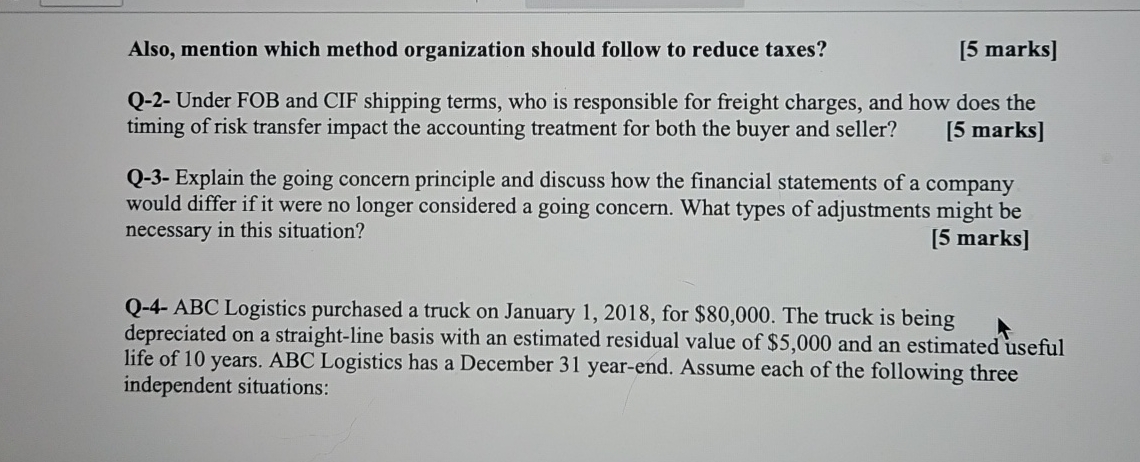

Question: Also, mention which method organization should follow to reduce taxes? [ 5 marks ] Q - 2 - Under FOB and CIF shipping terms, who

Also, mention which method organization should follow to reduce taxes?

marks

Q Under FOB and CIF shipping terms, who is responsible for freight charges, and how does the timing of risk transfer impact the accounting treatment for both the buyer and seller?

marks

Q Explain the going concern principle and discuss how the financial statements of a company would differ if it were no longer considered a going concern. What types of adjustments might be necessary in this situation?

marks

QABC Logistics purchased a truck on January for $ The truck is being depreciated on a straightline basis with an estimated residual value of $ and an estimated useful life of years. ABC Logistics has a December yearend. Assume each of the following three independent situations:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock