Question: please answer all three of these problems, i REALLY need all Two independent situations are described below. Each involves future deductible amounts and/or future taxable

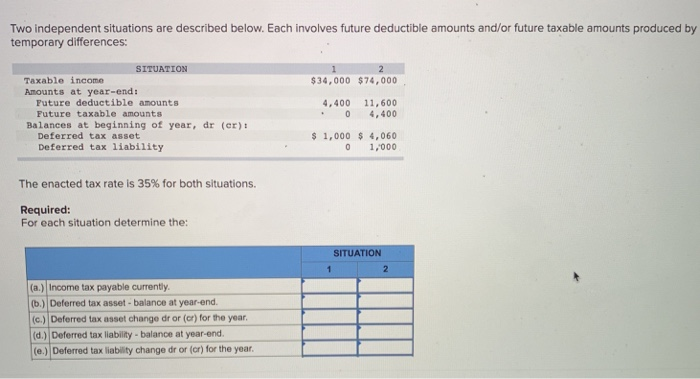

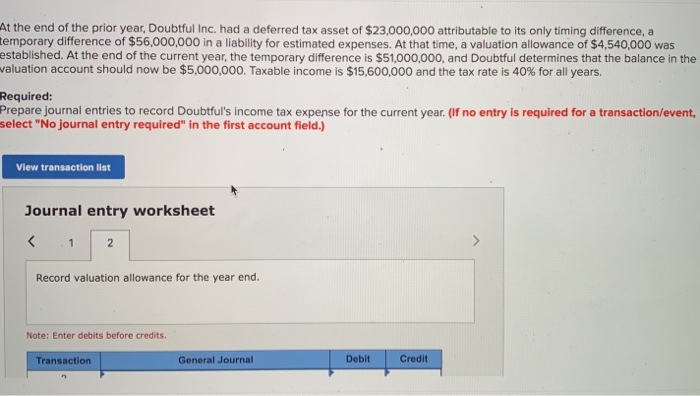

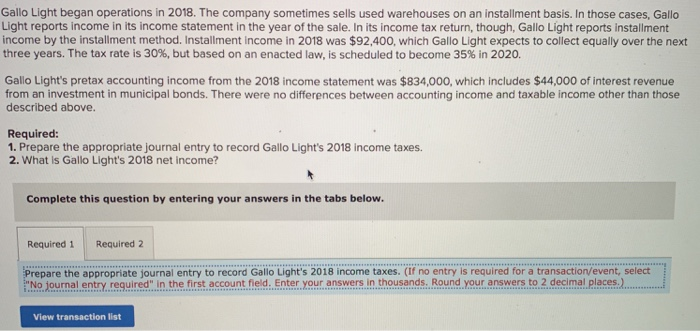

Two independent situations are described below. Each involves future deductible amounts and/or future taxable amounts produced by temporary differences SITUATION Taxable income Amounts at year-end: $34,000 $74,000 4,400 11,600 0 4,400 Future deductible amounts Future taxable amounts Balances at beginning of year, dr (er): $ 1,000 4,060 0 1,000 Deferred tax asset Deferred tax liability The enacted tax rate is 35% for both situations. Required: For each situation determine the: SITUATION (a.) Income tax payable currently (b.) Deferred tax asset-balance at year-end. (c) | Deferred tax asset change dr or (cr) for the year. (d.) Deferred tax liability-balance at year-enc. e.) Deferred tax liability change dr or (or) for the year At the end of the prior year, Doubtful Inc. had a deferred tax asset of $23,000,000 attributable to its only timing difference, a temporary difference of $56,000,000 in a liability for estimated expenses. At that time, a valuation allowance of $4,540,000 was established. At the end of the current year, the temporary difference is $51,000,000, and Doubtful determines that the balance in the valuation account should now be $5,000,000. Taxable income is $15,600,000 and the tax rate is 40% for all years. Required: Prepare journal entries to record Doubtful's income tax expense for the current year. (If no entry is required for a transaction/event, select "No journal entry required" in the first account field.) View transaction list Journal entry worksheet Record valuation allowance for the year end. Note: Enter debits before credits Debit General Journal Credit Transaction Gallo Light began operations in 2018. The company sometimes sells used warehouses on an installment basis. In those cases, Gallo Light reports income in its income statement in the year of the sale. In its income tax return, though, Gallo Light reports installment income by the installment method. Installment income in 2018 was $92,400, which Gallo Light expects to collect equally over the next three years. The tax rate is 30%, but based on an enacted law, is scheduled to become 35% in 2020. Gallo Light's pretax accounting income from the 2018 income statement was $834,000, which includes $44,000 of interest revenue from an investment in municipal bonds. There were no differences between accounting income and taxable income other than those described above. Required 1. Prepare the appropriate journal entry to record Gallo Light's 2018 income taxes. 2. What is Gallo Light's 2018 net income? Complete this question by entering your answers in the tabs below Required 1 Required 2 pare the appropriate journal entry to record Gallo Light's 2018 income taxes. (If no entry is required for a transaction/event, select No journal entryrequired". in the first account.fileld. Enter your answers in thousands. Round your answers to 2 decimal places.) View transaction list

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts