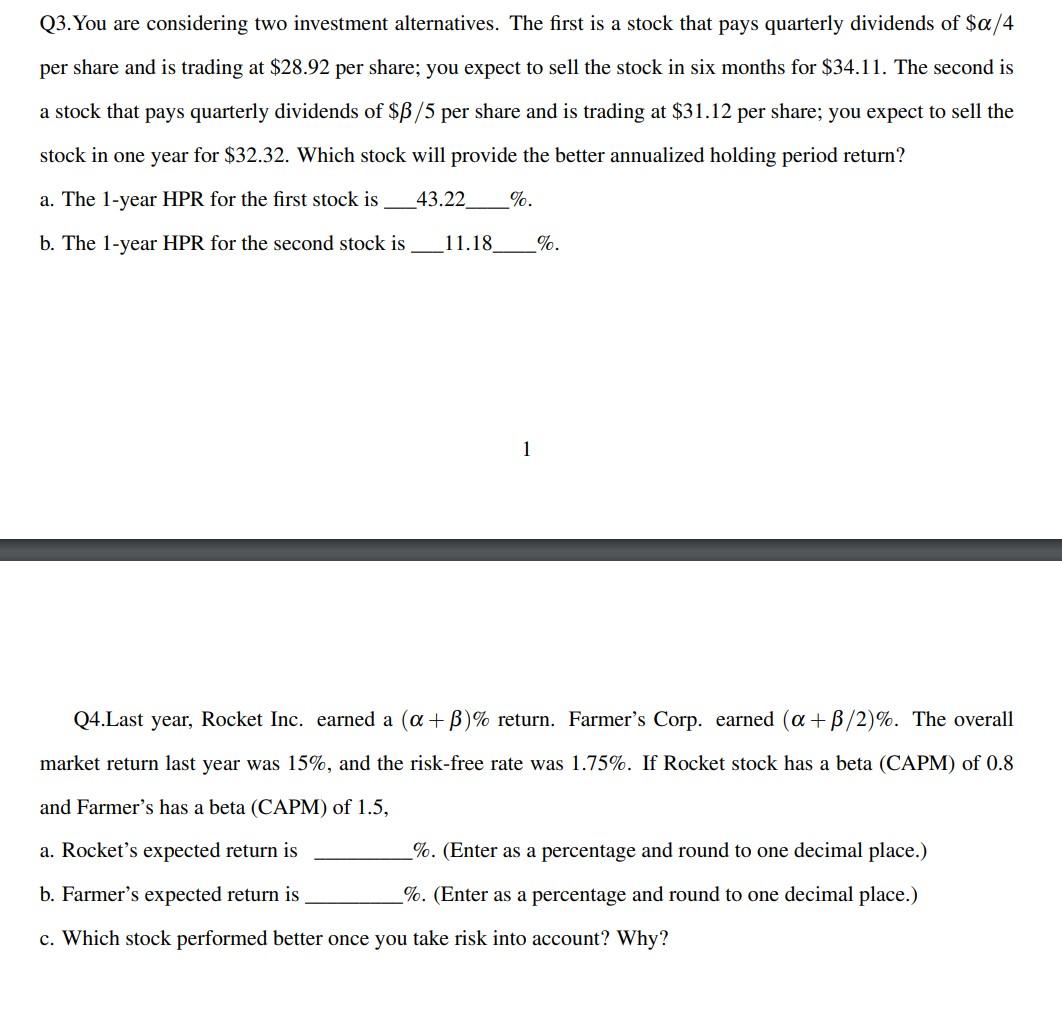

Question: alpha a = 5, beta B = 10 Please answer both Q3. You are considering two investment alternatives. The first is a stock that pays

alpha a = 5, beta B = 10

Please answer both

Q3. You are considering two investment alternatives. The first is a stock that pays quarterly dividends of $a/4 per share and is trading at $28.92 per share; you expect to sell the stock in six months for $34.11. The second is a stock that pays quarterly dividends of $3/5 per share and is trading at $31.12 per share; you expect to sell the stock in one year for $32.32. Which stock will provide the better annualized holding period return? a. The 1-year HPR for the first stock is b. The 1-year HPR for the second stock is 43.22 %. 11.18 1 %. Q4. Last year, Rocket Inc. earned a (a +)% return. Farmer's Corp. earned (a+/2)%. The overall market return last year was 15%, and the risk-free rate was 1.75%. If Rocket stock has a beta (CAPM) of 0.8 and Farmer's has a beta (CAPM) of 1.5, a. Rocket's expected return is b. Farmer's expected return is c. Which stock performed better once you take risk into account? Why? %. (Enter as a percentage and round to one decimal place.) %. (Enter as a percentage and round to one decimal place.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts