Question: already sent in this question but first expert answer was wrong and the explanation was not clear You are a manager at Northern Fibre, which

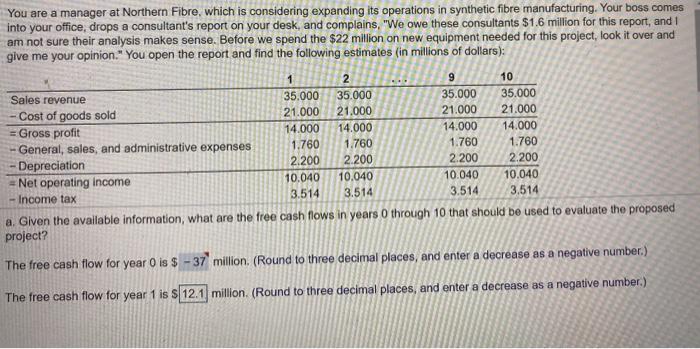

You are a manager at Northern Fibre, which is considering expanding its operations in synthetic fibre manufacturing. Your boss comes into your office, drops a consultant's report on your desk, and complains, "We owe these consultants $1.6 million for this report, and 1 am not sure their analysis makes sense. Before we spend the $22 million on new equipment needed for this project, look it over and give me your opinion." You open the report and find the following estimates (in millions of dollars): 1 2 9 10 Sales revenue 35.000 35.000 35.000 35.000 -Cost of goods sold 21.000 21.000 21.000 21.000 = Gross profit 14.000 14.000 14.000 14.000 General, sales, and administrative expenses 1.760 1.760 1.760 1.760 Depreciation 2.200 2.200 2.200 2.200 Net operating income 10.040 10.040 10.040 10.040 3.514 Income tax 3.514 3.514 3,514 a. Given the available information, what are the free cash flows in years 0 through 10 that should be used to evaluate the proposed project? The free cash flow for year is $ - 37 million (Round to three decimal places, and enter a decrease as a negative number.) The free cash flow for year 1 is 5 12.1 million. (Round to three decimal places, and enter a decrease as a negative number.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts