Question: Already did Part A, but please help with the rest. Thank you. Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $80,000

Already did Part A, but please help with the rest. Thank you.

Already did Part A, but please help with the rest. Thank you.

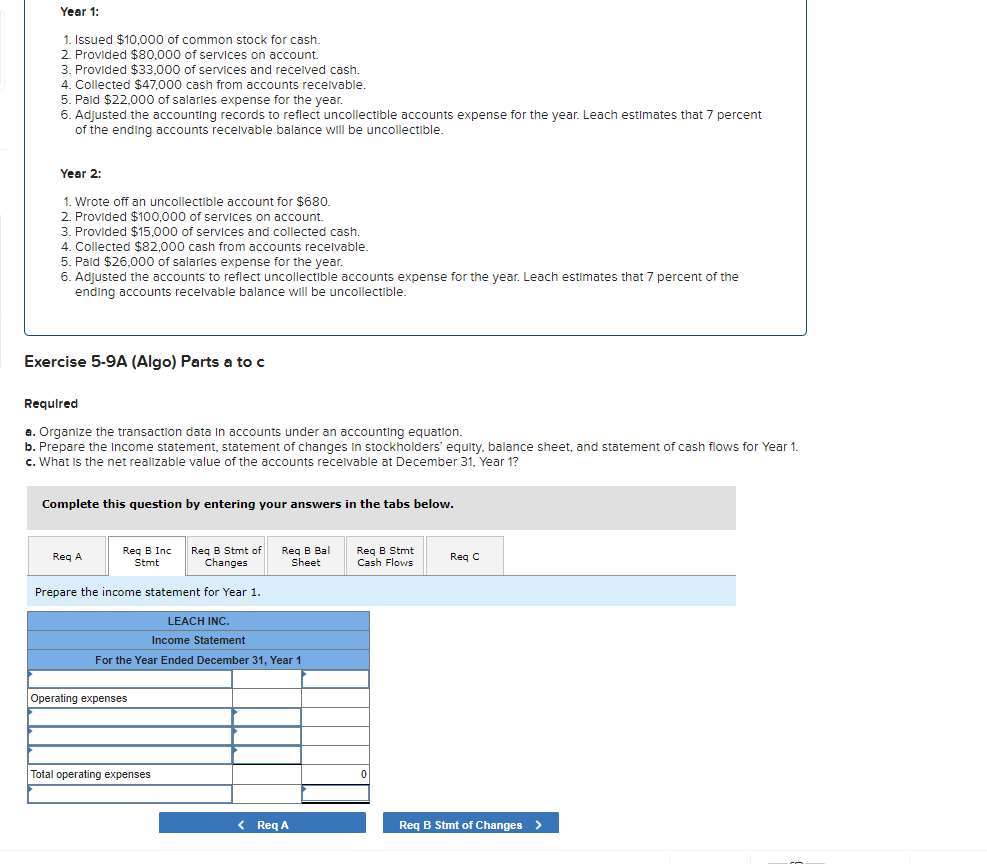

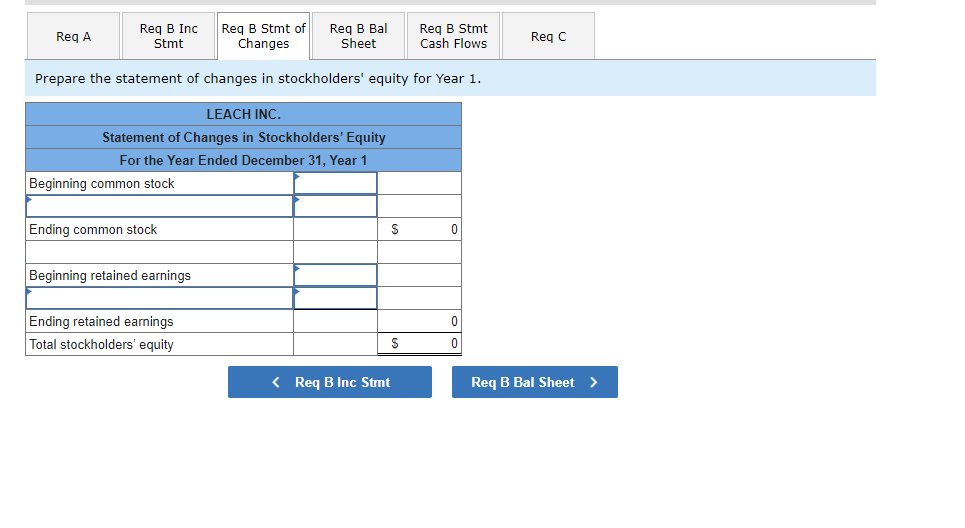

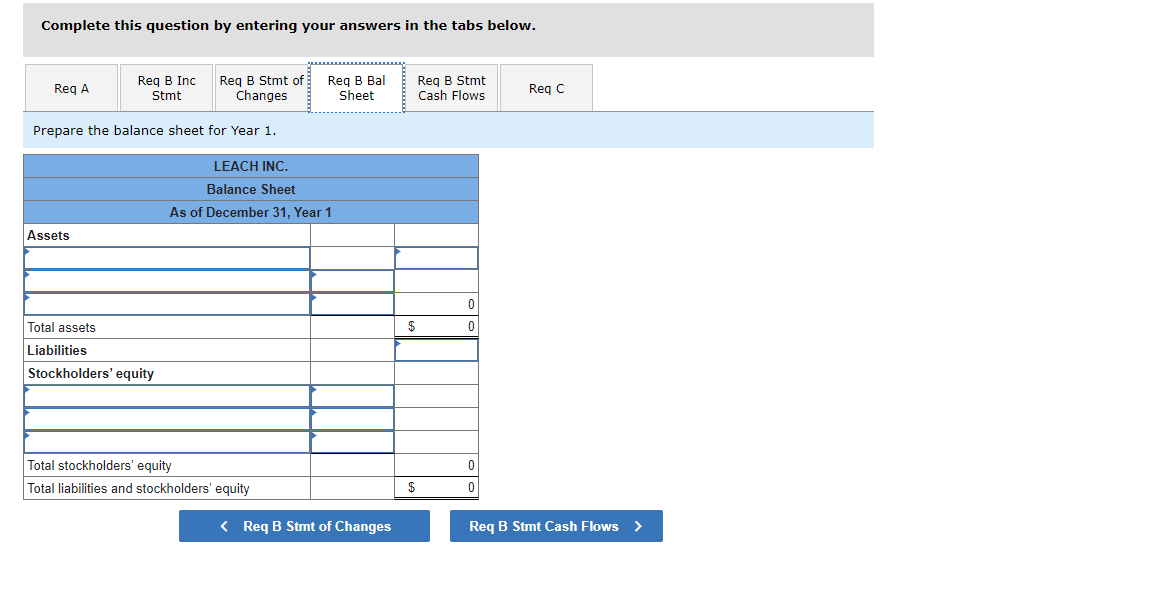

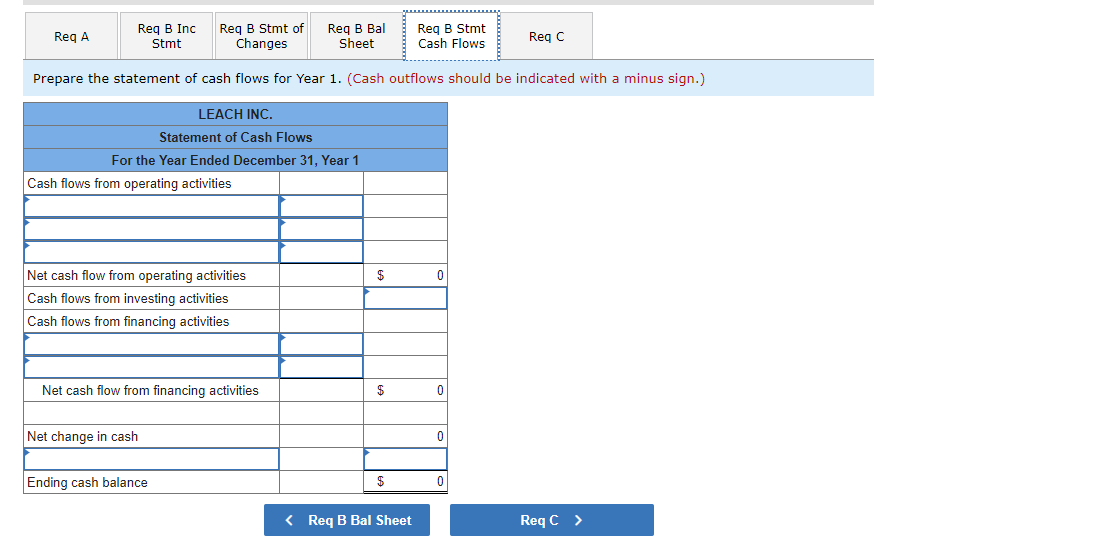

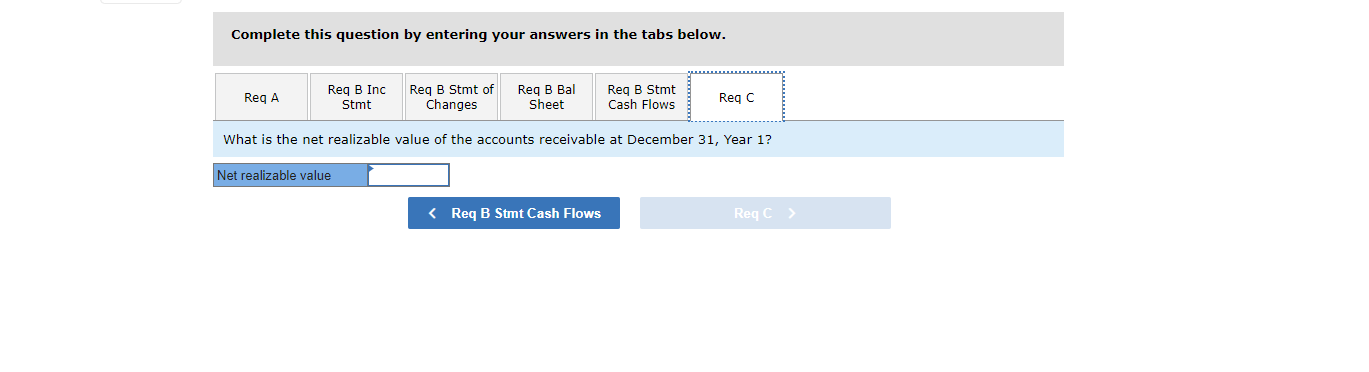

Year 1: 1. Issued $10,000 of common stock for cash. 2. Provided $80,000 of services on account. 3. Provided $33,000 of services and recelved cash. 4. Collected $47,000 cash from accounts recelvable. 5. Paid $22,000 of salarles expense for the year. 6. Adjusted the accounting records to reflect uncollectlble accounts expense for the year. Leach estimates that 7 percent of the ending accounts recelvable balance will be uncollectlble. Year 2: 1. Wrote off an uncollectlble account for $680. 2. Provided $100,000 of services on account. 3. Provided $15,000 of services and collected cash. 4. Collected $82,000 cash from accounts recelvable. 5. Pald $26,000 of salarles expense for the year. 6. Adjusted the accounts to reflect uncollectible accounts expense for the year. Leach estimates that 7 percent of the ending accounts recelvable balance will be uncollectible. Exercise 5-9A (Algo) Parts a to c Requlred a. Organize the transaction data in accounts under an accounting equation. b. Prepare the Income statement, statement of changes In stockholders' equity, balance sheet, and statement of cash flows for Year c. What is the net realizable value of the accounts recelvable at December 31 , Year 1 ? Complete this question by entering your answers in the tabs below. Prepare the income statement for Year 1. Prepare the statement of changes in stockholders' equity for Year 1. Complete this question by entering your answers in the tabs below. Prepare the balance sheet for Year 1. Prepare the statement of cash flows for Year 1. (Cash outflows should be indicated with a minus sign.) Complete this question by entering your answers in the tabs below. What is the net realizable value of the accounts receivable at December 31 , Year 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts