Cost-Volum Profit Analysis and Flanning Required a. Prepare a contribution income statement for June. b. Determine NYT's monthly break-even point in units Determine NYT's margin of safety for June 2013 d. Determine the unit sales required for a monthly after-tax profit of $15,000 c. Prepare a cost-volume-profit graph. Label the horizontal axis in units with a maximum value of 4,000. Label the vertical in dollars with a maximum value of $300,000. Draw a verticalline on the graph for the current (3,000) unit level and label total variable costs, total fixed costs and total before-tax profits at 3,000 units P3-30. High-Low Cost Estimation and Profit Planning O3, 4 Comparative 2012 and 2013 income statements for Dakota Products Inc. follow: 97

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts