Question: Alternative 2 with explanation . Do It! Review 10-4 The service division of Raney Industries reported the following results for 2020. Sales Variable costs Controllable

Alternative 2 with explanation .

Alternative 2 with explanation .

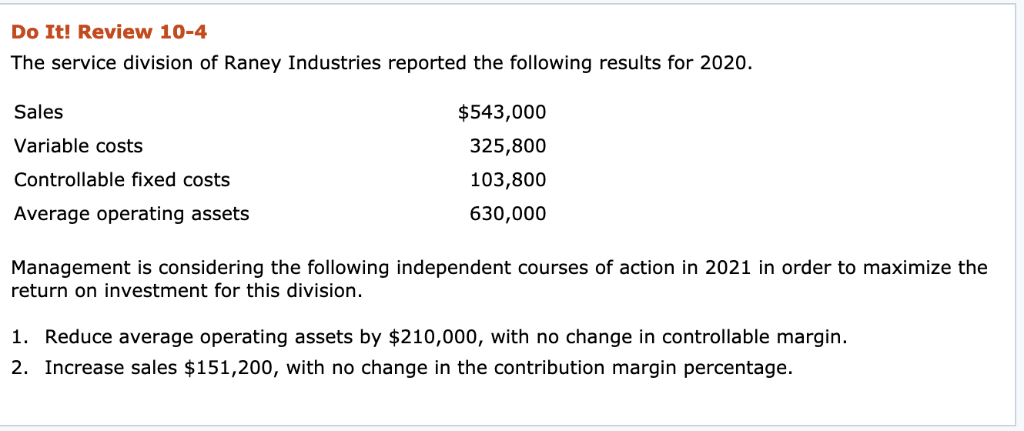

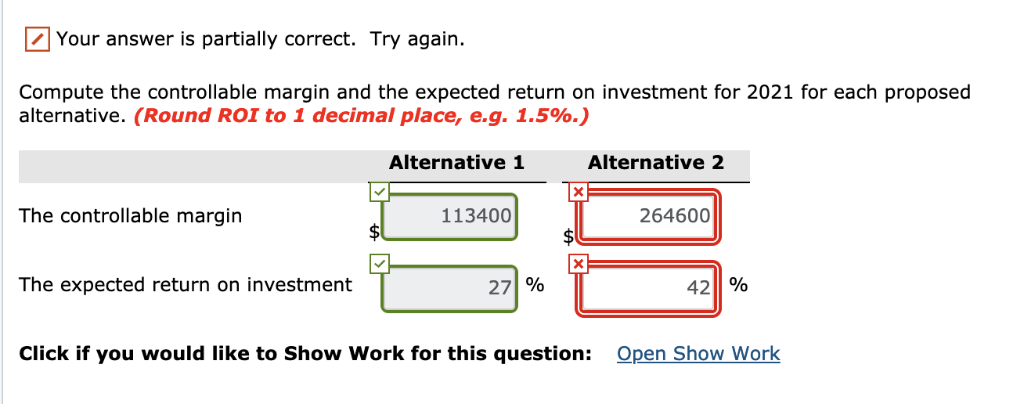

Do It! Review 10-4 The service division of Raney Industries reported the following results for 2020. Sales Variable costs Controllable fixed costs Average operating assets $543,000 325,800 103,800 630,000 Management is considering the following independent courses of action in 2021 in order to maximize the return on investment for this division. 1. Reduce average operating assets by $210,000, with no change in controllable margin. 2. Increase sales $151,200, with no change in the contribution margin percentage. Your answer is partially correct. Try again. Compute the controllable margin and the expected return on investment for 2021 for each proposed alternative. (Round ROI to 1 decimal place, e.g. 1.5%.) Alternative 1 Alternative 2 The controllable margin 113400 264600 The expected return on investment 271 % 4211 % Click if you would like to Show Work for this question: Open Show Work

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts