Question: ALTERNATE PROBLEMS L01 Problem 7-1A Allowance Method for Accounting for Bad Debts At the beginning of 2017, Miyazaki Company's Accounts Receivable balance was $105,000 the

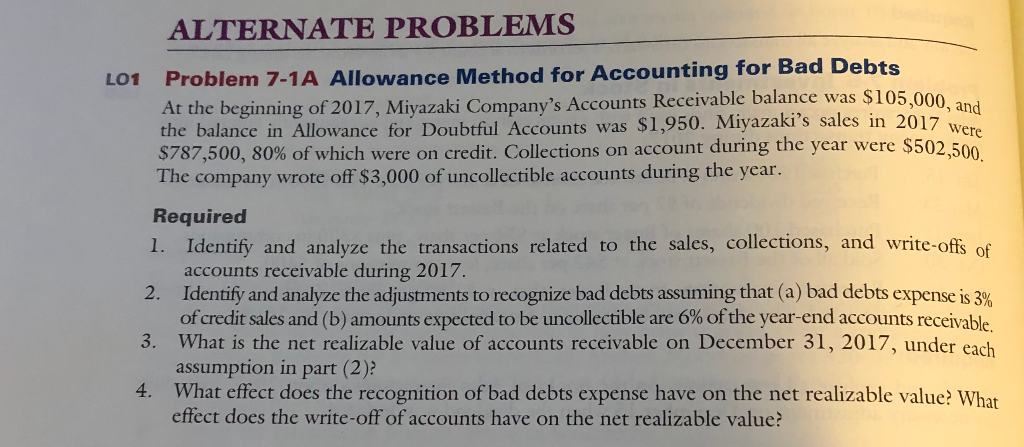

ALTERNATE PROBLEMS L01 Problem 7-1A Allowance Method for Accounting for Bad Debts At the beginning of 2017, Miyazaki Company's Accounts Receivable balance was $105,000 the balance in Allowance for Doubtful Accounts was $1,950. Miyazaki's sales in 2017 $787,500, 80% of which were on credit. Collections on account during the year were $502.50 The company wrote off $3,000 of uncollectible accounts during the year. Required 1. Identify and analyze the transactions related to the sales, collections, and write-offs of accounts receivable during 2017. 2. Identify and analyze the adjustments to recognize bad debts assuming that (a) bad debts expense is 30 of credit sales and (b) amounts expected to be uncollectible are 6% of the year-end accounts receivable 3. What is the net realizable value of accounts receivable on December 31, 2017, under each assumption in part (2)? 4. What effect does the recognition of bad debts expense have on the net realizable value? What effect does the write-off of accounts have on the net realizable value

Step by Step Solution

There are 3 Steps involved in it

To solve this problem we need to go through the required steps systematically 1 Analyze the transact... View full answer

Get step-by-step solutions from verified subject matter experts