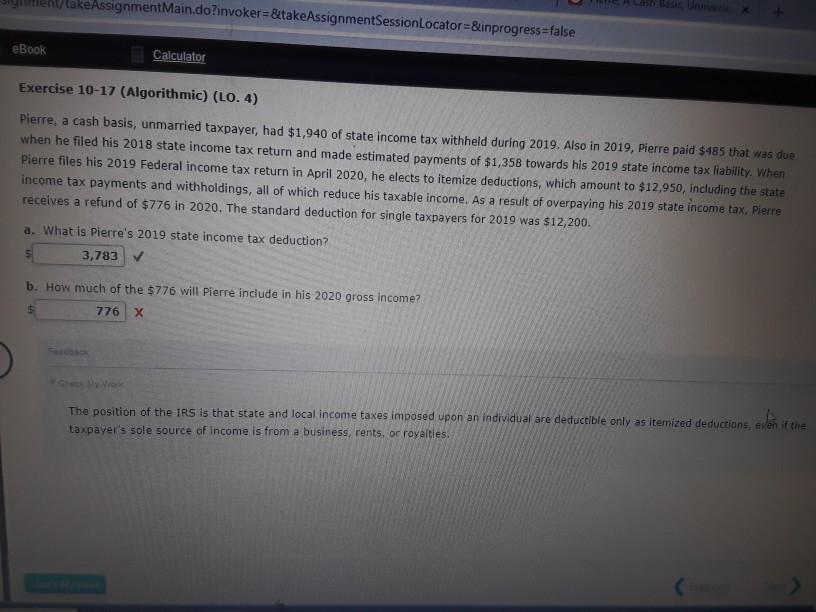

Question: why the part b Is wrong since he took itemize deduction?? take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Calculator Exercise 10-17 (Algorithmic) (LO. 4) Pierre, a cash basis, unmarried

why the part b Is wrong since he took itemize deduction??

take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Calculator Exercise 10-17 (Algorithmic) (LO. 4) Pierre, a cash basis, unmarried taxpayer, had $1,940 of state income tax withheld during 2019. Also in 2019, Pierre paid $485 that was due when he filed his 2018 state income tax return and made estimated payments of $1,358 towards his 2019 state income tax liability. When Pierre files his 2019 Federal income tax return in April 2020, he elects to itemize deductions, which amount to $12,950, including the state income tax payments and withholdings, all of which reduce his taxable income. As a result of overpaying his 2019 state income tax, Pierre receives a refund of $776 in 2020. The standard deduction for single taxpayers for 2019 was $12,200. a. What is Pierre's 2019 state income tax deduction? 3,783 b. How much of the $776 will Pierre include in his 2020 gross income? 776 The position of the IRS is that state and local income taxes imposed upon an individual are deductible only as itemized deductions, even if the taxpayer's sole source of income is from a business, rents, or royalties. take AssignmentMain.do?invoker=&takeAssignmentSessionLocator=&inprogress=false eBook Calculator Exercise 10-17 (Algorithmic) (LO. 4) Pierre, a cash basis, unmarried taxpayer, had $1,940 of state income tax withheld during 2019. Also in 2019, Pierre paid $485 that was due when he filed his 2018 state income tax return and made estimated payments of $1,358 towards his 2019 state income tax liability. When Pierre files his 2019 Federal income tax return in April 2020, he elects to itemize deductions, which amount to $12,950, including the state income tax payments and withholdings, all of which reduce his taxable income. As a result of overpaying his 2019 state income tax, Pierre receives a refund of $776 in 2020. The standard deduction for single taxpayers for 2019 was $12,200. a. What is Pierre's 2019 state income tax deduction? 3,783 b. How much of the $776 will Pierre include in his 2020 gross income? 776 The position of the IRS is that state and local income taxes imposed upon an individual are deductible only as itemized deductions, even if the taxpayer's sole source of income is from a business, rents, or royalties

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts