Question: Alpha Industries is considering a project with an initial cost of $8.8 million. The project will produce cash inflows of $168 million per year for

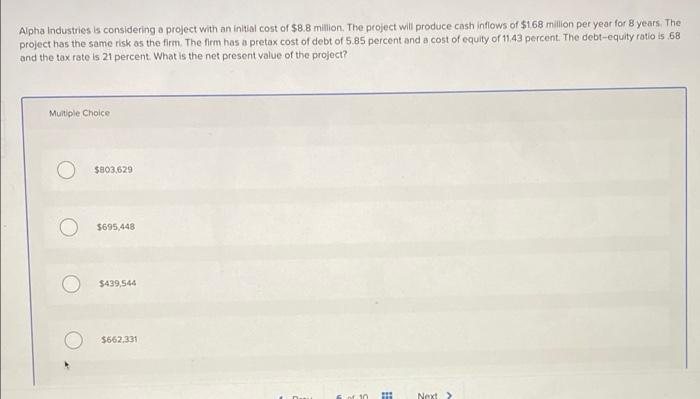

Alpha Industries is considering a project with an initial cost of $8.8 million. The project will produce cash inflows of $168 million per year for 8 years. The project has the same risk as the firm. The firm has a pretax cost of debt of 5.85 percent and a cost of equity of 11.43 percent. The debt-equity ratio is 68 and the tax rate is 21 percent. What is the net present value of the project? Multiple Choice $803,629 $695,448 $439,544 $662,331 in Next

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts