Question: Already tried entering 2096 did not work. Exercise 10-4 (Algorithmic) (LO. 2) Pierre, a cash basis, unmarried taxpayer, had $5,240 of state income tax withheld

Already tried entering 2096 did not work.

Already tried entering 2096 did not work.

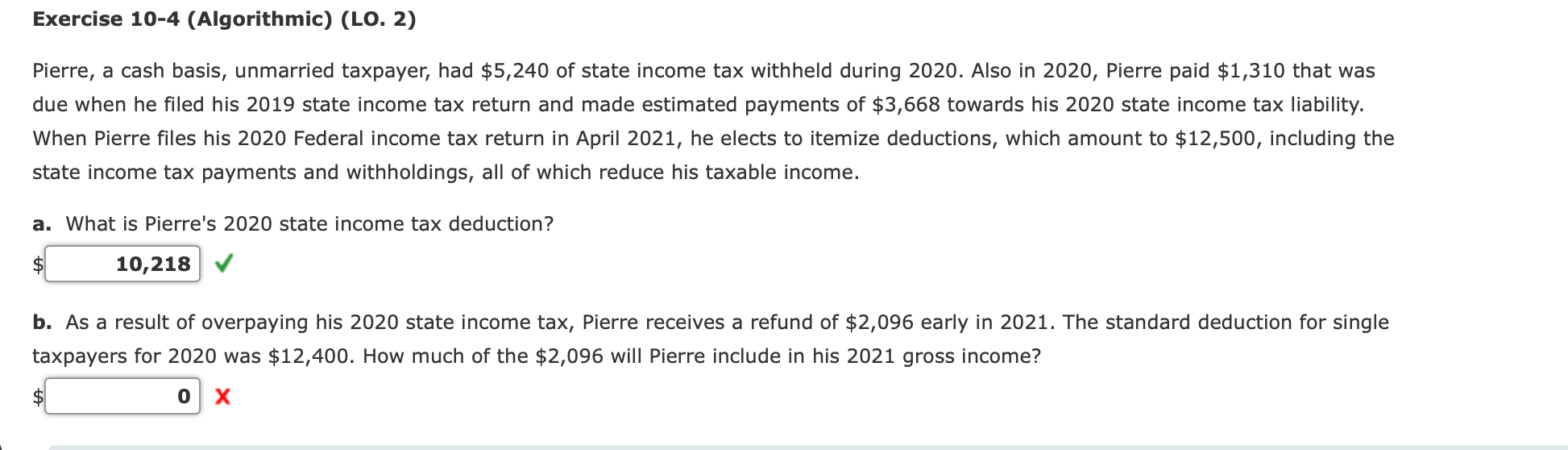

Exercise 10-4 (Algorithmic) (LO. 2) Pierre, a cash basis, unmarried taxpayer, had $5,240 of state income tax withheld during 2020. Also in 2020, Pierre paid $1,310 that was due when he filed his 2019 state income tax return and made estimated payments of $3,668 towards his 2020 state income tax liability. When Pierre files his 2020 Federal income tax return in April 2021, he elects to itemize deductions, which amount to $12,500, including the state income tax payments and withholdings, all of which reduce his taxable income. a. What is Pierre's 2020 state income tax deduction? 10,218 b. As a result of overpaying his 2020 state income tax, Pierre receives a refund of $2,096 early in 2021. The standard deduction for single taxpayers for 2020 was $12,400. How much of the $2,096 will Pierre include in his 2021 gross income? 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts