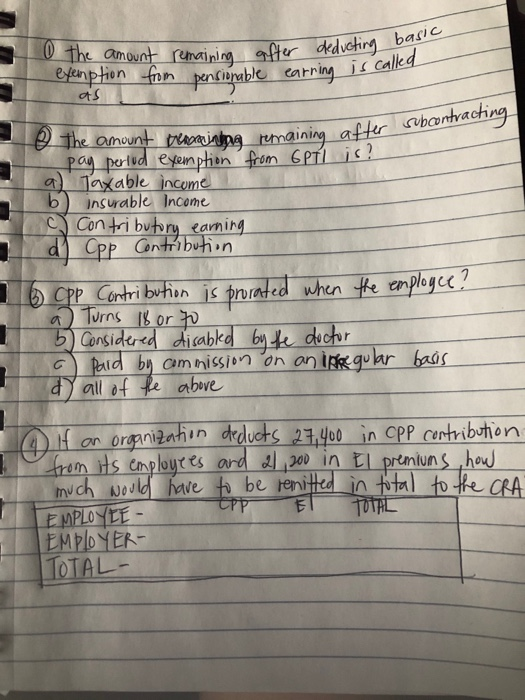

Question: alning after deducting basic o the amount remaining efter dedi exemption from pensionable earning as is called catring is subcontracting after remaining ng after is?

alning after deducting basic o the amount remaining efter dedi exemption from pensionable earning as is called catring is subcontracting after remaining ng after is? e the amount termining remaining I pay perlud exemption from GPTI al Taxable income b) insurable Income c) Contributory earning Opp Contribution - Opp Contribution is prorated when the employce! a Turns 18 or to 5 Considered disabled by he doctor paid by commission on an irregular basis d) all of the above I if an organization deducts 27,400 in cpp contribution- from its employees and 21,200 in El premiums how much would have to be remitted in total to the CRA" EPP EMPLOYEE ET TOTAL EMPLOYER- TOTAL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts