Question: Also, how would I calculate PV without using Excel? Determining Bond Features and Selling Price On January 1, 2020, the following debt was authorized and

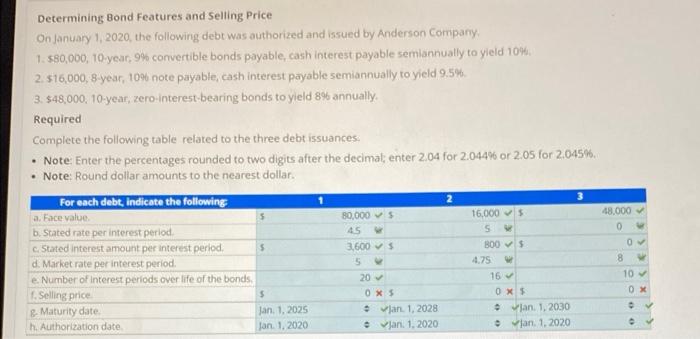

Determining Bond Features and Selling Price On January 1, 2020, the following debt was authorized and issued by Anderson Company 1.580,000, 10 year, 9% convertible bonds payable, cash interest payable semiannually to yield 104, 2. 516,000, 8-year, 10% note payable, cash interest payable semiannually to yield 9.5% 3. $48,000, 10-year, zero interest-bearing bonds to yield 89 annually. Required Complete the following table related to the three debt issuances. Note: Enter the percentages rounded to two digits after the decimal; enter 2.04 for 2.044% or 2.05 for 2,045%. Note: Round dollar amounts to the nearest dollar. For each debt, indicate the following 2 3 a. Face value 80,000 S 16,000 $ 48.000 b. Stated rate per interest period c Stated interest amount per interest period, 3.600 B00S 0 d. Market rate per interest period 5 4.75 8 e. Number of interest periods over life of the bonds 20 16 10 Selling price 5 OX OX OX Maturity date Jan. 1. 2025 jan 1, 2028 jan. 1. 2030 h. Authorization date Jan 1, 2020 jan. 1.2020 jan. 1.2020 45 0 5 oooo

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts