Question: Also the second part needs to be answered with a loan calculator, thanks. Calculate the financial impact of buying a CT unit that would cost

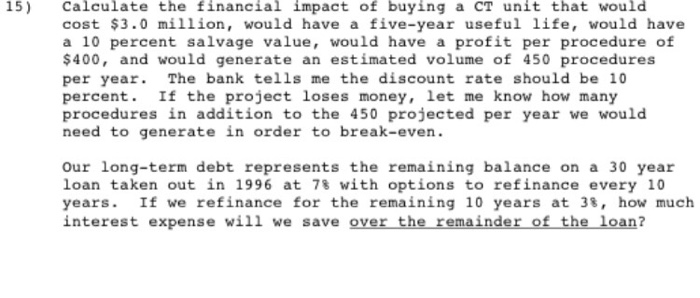

Calculate the financial impact of buying a CT unit that would cost $3.0 million, would have a five-year useful life, would have a 10 percent salvage value, would have a profit per procedure of $400, and would generate an estimated volume of 450 procedures per year. The bank tells me the discount rate should be 10 percent. If the project loses money, let me know how many procedures in addition to the 4 50 projected per year we would need to generate in order to break-even. Our long-term debt represents the remaining balance on a 30 year loan taken out in 1996 at 7% with options to refinance every 10 years. If we refinance for the remaining 10 years at 3%, how much interest expense will we save over the remainder of the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts