Question: Allocation base . . . . . . . . . . . . . . . . . . . . . . .

Allocation base . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . Machine-hours Estimated manufacturing overhead cost. . . . . . . . . . . . . . $100,000 Estimated total amount of the allocation base . . . . . . . . . 50,000 machine-hours Actual manufacturing overhead cost . . . . . . . . . . . . . . . . . $90,000 Actual total amount of the allocation base . . . . . . . . . . . . 40,000 machine-hours Beginning inventories were: Raw materials....$45,000 Work in progress....20,000 Finished Goods....32,000 For the current year the company's predetermined overhead rate was based on a formula that estimated $640,000 of total manufacturing overhead for an estimated activity level of 40,000 direct labor hours. The company applies overhead cost to jobs on the basis of direct labor hours. 1. What is the journal entry to record raw materials used in production? 2. What is the ending balance in Raw Materials? 3. What is the journal entry to record the labor costs incurred during the year? 4. What is the total amount of manufacturing overhead applied to production during the year? 5. What is the total manufacturing cost added to Work in Process during the year? 6. What is the journal entry to record the transfer of completed jobs that is referred to in item g above? 7. What is the ending balance in Work in Process? 8. What is the total amount of actual manufacturing overhead cost incurred during the year? 9. Is manufacturing overhead underapplied or overapplied for the year? By how much? 10. What is the cost of goods available for sale during the year? 11. What is the journal entry to record the cost of goods sold referred to in item h above? 12. What is the ending balance in Finished Goods? 13. Assuming that the company closes its underapplied or overapplied overhead to Cost of Goods Sold, what is the adjusted cost of goods sold for the year? 14. What is the gross margin for the year? 15. What is the net operating income for the year?

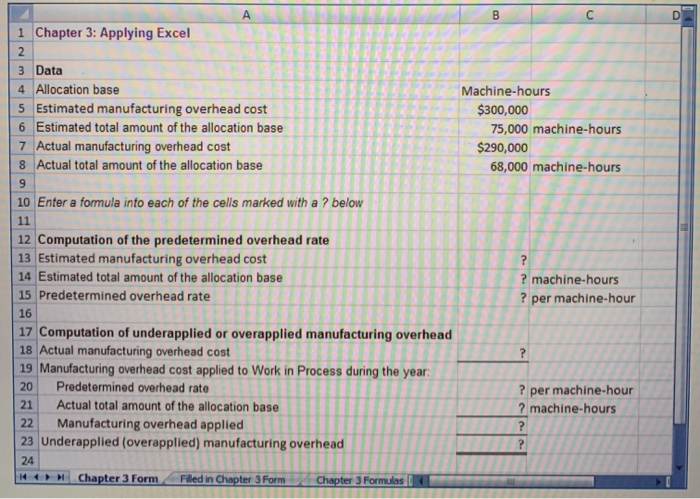

1 Chapter 3: Applying Excel 2 3 Data 4 Allocation base 5 Estimated manufacturing overhead cost 6 Estimated total amount of the allocation base 7 Actual manufacturing overhead cost 8 Actual total amount of the allocation base Machine-hours $300,000 75,000 machine-hours $290,000 68,000 machine-hours ? machine-hours ? per machine-hour 10 Enter a formula into each of the cells marked with 11 12 Computation of the predetermined overhead rate 13 Estimated manufacturing overhead cost 14 Estimated total amount of the allocation base 15 Predetermined overhead rate 16 17 Computation of underapplied or overapplied manufacturing overhead 18 Actual manufacturing overhead cost 19 Manufacturing overhead cost applied to Work Process during the year 20 Predetermined overhead rate 21 Actual total amount of the allocation base Manufacturing overhead applied 23 Underapplied (overapplied) manufacturing ? per machine-hour ? machine-hours ? 22 N H Chapter 3 FormFiled in Chapt Oy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts