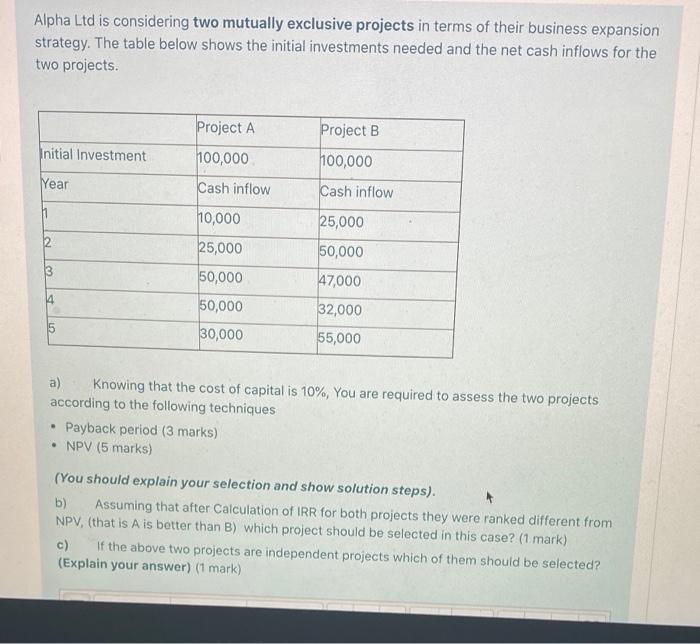

Question: Alpha Ltd is considering two mutually exclusive projects in terms of their business expansion strategy. The table below shows the initial investments needed and the

Alpha Ltd is considering two mutually exclusive projects in terms of their business expansion strategy. The table below shows the initial investments needed and the net cash inflows for the two projects. Project A Project B Initial Investment 100,000 100,000 Year Cash inflow Cash inflow 25,000 50,000 3 10,000 25,000 50,000 50,000 30,000 47,000 4 5 32,000 55,000 a) Knowing that the cost of capital is 10%, You are required to assess the two projects according to the following techniques Payback period (3 marks) NPV (5 marks) (You should explain your selection and show solution steps). b) Assuming that after Calculation of IRR for both projects they were ranked different from NPV, (that is A is better than B) which project should be selected in this case? (1 mark) c) If the above two projects are independent projects which of them should be selected? (Explain your answer) (1 mark)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts